Life insurers mired in irregularities

One-fourth of the life insurance firms in the country are plagued with financial irregularities and mismanagement that have put the entire industry in danger.

Officials and experts have also blamed bad investment, high agent commissions and excessive management costs, along with unhealthy competition for the crisis, which has added more pressure to the financial sector already struggling with troubled banks.

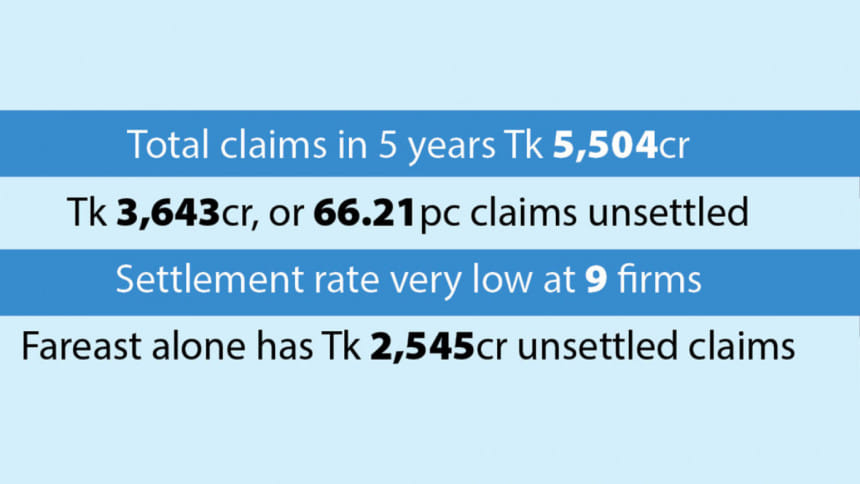

Data from the Insurance Development and Regulatory Authority (IDRA) showed that 31 out of 36 life insurers are required to settle about 11 lakh policyholders' claims worth Tk 3,643 crore.

But it is uncertain when the clients will get their money back.

The unsettled claims accumulated in five years until the second quarter of 2024 are 66.21 percent of the total claims in this period.

NO MAJOR STEP

IDRA data showed the claim settlement rate among life insurers has declined in recent years, dropping from 85 percent in 2020 to 72 percent in 2023.

Of the 31 insurance companies with unsettled claims, nine have the worst settlement rates, according to IDRA data.

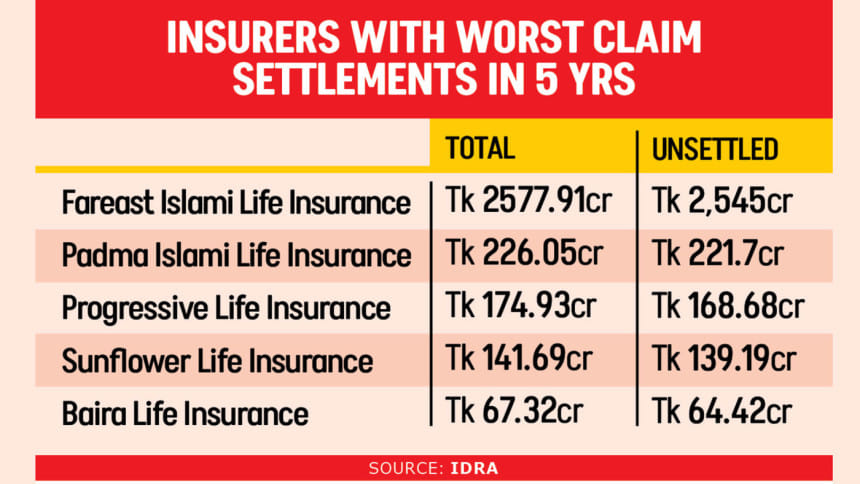

Fareast Islami Life alone recorded Tk 2,577 crore in claims but paid just Tk 32 crore.

An IDRA-commissioned audit in April 2021 by Shiraz Khan Basak & Company revealed Tk 2,367 crore in embezzled funds and additional accounting irregularities worth Tk 432 crore in Fareast.

The money was embezzled mainly in two ways: purchase of land at prices higher than the market value and bank loans availed by mortgaging the company's Mudaraba Term Deposit Receipt (MTDR), according to the report.

MTDR is a profit-bearing account based on the Mudaraba concept that offers returns on money deposited for a fixed period.

A senior official of the IDRA, who wished not to be named, told The Daily Star that widespread financial irregularities disrupted claim payments, fostering public distrust in the sector.

Such irregularities were widespread in companies like Fareast Islami Life Insurance, Padma Islami Life Insurance, Progressive Life Insurance, Sunflower Life Insurance and BAIRA Life Insurance, officials said.

The official also mentioned that bad investments, high agent commissions, and excessive management costs have further reduced life funds, undermining the companies' ability to meet obligations.

Regulators have never taken any major steps against these companies due to political reasons and legal limitations, the official said.

These companies are doing a lot of damage to themselves as well as the industry, the official added.

The official thinks it is not possible for these companies to turn around in any way without more investments in these companies.

Another senior IDRA official, who also requested anonymity, said the regulator could not take any major step against Fareast during the previous Awami League government because of the influence of Salman F Rahman, the then private industry and investment adviser to former prime minister Sheikh Hasina, and Sheikh Kabir, former president of the Bangladesh Insurance Association.

Salman is behind bars on various charges, including murder during the July-August mass uprising.

Kabir could not be reached for comments despite repeated attempts.

Most of the other life insurers fared poorly as well. Padma Islami Life paid only Tk 4 crore against Tk 226 crore in claims, Progressive Life Insurance settled Tk 6 crore of Tk 174 crore claims, Sunflower Life Insurance Tk 2 crore of Tk 141 crore, and BAIRA Life Insurance settled Tk 2 crore of Tk 67 crore claims.

Sunlife Insurance Company was able to pay only Tk 3 crore against the claims of Tk 64 crore whie Prime Islami Life Insurance settled Tk 50 crore of Tk 86 crore claims.

During these five years, Golden Life Insurance paid its clients only Tk 1 crore against Tk 37 crore claims and Homeland Life Insurance settled Tk 4 crore of Tk 25 crore claims.

In contrast, Alpha Islami Life, LIC Bangladesh, Mercantile Islami Life, and Trust Islami Life settled all claims, according to the IDRA data.

POLICYHOLDERS IN TROUBLE

Khaleda Akhter, the wife of Aminul Islam of Chattogram's Mirsarai upazila, said Aminul had bought a 12-year insurance policy worth Tk 2, 88, 000 from Homeland Life Insurance in 2008.

The family contacted the firm several times, but they are yet to get the money back four years after his policy matured in 2020.

As per the Insurance Act 2010, claims must be settled within 90 days of submitting all required documentation after a policy matures.

Khaleda said the company had told them that it would repay in December.

Abdul Motin, additional managing director of the company, also said it was trying to settle the claims by December. "We'll withdraw our fixed deposit receipt and settle the claims if we can't pay by that time."

But Khaleda sounded sceptical. "We're going through a tough time because of a financial crisis in the family. We're facing one danger while recovering from another," she told The Daily Star on October 31.

WHAT INSURERS SAY

The insurers said they now plan to sell their assets, withdraw FDRs and limit management expenditure to pay the unsettled claims.

Mohammad Abdullah Al Manum, head of finance of Progressive Life Insurance, informed that out of the claim of Tk 174.93 crore, they settled nearly Tk 25 crore as of August this year.

He said several types of mismanagement in the company from 2020 to 2023, besides covid-19, hampered their business.

He also said that bad investments of about Tk 30 crore led to the current situation.

Manum mentioned that due to mismanagement, the Bangladesh Securities and Exchange Commission reconstituted the company's board in July last year.

The new board is working under a three-year plan to take the company's business on a positive trend. They were already reaping some benefits, he claimed.

Amzad Hossain Khan Chowdhury, chief executive officer of Golden Life Insurance Limited, said the company had various types of anomalies from 2011 to 2014. Then it failed to turn around in the period from 2014 to 2018.

Asked to explain the anomalies, Amzad said field-level employees sold policies but did not report those or submit the money receipts to the head offices in many cases. When these clients claimed their funds, the money got pending.

Since he joined the company in October 2020, the situation has improved somewhat, Amzad claimed. But many of the old liabilities are yet to be paid. As a result, many claims are still unsettled.

"Another thing is that we have not been able to pay benefits to our employees as per our commitment, which has created a kind of distrust towards us. Which has hurt the business," he added.

Shamsul Alam, managing director of Prime Islami Life Insurance Limited, said many customers did not apply with all the information to get the claims. They have been instructed to apply with the correct information.

He also mentioned that until June 2024, the total claim is Tk 165 crore, and they settled Tk 129 crore.

Motin of Homeland Life Insurance said expenses have exceeded revenue since the company started its journey in 1996.

The company has not made the right decision while investing the customers' money in some cases.

Additionally, income has fallen due to a lack of trust in the company.

Zakir Hossain, chief executive officer of Sunflower Life Insurance, told The Daily Star that the company's finances suffered following the Covid-19 pandemic, impacting fund availability.

"Our business didn't turn around after that. We've sought IDRA's permission to sell some assets, which could allow partial claim payments if approved," he added.

Noor Mohammed Bhuiyan, chief executive officer of Padma Islami Life Insurance, said they paid claims worth Tk 13.87 crore out of Tk 226.05 crore.

He said their data were not arranged properly because they did not have a chief financial officer. So their information did not match with IDRA's data, which will be corrected during an audit, he said.

Bhuiyan mentioned that in the last five years, the premium income of insurance companies — interest from bank deposits — has halved to 6 percent from 12 percent.

As a result, their income shrank and the claims could not be paid on time as before.

The company will now liquidate its fixed assets to pay insurance claims of the customers, Bhuiyan said.

He also said they were working on keeping management expenditures within limits.

This reporter's repeated attempts to reach Fareast CEO Apel Mahmud, Company Secretary Kalim Uddin, and Assistant Managing Director Abudur Rahim Bhuiyan from October 29 to 31 failed.

Mamun Khan, CEO of BAIRA Life Insurance Company Limited, did not respond to calls for comments.

WHAT EXPERTS SAY

A Bangladeshi chartered accountant and life insurance expert with over 20 years of experience in both multinational and local companies said a kind of unhealthy competition has been created in this sector.

The country has more insurance companies than it needs, according to the expert, who requested anonymity for professional reasons.

Excessive competition and a lack of management expertise contributed to the sector's current state, he said.

Insurance products need to be diversified, while companies need to focus on transparency and management cost reduction through the use of technology, he added.

Talking to The Daily Star recently, the expert suggested consolidating the weak insurance companies' assets under IDRA's oversight to pay the clients and monitoring the financially sound firms closely.

Md Main Uddin, a banking and insurance professor at Dhaka University, recommended phasing out companies with a claim settlement rate below 40 percent.

He warned against mergers or acquisitions, which he said would turn a good company into a bad one.

Main also stressed that individuals responsible for the sector's troubles should face penalties to prevent irregularities in future.

WHAT REGULATOR SAYS

IDRA spokesman Zahangir Alam said the regulator has two major options — appoint administrators or cancel licences of firms. But such harsh steps as cancelling licences cannot be taken considering the government's reputation.

He said instructions have been given to recover the money by taking legal action against the directors who were involved in financial irregularities.

He also said IDRA has appointed observers to Fareast, Padma, Progressive, Sunflower and BAIRA life insurance companies.

Zahangir said the boards of troubled companies were being called for regular meetings and pressured to secure new funding.

These companies were instructed to monetise fixed assets to settle claims, while IDRA increased monitoring of relatively stable companies to prevent further financial instability.

M Aslam Alam, chairman of the IDRA, told The Daily Star that solving the problems in the sector is a "big challenge" for the regulator and it will take time to do this.

"We've taken several steps. But we can't fix the industry overnight."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments