Banks' capital falls as defaults pile up

Banks' overall capital base shrank 1.36 percent in the second quarter of this year compared to the first quarter as the asset quality of state banks deteriorated further.

On June 30, the banks' capital was Tk 63,694 crore, which is 10.68 percent of their total risk-weighted assets. The amount was Tk 64,575 crore on March 31, or 11.32 percent of their risk-weighted assets.

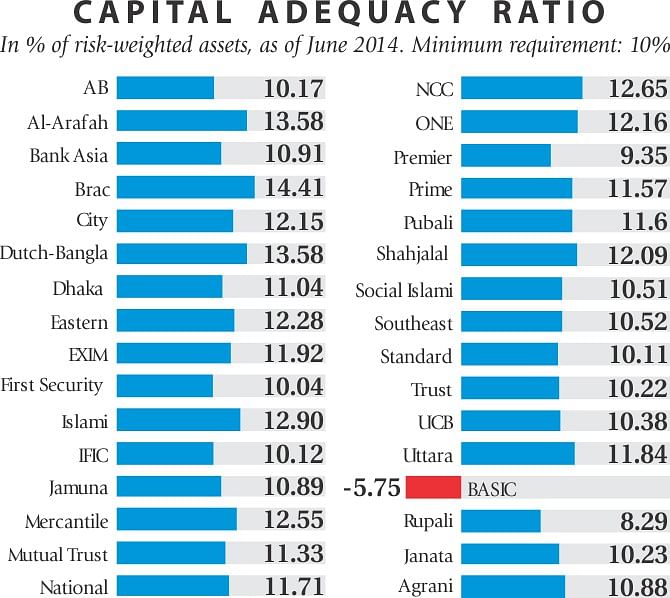

In line with international standards, banks have to maintain a capital adequacy ratio (CAR) of 10 percent against their risk-weighted assets.

State-owned commercial banks' capital fell by around 9 percent in June and stood at Tk 9,250 crore mainly due to a rise in default loans.

As capital went down, their CAR now stands at only 8.05 percent, which is embarrassing in the context of a commercial bank. Bank officials said if CAR is low, various charges go up in international business.

State-owned specialised banks, except Bangladesh Development Bank, had no capital at the end of June, rather they had negative capital, which rose by around Tk 600 crore in three months to stand at Tk 4,338 crore.

According to central bank statistics, capital position deteriorated mainly in Sonali, Rupali, BASIC, Bangladesh Krishi and Rajshahi Krishi Unnayan Bank.

At the end of June, Sonali Bank's capital shortfall was Tk 1,511 crore against the requirement of Tk 3,539 crore. The deficit was Tk 278 crore at the end of March.

Zaid Bakht, a director of Sonali Bank, said capital shortfall rose due to a mistake in the accounting system.

Actually, the bank's risk-weighted assets decreased and capital increased in June compared to March, he said.

Bangladesh Krishi Bank's capital shortfall was Tk 5,996 crore at the end of June and that of Rajshahi Krishi Unnayan Bank Tk 650 crore, according to the central bank.

Khondkar Ibrahim Khaled, a former chairman of Bangladesh Krishi Bank, said agriculture-based banks give loans to farmers at low interest rates.

Besides, during any natural calamity these banks cannot realise loans from farmers. As a result, income of the agricultural banks is not as high as that of the commercial banks and hence they always face a capital deficit.

So, the government has to provide them with capital as they work to boost agricultural economy, Khaled said.

He also said the failure of the management of the state banks is the main reason behind the capital shortfall of these banks.

He said the managing directors and deputy managing directors of the state banks should be appointed on the basis of their professionalism, honesty and efficiency.

Capital shortfall of BASIC Bank, another state-owned bank, also increased further to Tk 1,675 crore in June from Tk 1,037 crore three months ago.

An official of the banking division under the finance ministry said the government plans to provide capital to all state banks, including BASIC.

As BASIC Bank has got a new board and management, it may be provided with capital, he said.

He said the banking secretary will meet the finance division secretary soon and take a final decision on which bank will get how much capital. However, the private banks have gone further ahead in raising their capital and the amount rose by 2 percent to Tk 50,148 crore in June.

Only three private banks had a capital shortfall -- Bangladesh Commerce Bank Tk 40 crore, Premier Bank Tk 56 crore and ICB Islamic Bank Tk 1,415 crore.

Except one bank, the foreign banks' capital situation was healthy. On an average, their CAR was 20.64 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments