Market cap-GDP ratio slips

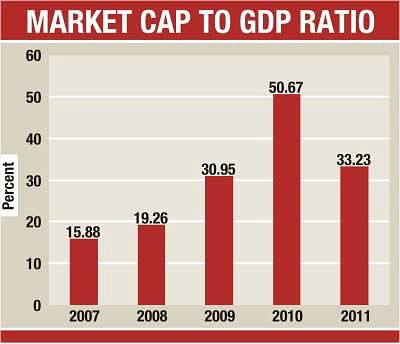

The market capitalisation to GDP ratio on the Dhaka Stock Exchange fell by 17.44 percent last year due to a series of abnormal downswings.

The ratio was 50.67 percent in 2010, while it was 33.23 percent in 2011.

AB Mirza Azizul Islam, former finance adviser to caretaker government, said: “The market cap to GDP [gross domestic product] is related with the index. The ratio fell as the index declined sharply due to a series of declines in 2011.”

The index rose sharply due to an artificial hike in share prices in 2010-11 without any price sensitive information and valid reason, said Islam, also a former chairman of Securities and Exchange Commission.

He said investors lacked confidence as the market fell sharply last year.

New initial public offerings, including state-owned issues, are needed for the market so that turnover can go up and investors can regain confidence, he added.

“The market cap-GDP ratio declined due to a sharp fall in index last year, a lack of new issues and rights offers,” said Faruk Ahmed Siddiqi, another former chairman of the SEC.

The prices of most of the issues gained abnormally in 2010 and market capitalisation also went up, said Siddiqi.

He said the index declined last year and new issues were not listed according to the demand of the market.

The index started the year 2010 with 4,535.53 points and end the year at 8,290.41 points, while at the end of 2011 the index was at 5,275.61 points.

In 2010, the benchmark index of the prime bourse rose to its highest level at 8,918 points, while the highest ever single-day turnover on the bourse was Tk 3,249 crore on December 5 after a record breaking rally in the turnover.

A total of 14 securities got listed on the stockmarket last year though the market showed clear signs of volatility with twin price debacles, according to the DSE.

Price earnings (P/E) ratio also came down to 13.68 last year from 29.16 in 2010.

The current P/E ratio of the market is lucrative for long term investment, said Islam.

He said investors should consider the fundamentals of companies to make investment

decisions.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments