BB to be tough on borrowers

Borrowers who became defaulters despite taking a special rescheduling facility in 2013 will not be allowed to regularise their loans anymore, a central bank official said. As part of the move, Bangladesh Bank is now carrying out a special inspection to assess the status of those loans.

“We will cancel the applications of the defaulters if they approach us for rescheduling their bad loans,” said SK Sur Chowdhury, deputy governor of the BB.

Currently, a defaulted borrower can reschedule loans three times.In 2013, the BB allowed defaulters to reschedule loans by paying only 1-2 percent of their loans as down payment.

The privilege was offered as businesses were affected by political unrest ahead of the January 2014 national election.

Generally, a defaulter can reschedule loans for the first time by paying a 10 percent down payment of the outstanding amount.

Defaulted borrowers, including the willful defaulters, took that special benefit to reschedule their loans.

According to bankers, half the borrowers who rescheduled loans under the facility have become defaulters now.

“We are in serious trouble with them as we have to keep provision against these loans from our profits,” said a chief executive officer of a private bank.

However, chief executive of another bank was of a different view on the BB stance on rescheduling the defaulted loans.

“I don't see anything wrong with rescheduling these loans if borrowers fulfil the central bank's rules in this regard,” he said.

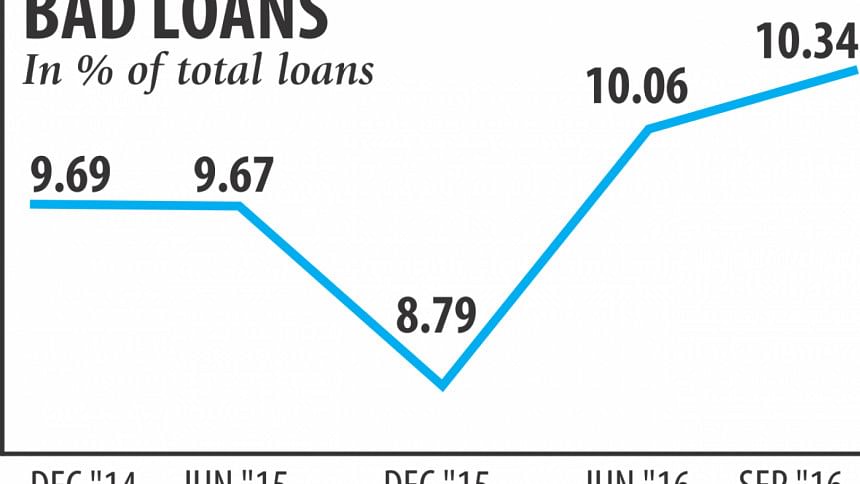

As of September 2016, the cumulative non-performing loans (NPLs) of the banks reached Tk 65,731 crore or 10.34 percent of the total outstanding loans. In terms of percentage, it is the highest since June 2014, according to the central bank.

If the written-off loans are added to the NPLs, the amount will stand at Tk 110,000 crore.

Analysts blamed the rising NPLs on the political turmoil from 2012 to 2015, loan scams, incoherent rules taken by the central bank and poor governance.

The diversion of loans into the purchase of lands is another reason behind the rise in NPLs.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments