NBR revises down VAT, SD on 9 items

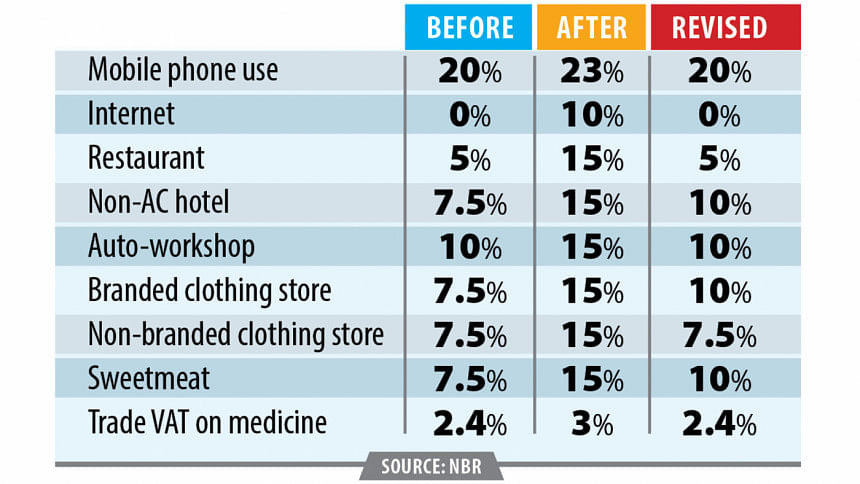

The National Board of Revenue yesterday revised down the value-added tax and supplementary duty (SD) on nine goods and services, including mobile phone usage, internet services and medicine.

The revision comes nearly two weeks after the government hiked the rates of about 100 goods and services, drawing criticism that the move would stoke inflation, which has remained over 9 percent since March 2023.

VAT on clothes, restaurants, sweets, non-AC hotels and motor workshops has been slashed, said the NBR in a press release.

The NBR restored SD on mobile phone usage to 20 percent from 23 percent and withdrew the 10 percent SD on broadband internet services.

Trade VAT on medicine has been rolled back to the previous rate of 2.4 percent, down from 3 percent, while VAT on restaurants has been brought back to 5 percent from 15 percent.

However, three to five-star hotels will continue to be subject to a 15 percent VAT rate as they can claim input tax credits.

VAT on the merchandise made by clothing brands has been lowered to 10 percent from 15 percent, while those from non-branded stores will be subject to 7.5 percent VAT. Earlier, VAT on both branded and non-branded outlets was 7.5 percent.

VAT on sweet shops has been reduced to 10 percent, reversing the earlier hike of 15 percent.

Non-AC hotels now face a 10 percent VAT, down from 15 percent, but it's higher than the earlier rate of 7.5 percent.

VAT on automobile workshop services though has been kept at 10 percent despite stakeholders' demands for a reduction to 5 percent.

The recent tax hike sparked an outcry from various quarters, including economists, policy analysts, rights bodies and political parties.

Some stakeholders also staged demonstrations to push for a reversal of the decision.

Talking to this newspaper, SM Nazer Hossain, vice-president of the Consumers Association of Bangladesh, said the interim government deserves appreciation for reducing VAT and SD charges on certain items. "But there are several items closely tied to daily life, and they require reconsideration."

The increased VAT and SD charges have already led to price hikes of essentials such as soap, tissue papers and detergent.

"This situation poses a threat to the livelihood of ordinary people. With Ramadan approaching, this might further ignite competition among sellers to increase prices on several goods. Therefore, these decisions demand urgent revision," he added.

The increase in VAT and SD aligns with the recommendations of the International Monetary Fund as part of a $4.7 billion loan it approved for Bangladesh in January last year.

The IMF advised the government to rationalise tax exemptions, improve compliance with laws and bring about reforms in tax measures to bolster domestic revenue collection in Bangladesh, which has one of the lowest tax-to-GDP ratios in the world.

The hike in indirect taxes comes as overall revenue collection fell by about 1 percent in the first half of the fiscal year, increasing pressure on the government to borrow from domestic and foreign sources.

The NBR should scrutinise its policies more thoroughly before implementation, said Selim Raihan, executive director of the South Asian Network on Economic Modelling.

"It [the NBR] should refrain from making ad-hoc decisions and focus on increasing revenue coverage in the income tax net," said Raihan, also a professor of economics at Dhaka University.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments