VAT law gets cabinet nod

The government yesterday approved in principle the draft of a new value-added tax law that will widen the tax base and scope for collecting more tax.

The massive changes to the law come in line with an IMF condition the government is facing to get $1 billion credit from the donor, said a finance ministry official.

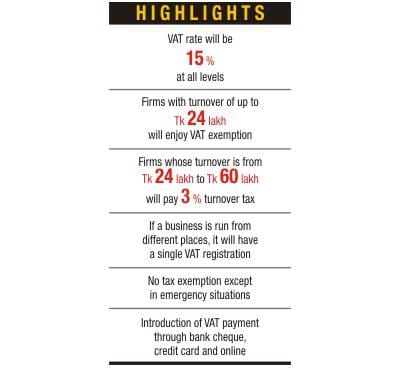

The cabinet in a meeting with Prime Minister Sheikh Hasina in the chair approved the draft. Once the draft gets through parliament, it will impose a single VAT rate of 15 percent at all levels.

Although the new law is expected to be passed in parliament by June, it will be effective from 2015, said an official of the National Board of Revenue.

If the new law comes into effect, tax receipts from VAT will almost double to more than Tk 60,000 crore.

After the cabinet meeting, Cabinet Secretary M Musharraf Hossain Bhuiyan briefed journalists on the draft law and said the new law incorporated global good practices and took suggestions from the stakeholders.

Bhuiyan said the other objectives of the proposed law are to remove inconsistencies in the existing law, reduce exemption of VAT and make the existing law time-befitting.

The finance ministry official said the $1 billion credit proposal of the International Monetary Fund was scheduled to be placed in the institution's board meeting in March but it was deferred as the law was not passed.

The law was scheduled to be passed in parliament on January 30.

The official also said, if the law is passed, the IMF is likely to place the credit proposal at its meeting in April or May.

According to international standards, the VAT rate should be 15 percent, as the existing tariff values, fixed rates and the truncated base system have led to numerous VAT rates.

The proposed law provides for removal of these rates.

Introduced in 1991, the VAT law experienced some small changes in the past, but this time it saw massive modification, the official said.

The draft law stipulates that VAT will be imposed at any point where new value will be added from import or production level to retail level.

However, the firms whose annual turnover will be up to a maximum of Tk 24 lakh to Tk 60 lakh will pay 3 percent turnover tax.

In the proposed law, there is no provision for any special privilege for cottage industry. However, if the turnover of a firm is up to Tk 24 lakh, its product or service will be exempted from paying VAT.

If the accounts of a business run from several places are maintained centrally, the firm will have only one registration.

The NBR official said, in future every taxpayer will have to add his national ID number to his tax identification number (TIN) and business identification number (BIN).

One will also have to provide national ID number and TIN while opening a bank account, he added.

Now VAT has to be deposited through treasury receipt form, but the new law will facilitate such payment through bank cheques, credit cards, internet and mobile phone.

The new law will also cut short the list of commodities that now enjoy tax or VAT exemption.

The government will exempt VAT only in case of emergency.

In the new law, sales of second-hand goods have also been brought under the purview of VAT.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments