Paying with MFS at retails gaining traction

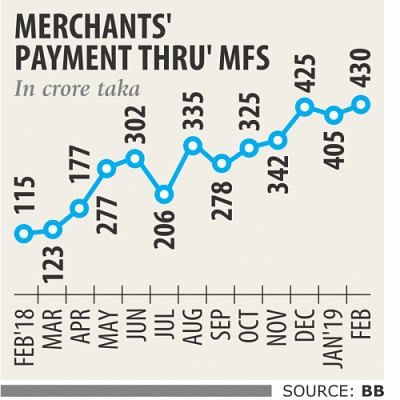

Payments through the mobile financial service platform have trebled in the last one year, in a development that will bring cheer to the central bank as it strives to move towards a cashless society.

In February, total MFS merchant payment stood at Tk 429.83 crore, in contrast to Tk 115.43 crore a year earlier, according to data from the central bank.

At present, people are using MFS to pay for goods at both brick-and-mortar and e-commerce shops and also for rides, tuition fees and utility bills. Even salary disbursement and government payments are made through the platform.

To further increase the platform's popularity MFS operators are currently providing cashbacks and discounts for making payments through them, a move that also accounts for the spike in transactions, said industry insiders.

Currently, about 1 lakh merchants are connected with the platform, of which 80,000 accounts are registered with bKash alone.

bKash said payment through merchants is becoming popular day by day.

In 2017, their total number of merchants was about 50,000. In just one year the number shot up 60 percent.

“Payments like tuition fee and electricity bill can be made easily through bKash from anywhere, anytime. You can also fetch money from your bank accounts to bKash wallet and spend that accordingly,” said Shamsuddin Haider Dalim, head of corporate communication at bKash.

Rahee Raihan, head of finance and accounts at Meena Bazar, one of the largest supermarket chains in the country, said they are observing that digital wallets are getting popular in their system in the last one year or so.

Even one year ago, there were just a handful of customers who were paying with their MFS account. But now, it accounts for more than 6.5 percent of Meena Bazar's total transactions.

Cards account for about 32 percent of the payment, which is more or less the same as a year ago.

“But in the last one year we are getting more and more payments through the MFS channel,” Raihan said, adding that the MFS ecosystem is getting vibrant by the day. Initially, people used MFS largely to send or receive money, said Shahadat Khan, chief executive officer of SureCash, a fast-growing MFS service provider.

“But recently we found the situation is changing. People are using MFS to pay for tuition fees and products both online and offline.”

From the service point of view, operators are trying to bring more and more services onboard, which will help the industry to grow.

“Progressively, cash transactions will be discouraged like in neighbouring countries,” Khan said, while citing China as an example of a country that is managing to successfully phase out cash.

Of SureCash's total transactions, 10 percent is merchant payment.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments