Govt targets lowest budget deficit in 14 years

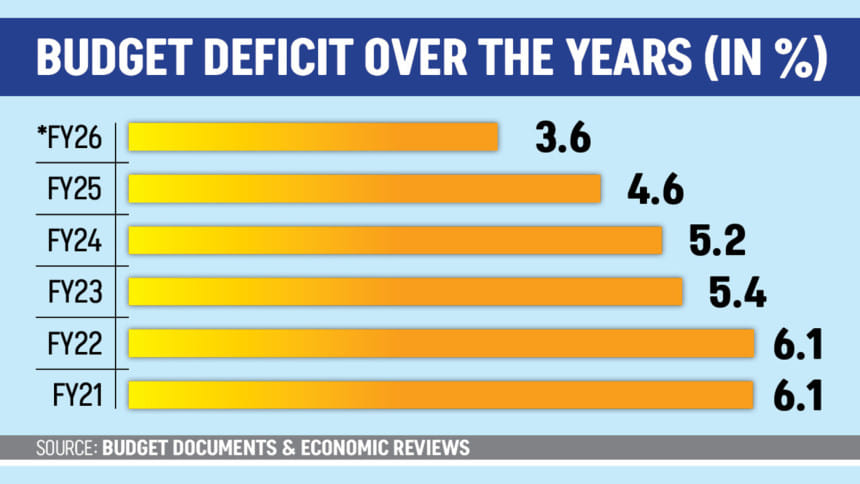

The interim government plans to reduce the national budget deficit to 3.6 percent of gross domestic product in the upcoming fiscal year -- the lowest in 14 years -- as it seeks to rebuild fiscal credibility, limit borrowing, and ease pressure from rising debt servicing costs.

The proposed deficit for fiscal 2025-26 marks a sharp departure from more than a decade of looser fiscal policy. Since 2010-11, when the deficit stood at 3.8 percent, Bangladesh has routinely run deficits exceeding 5 percent, with pandemic-era spending pushing it above 6 percent.

Now, a key objective of the new budget strategy is to cut both domestic and external borrowing to reduce the country's debt risk from "moderate" to "lower". Officials say this will help avoid a future scenario where a significant share of the budget is consumed by interest and loan repayments.

"It will be a budget for restoring discipline in the financial sector," said Planning Adviser Wahiduddin Mahmud after a high-level meeting this week. "Our objective is to avoid falling into a debt trap, where a significant portion of the budget is consumed by loan repayments -- be it operating costs or interest payments."

The government aims to contain total expenditure at 12.7 percent of GDP, down from 14.2 percent in the original budget for the current fiscal year. As the overall budget size will be smaller, officials say it is designed with macroeconomic stability and long-term sustainability in mind.

Finance Adviser Salehuddin Ahmed echoed this emphasis on discipline. "We'll try our best to reduce the budget deficit significantly. While cutting administrative expenses is difficult, the government plans to curb expenditure by dropping large, capital-intensive infrastructure projects," he told The Daily Star in an interview.

The revised budget for the current fiscal year has already brought the deficit down to 4 percent, from the originally planned 4.6 percent, setting the stage for further tightening in the next fiscal year starting July 1.

For that year, the government projects a budget deficit of Tk 2,26,000 crore, to be financed through Tk 1,25,000 crore from domestic sources and the remainder from foreign loans and grants.

In recent years, Bangladesh has relied heavily on central bank borrowing to finance its deficit. That dependence exacerbated inflationary pressures, with consumer prices remaining above 9 percent since March 2023, even as inflation eased globally.

By narrowing the gap between revenue and expenditure, the government hopes to reduce its reliance on central bank financing, identified by some economists as a key driver of persistent inflation.

The move to restore fiscal discipline is long overdue. "To break this vicious cycle, revenue must be increased, but expenditure must also remain limited," Mahmud said.

Economists have long warned that Bangladesh's dependence on borrowing and its weak revenue mobilisation pose structural risks. The interim administration's pivot toward consolidation and restraint is being seen as a serious effort to restore macroeconomic balance and strengthen the country's readiness for graduation from LDC status.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments