United Air shareholders on the verge of losing everything

Stock investors of United Airways who own 95 per cent of the shares of the defunct airline have been left high and dry after the regulator delisted the company from the main trading board of the exchanges.

In a directive on Tuesday, the Bangladesh Securities and Exchange Commission (BSEC) ordered the Dhaka and Chattogram stock exchanges to transfer the company to the over-the-counter board from the main trading board.

The bourses yesterday said they had already transferred the company to the OTC market.

"Considering the high-risk level due to the volatility of market price and weak fundamentals, the BSEC directs to transfer the shares of United Airways from the main market to the OTC market," the directive said.

Meanwhile, investors had been anxiously waiting since March 2016 to see the airline resume operations and thus boost the share price.

With the transfer to the OTC market, it would be difficult for investors to get the money back, said Shahidul Islam, chief executive officer of the VIPB Asset Management Company.

"Trading shares on the OTC board will be tougher because few buyers will show interest in the stock after the latest move from the regulator, said a stock broker.

"As a result, their combined investment of around Tk 786 crore considering the face value of the shares is hanging in the balance," he added.

As the company had been in a freefall, the directors of United Airways sold off their shares. The directors now own 5 per cent of the shares, way lower than 34 per cent in 2014.

"Our investment is going to evaporate as the stock has been transferred to the OTC market," said Abdul Mannan, another investor.

The investor said he had invested in the company in hopes that United Airways would resume its flight operations again after a lull.

In August 2019, United Airways was the most sought-after share on the DSE amid rumours that the private carrier is planning to make a comeback after a lull.

In February 2016, United ceased flight operations without any announcement amid mounting losses.

It incurred losses of Tk 139.17 crore in fiscal 2016-17, up 8.11 percent year-on-year. On June 30, 2017, its accumulated loss stood at Tk 277.41 crore. It has not published its financial reports since.

"The company has little possibility of flying again. So, we want to prevent new investors from putting their money into such a company," said a top official of the BSEC.

"So, we have delisted it," he said, adding that this is a regular practice in international markets.

The official also said that many people invested in United Airways despite witnessing that the shares were plunging. Investors need to consider a company's future while making investment decisions.

"If we find companies that have little potential to make a turnaround, we may delist them as well. So, people should be careful while investing in junk stocks."

Prof Abu Ahmed, a stock market analyst, welcomed the BSEC move.

"The BSEC has done the right thing. In fact, it should have been done earlier. The company was used for gambling, so the delisting is not a wrong move.

"The fraud sponsors sold off their shares. Now, there is no reason to keep the company listed as it has no potential," he said.

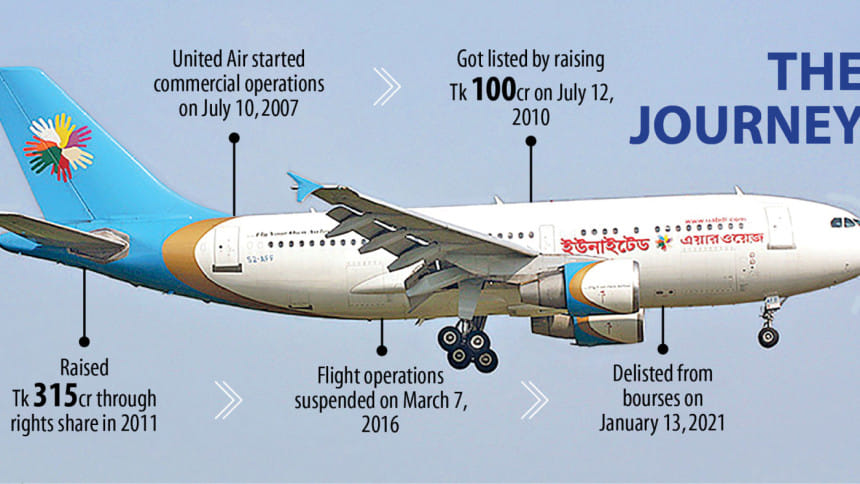

Established on June 28, 2005, United Airways flagged off its commercial operation on July 10, 2007 with a Dash-8 aircraft.

Within a short period, it had spread its wings to international airspace with flights to Kolkata, Dubai, Kathmandu, Kuala Lumpur, Jeddah, Muscat and London.

United Airways operated more than 65,000 international flights and at one point had cornered 60 per cent of domestic air travel.

In 2010, it was listed with the DSE and the Chittagong Stock Exchange, raising Tk 100 crore from the capital market through an initial public offering.

The company has a term loan of Tk 32.98 crore and short-term loan of Tk 120.75 crore, DSE data showed.

United Airways owes Tk 175.50 crore to the Civil Aviation Authority of Bangladesh as aeronautical and non-aeronautical charges, said AHM Touhid-ul-Ahsan, a director of the Hazrat Shahjalal International Airport.

He said eight of the company's aircrafts had remained abandoned at the cargo approach area for the last four years, disrupting loading and unloading activities of cargo aircraft at the prime airport of the country.

Tasbirul Ahmed Choudhury, chairman of United Airways, could not be reached for comment.

The shares of United Airways traded at Tk 1.90 on the DSE on Tuesday. It had traded between Tk 6.8 and Tk 7.2 before the operation suspension.

Islam of VIPB Asset Management Company said he supported the delisting because every company should maintain some minimum criteria to remain listed.

"Some other companies should be delisted too," he added.

An analyst said the sponsors were mainly responsible for the failure of United Airways but it is the general investors who are bearing the brunt.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments