Rural credit comes with extra costs

Rural customers have to spend money to get farm loans, which includes giving tips to convince officials, and the incidence is the highest in case of state-owned banks, a survey by Bangladesh Bureau of Statistics found.

Of the 1.18 crore cases of agricultural loans dispatched in 2013, 56 percent entailed spending a certain amount to get them, according to the Rural Credit Survey 2014.

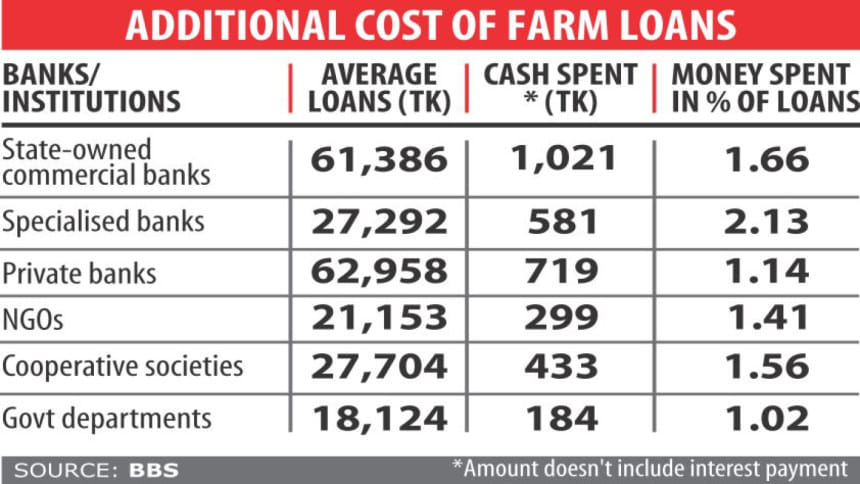

The customers had to spend some money -- Tk 409 on average -- for application, photograph, preparation of required documents, registration, transportation, tips for convincing officials and so on.

They had to spend the most to get loans from banks -- Tk 809 on average: for state banks, the amount was Tk 1,021.

The lowest amount of money was spent for loans from government departments -- Bangladesh Rural Development Board, Department of Youth Development, Department of Women Affairs and Department of Social Services -- which is Tk 184 on average.

“It is notable that the clients had to spend a certain amount to get loans in all the cases, which curtailed the actual amount they received for their purposes,” BBS said in the survey report.

“That should not be the case as per the rules for sanctioning loans,” Khondker Ibrahim Khaled, a former deputy governor of the central bank, said.

Save for one, none of the reasons shown in the survey for which money is being expended is valid, he said.

Only the amount spent to get one's photo taken is legitimate, as one has to submit a photograph to get any form of credit.

To eliminate the cost, Khaled, who was a long-serving managing director and chairman of Krishi Bank, the country's largest agricultural bank, said the banks can designate a photographer in every neighbourhood.

He went on to recommend the central bank should form a committee to see if the findings of the survey are genuine or not. If evidence is found, Bangladesh Bank should take punitive actions against the institutions.

The BBS in January 2014 conducted the survey in 56,000 households from 483 upazilas of 64 districts for loans given in 2013.

Some 48.7 percent of the households received rural credit in 2013.

Nongovernmental organisations gave out the highest number of loans, around 49 lakh, followed by banks at 12 lakh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments