Private investment sees first fall in three years

Private investment has declined this fiscal year, a development which does not bode well for the economy even though GDP growth is predicted to see the fastest pace in nine years.

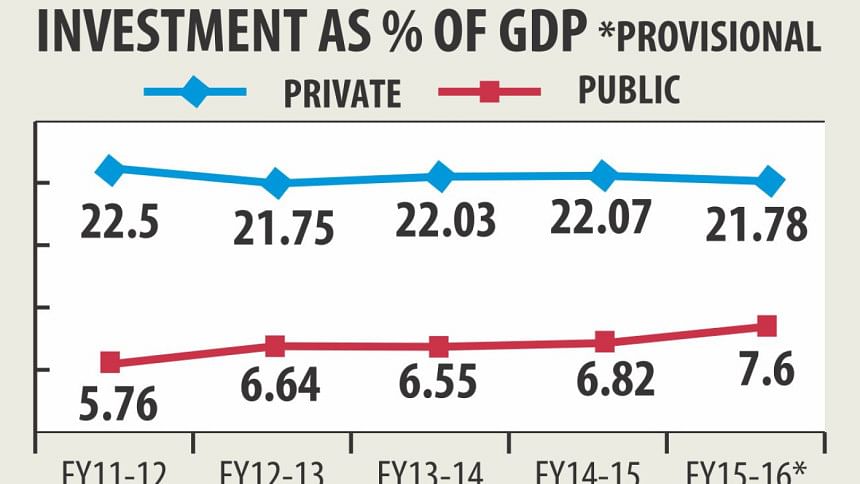

In fiscal 2015-16, the private investment to gross domestic product ratio will be 21.78 percent, according to provisional data from Bangladesh Bureau of Statistics.

This signifies a year-on-year drop of 0.29 percentage points -- and a decline for the first time in three years.

“This is not good news from a growth sustainability point of view in the near- and medium-terms,” said Zahid Hussain, lead economist at the World Bank’s Dhaka office.

The business confidence is still weak, primarily because the structural impediments to investment, such as infrastructure bottlenecks and the cost of doing business have not changed, he said.

The business community is also complaining about the high interest rates.

From a broad cross-country perspective, Bangladesh’s average nominal lending rate over the past decade was higher than in advanced economies and slightly higher than in Asia’s emerging economies, according to Hussain.

The bank interest rates in Bangladesh fell much in recent times, the central bank statistics show. In the last two years, the average lending rate declined 2 percentage points and stood at 11.05 percent in January.

Infrastructure constraints in energy, connectivity, telecom and urbanisation, coupled with the difficulties in property registrations and contract enforcement appear to be more binding than the cost of finance. Access to unencumbered land is also a severe constraint, he said. Khondkar Ibrahim Khaled, former deputy governor of Bangladesh Bank, echoed the same.

“Whatever the government says, when the businessmen go to the relevant authorities for electricity and gas after setting up industries, they do not get the connections.”

Subsequently, the businessmen seek alternative ways to get their industries up and running, which pushes up their costs of doing business.Khaled said the bank lending rate may be slightly high, but it is in no way responsible for sluggishness in private investment.

A high official of a state-owned commercial bank said the bank has approved many big loans but those were never disbursed as the gas and power connections were not available for the projects.In the first six months of the fiscal year, industrial term loan disbursement declined 2.99 percent, according to central bank statistics.

Hussain said efficient public investment and regulatory reforms are urgently needed to get the private investment rate out of the 21-22 percent of GDP trap.

However, the public investment to GDP ratio increased 0.78 percentage point to 7.6 percent this fiscal year, according to the BBS. As a result, the overall investment to GDP ratio is expected to be in the neighbourhood of 29.38 percent, which was 28.89 percent in the last fiscal year.

GDP growth in the current fiscal year is predicted to be 7.05 percent for the first time in nine years, an increase of 0.5 percentage point over the previous year. Of the 0.5 percentage point-gain, 0.4 percentage points came from the service sector.

Public administration and defence, and the education sector contributed 0.3 percentage points, which suggests the hike in salaries of public servants and teachers was the major factor behind the GDP growth of over 7 percent.

Hussain said since the value added in these sectors is based on wages and salaries, the large increase in public sector wages has played a big role in moving the overall growth to over 7 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments