Major economic challenges lie ahead for Bangladesh

Three major economic challenges, all tied to one another, have got experts worried when it comes to Bangladesh's economic recovery from the pandemic. They are a persistent higher rate of inflation, the upward trend of the foreign exchange rate, and a deepening liquidity crunch in the banking sector. For months, this newspaper has been reporting on the growing sufferings of ordinary people as a result of fast rising inflation. Some of that has been down to pressures emanating from the global economy. However, other domestic factors have also contributed to the increasing prices, including the activities of trade syndicates. The government's decision to raise fuel prices—despite opposition from the public and most experts—has been a major factor in that too.

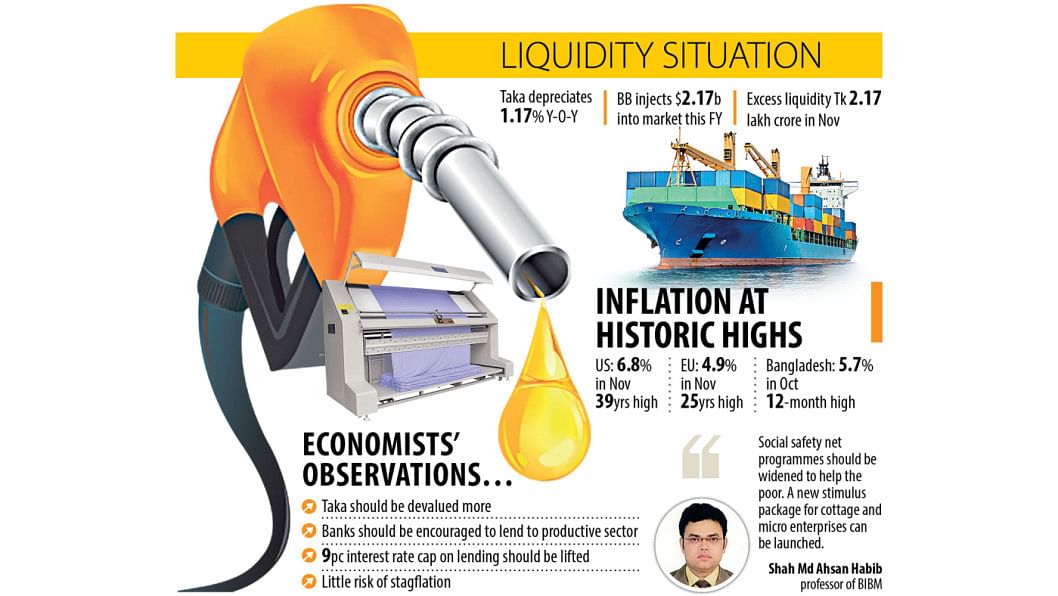

Higher global inflation has further raised Bangladesh's import payments, putting pressure on the foreign currency reserves and the exchange rates. Due to the increasing demands, the Bangladesh Bank has been injecting huge amounts of US dollars to help businesses settle import bills—which is creating liquidity stress on the banking system, as lenders have to purchase US dollars in exchange of taka. This is particularly concerning, given that for nearly a decade now, mismanagement and political decisions made in the interest of influential quarters have demolished any and all discipline in the banking sector, putting it under increasing pressure from rising non-performing loans (NPLs).

Despite some of these challenges being highlighted over and over again by experts, the government has so far remained reluctant to make any course corrections. Our policymakers, sadly, seem oblivious to the fact that doing the same thing over and over again and expecting a different result has repeatedly been proven to be the definition of madness. According to experts, none of these challenges are beyond redress. However, if our policymakers continue along this loop of applying the same failed policies, then expecting them to be solved would be nothing short of wishful thinking—if not outright delusional.

To protect the economy from another crisis, the government and the central bank must take new measures. Among them, expanding social safety net programmes is one of the most urgent measure to shelter the poor and the vulnerable. As it is critical to ensure that there is an adequate credit flow to the private sector for the economy to bounce back, introducing new stimulus packages to small businesses, and even more importantly, fixing the problems with the existing ones, should be on the government's priority list. Additionally, the government should strongly consider depreciating the taka more against the dollar to discourage some of the unnecessary imports. Even though that might increase inflation slightly, it will help stabilise the macro-economy and could protect our fast depleting reserves.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments