Rupali’s secondary offering plan back on track

The plan to offload an additional 15.2 per cent shares of state-run Rupali Bank has been revived after a delay caused by the coronavirus pandemic and the lender's preoccupation in disbursing stimulus packages.

Last month, Md Obayed Ullah Al Masud, managing director of the state lender, requested the Financial Institutions Division of the finance ministry to take the necessary steps for the secondary offering.

A secondary offering is the sale of new or closely held shares by a company that has already made an initial public offering (IPO).

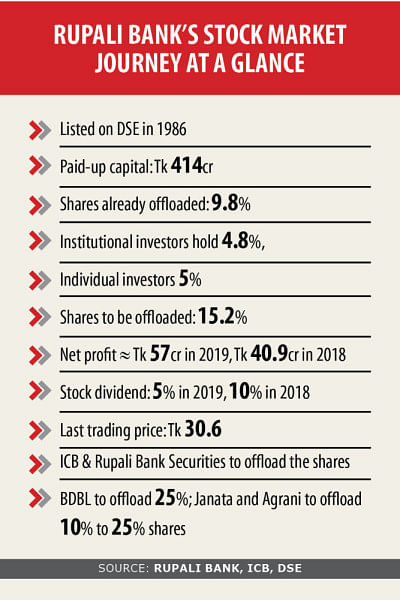

Rupali was listed with the stock exchanges in 1986, with 9.8 per cent of its shares now up for trade.

The decision to offload another 15.2 per cent shares of the bank came at a meeting on 9 February, where it was decided to list five state-run lenders in the stock market by September as part of the government move to prop up the ailing bourse.

As per plans, a quarter of the shares of Sonali, Agrani, Janata, Rupali and Bangladesh Development Bank (BDBL) would be offloaded.

BDBL is supposed to offload 25 per cent share, Janata and Agrani to offload 10 per cent to a maximum 25 per cent shares.

As Sonali acts as a treasury bank for the government, a decision on the country's largest bank would be taken later.

Rupali was supposed to offload the shares by May. But the issue got stuck because of the pandemic, which brought the economy to a standstill and forced the government to keep the country under a strict lockdown at least from 26 March to 30 May before easing resections from June.

Now that economic activities are returning to a version of normalcy, the issue has been hauled up again. And on 13 July, the board of Rupali gave its approval to offload more than 6.3 crore new shares in phases, depending on the situation in the market and share prices.

It was also decided that the shares would be offloaded through the Investment Corporation of Bangladesh (ICB) and Rupali Bank Securities, a subsidiary of the bank.

A committee has already been formed to work on the listing of the banks, which will be coordinated by the state-owned merchant bank ICB. Its subsidiary ICB Capital Management and respective banks' subsidiary merchant banks would jointly act as issue managers.

As Rupali has capital shortfall as per Basel-III guidelines, the proceedings from the share sale would be injected into the bank.

On Thursday, Rupali's share traded at Tk 30.6 on the Dhaka Stock Exchange. But the letter said the net asset value of the share is Tk 41.1, according to the bank's 2019 financial report.

The company issued 5 per cent stock dividend in 2019, 10 per cent in 2018, 24 per cent in 2017, 10 per cent in 2016, 15 per cent in 2015, 15 per cent in 2014, 15 per cent in 2013, 10 per cent in 2012, 20 per cent in 2011, and 10 per cent in 2010, data from DSE and Rupali Bank showed.

The government has formed a committee led by Abdullah Harun Pasha, additional secretary of the Financial Institutions Division, to oversee the process of listing the state-run lenders.

Banks have formed committees to take the IPO process forward.

A senior official of Agrani Bank said it had already formed a committee and the issue would be fast-tracked.

"We were busy with disbursing the funds under the stimulus packages," he added.

Shibli Rubayat Ul Islam, chairman of the Bangladesh Securities and Exchange Commission, welcomed the move.

"It is good news for the stock market. We want to approve the fund-raising at several stages so that Rupali's fundraising doesn't impact the turnover of the secondary market," Islam added.

Offloading shares of government-owned companies will be a blessing for the stock market because investors would be allowed to invest in profitable companies, said a top official of a merchant banker.

Besides, the bourse has not seen the floatation of many good stocks in recent times.

If the government lists low-performing companies or the ones that are suffering from losses such as Sonali, then the market will be impacted, the merchant banker added.

Some of the listed government companies are Atlas Bangladesh, Bangladesh Services, Bangladesh Submarine Cable Company, Bangladesh Shipping Corporation, Dhaka Electric Supply Company, Eastern Cables, Eastern Lubricants, ICB, Jamuna Oil, Meghna Petroleum, National Tubes and Padma Oil.

Power Grid Company of Bangladesh, Shyampur Sugar Mills, Titas Gas, Usmania Glass Sheet Factory, Zeal Bangla Sugar Mills and Renwick Jajneswar and Co are also listed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments