Forex market still volatile

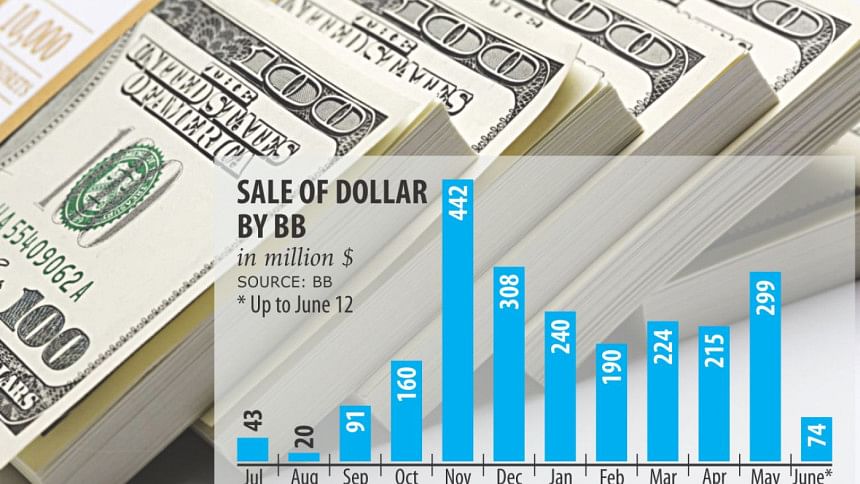

Bangladesh Bank has failed to cool down the volatility in the foreign exchange market despite an injection of more than $2.30 billion so far in fiscal 2017-18.

The turmoil in the foreign exchange market will exacerbate in the months to come on the back of higher import payments against lower export earnings, said economists and bankers.

The large import bill has already put an adverse impact on foreign exchange reserves, they said.

Between fiscal 2009-10 and fiscal 2016-17, the central bank bought back huge stacks of greenbacks from the market. It had to reverse its stance from this fiscal year because of bulging import bills.

Import payment has significantly increased in recent months and the latest trend of letters of credit opening indicates that it would shoot further upwards, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a forum of banks' chief executives and managing directors.

The reason being, the country has started to import liquefied natural gas to enable the plants to run uninterruptedly at full steam.

The price of petroleum products in the global market has also maintained an increased trend, which will pile on more pressure, said Rahman, also the managing director of Dhaka Bank.

"The banks should take on a cautious policy while importing goods to thwart any attempts of over-invoicing," he said.

The country's current account is already facing huge deficits for the higher import payments.

Bangladesh's current account deficit recorded an all-time high of $8.51 billion in the first 10 months of the fiscal year.

The large amount of dollar injected by the central bank into the market has failed to cheer banks, as they are still hungry for more greenbacks to meet their growing demand for import payments.

The ABB urged the central bank on May 31 to inject more greenbacks into the market to address the shortage of the currency.

They also urged the central bank to allow them to make flexible the bill for collection selling rate, which is the rate at which banks make import payments, as the current rate is not commercially viable for them.

The demands were placed by the ABB in a meeting with the central bank high-ups at the BB headquarters in the city.

The inter-bank rate and the BC selling rate have recently reached the same level, meaning banks are accruing huge losses. For instance, yesterday, the inter-bank exchange rate and the BC selling rate of the US dollar were both Tk 83.70.

The market usually determines the BC selling rate in line with the market economy, but the central bank has informally been putting a cap on the rate of the US dollar for long to control the volatility in the foreign exchange market.

The inter-bank exchange rate of the US dollar has also been maintaining an upward trend in the recent months. Yesterday it stood at Tk 83.70, up from Tk 80.60 a year earlier, according to data from the central bank.

Export earnings and remittance inflows grew 6.99 percent and 17 percent respectively in the first 10 months of the fiscal year, but they were inadequate to counteract the current account imbalance due to a 25.18 percent rise in import payment, said a BB official.

The government should take immediate measures to increase export earnings and remittance to ease the pressure on the foreign exchange, said AB Mirza Azizul Islam, a former caretaker government adviser.

He feared that foreign exchange reserves would decrease significantly in the coming days if the current account deficit maintains the ongoing trend. Foreign exchange reserves stood at $32.46 billion on June 7, this year, down from $33.22 billion on December 28 last year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments