14 banks see unusual rise in default loans

Default loans in 14 banks surged abnormally in 2018 -- in a development that will weaken the country's banking sector further.

Experts and bankers attributed the sector's declining health to the poor lending practices and politically-influenced loans, calling on the government and the central bank to address the issue immediately.

The 14 banks are Janata, AB, Islami Bank Bangladesh, Modhumoti, National, NRB, NRB Global, Shahjalal Islami, Social Islami, South Bangla Agriculture and Commerce, Farmers (now Padma), Trust, Union, and Meghna.

Last year, Janata Bank accumulated the highest volume of default loans amounting to Tk 11,406 crore, taking the total to Tk 17,225 crore, according to data from the central bank.

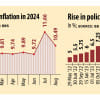

The non-performing loans (NPLs) in the banking sector went up by a hefty 26.38 percent, or Tk 19,608 crore, last year and Janata Bank was solely responsible for 58 percent of the increase.

The central bank has discovered that the state lender had disbursed a large amount of loans to Crescent and AnonTex groups, violating rules. A major portion of the loans has recently turned bad, putting it in a precarious situation.

The Farmers Bank, one of the fourth-generation banks that got licence in 2013, also faced a sudden rise in the delinquent loans as it earlier disbursed loans breaching rules.

The NPLs in the bank, which has recently been renamed as Padma Bank to sweep up its image crisis, rose 340 percent year-on-year to Tk 3,184 crore last year.

Md Ehsan Khasru, managing director of the bank, said the lender had not disbursed any loan last year; rather it put its efforts to recover the NPLs.

“The previous management and the board of directors are liable for the rise in the default loans in the bank. The default loans will come down this year because of our ongoing recovery programme,” he said.

The default loans at Trust Bank surged 164.50 percent year-on-year to Tk 1,529 crore last year.

Faruq Mainuddin Ahmed, managing director of the bank, said some of its borrowers had earlier obtained stay orders from the High Court so that they were not categorised as defaulters.

But the court vacated the orders last year, fuelling the bank's classified loans sharply, he claimed.

National Bank, a first-generation bank, saw an increase of 37 percent in default loans to Tk 2,210 crore last year.

ASM Bulbul, additional managing director of the bank, said that the lender had put the accounts of unscrupulous borrowers into the default zone as part of its strategy.

“The policy will help the bank put pressure on the borrowers and compel them to repay the loans,” he said.

In terms of percentage, Modhumoti Bank, a fourth-generation lender, faced the highest NPLs. Classified loans in the bank rose 555 percent year-on-year to Tk 58 crore last year.

Default loans at Meghna Bank, also a fourth-generation lender, stood at Tk 172 crore in 2018 in contrast to Tk 93 crore a year ago.

Adil Islam, managing director of Meghna Bank, however, said the NPLs in his bank were relatively lower than those of many other banks. “Yet, we have formed a number of recovery units to retrieve the classified loans,” he said.

The banks with higher defaulted loans have been in crisis to run operation, management and monitoring, said Salehuddin Ahmed, a former governor of the Bangladesh Bank.

Some banks, including Janata have breached credit discipline grossly while disbursing loans, which was not expected at all, he said.

The central bank is yet to take any remarkable measure to restore the corporate governance in the banking sector. As a result, the crisis has prolonged, Ahmed said.

AB Mirza Azizul Islam, a former finance adviser to a caretaker government, said both the state and private lenders had been distressed by the political influence.

Political connection with the management and board of directors should be delinked in order to ensure the sound financial health of the banks, he said.

The NPLs in the banking sector stood at Tk 93,911 crore last year, up from Tk 74,303 crore a year ago.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments