Foreign funds in stocks slip on market jitters

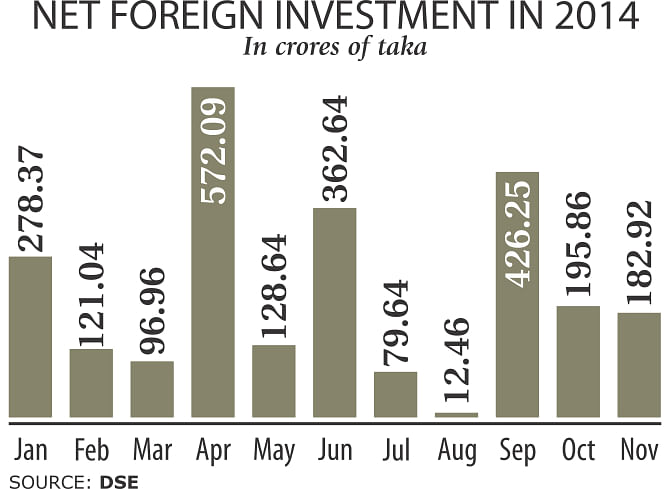

Net foreign investment in the stockmarket fell 6.61 percent in November from the previous month, as investors were wary of market volatility.

Foreign investors bought shares worth Tk 348.38 crore and sold shares worth Tk 165.46 crore to take net investment to Tk 182.92 crore last month, according to data from the Dhaka Stock Exchange.

Foreign investors were cautious about taking fresh positions, particularly in large-cap stocks due to their reported bad numbers in the quarterly declaration in October, said Mahfuzur Rahman, head of research of LankaBangla Securities.

Worries also grew on the economic front due to negative growth in exports, Rahman said.

Exports declined 7.63 percent year-on-year to $1.96 billion in October due to a slowdown in apparel exports, according to data from the Export Promotion Bureau. Garment exports fell 3.5 percent to $7.76 billion in October compared to same month last year.

However, declining fuel and commodity prices are an indication of better prospects of listed entities by margin expansion and revenue growth, Rahman said.

So investors' attention will further grow in this market, he added.

Stock indices declined last month, leading some foreign investors to place new buy orders, said Md Moniruzzaman, managing director of IDLC Investments.

DSEX, the benchmark index of the premier bourse, plunged 5.89 percent to 4,886.64 points last month.

“They focused on some selective stocks as their buying was higher compared to last month,” said Moniruzzaman.

The foreign investors are mostly fund managers like Morgan Stanley, JP Morgan, Goldman Sachs and BlackRock.

They manage various types of funds like endowment funds, hedge funds, long-only funds and mutual funds, and they invest in the Bangladesh market through these funds.

Also known as portfolio investment, foreign investments accounted for around 1 percent of DSE's total market capitalisation of Tk 322,537 crore as of yesterday.

Foreign investors' preferred sectors are: banks, non-bank financial institutions, power and energy, pharmaceuticals, telecoms and IT, an investment banker said.

They also focused on some multinational stocks that announced healthy dividends and generated good profits, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments