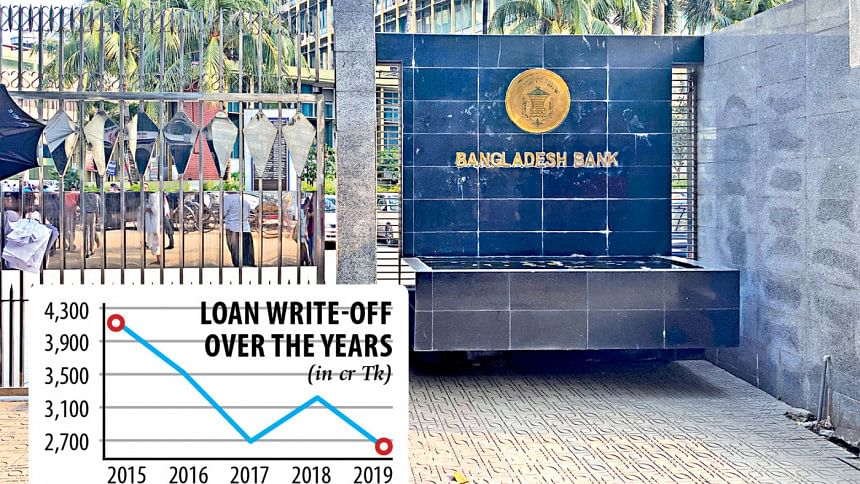

Loan write-offs touch down to a three-year low

Loans written off by banks plummeted to a three-year low in the first quarter of 2020 as lenders' capacity to keep 100 per cent provisioning against their delinquent assets has decreased because of the fall in profit.

Usually, loans are written off when they are entirely provisioned and there is no realistic prospect of recovering them. These loans are shifted to off-balance sheet records.

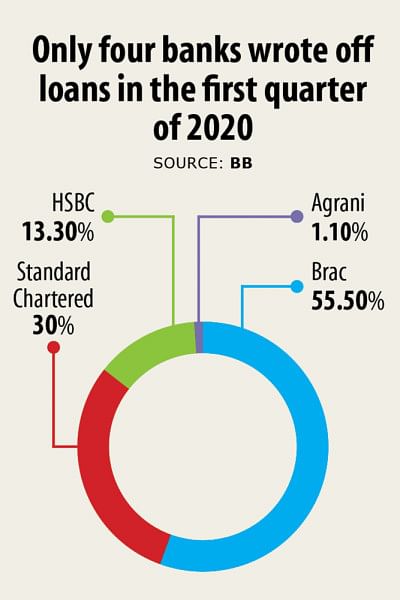

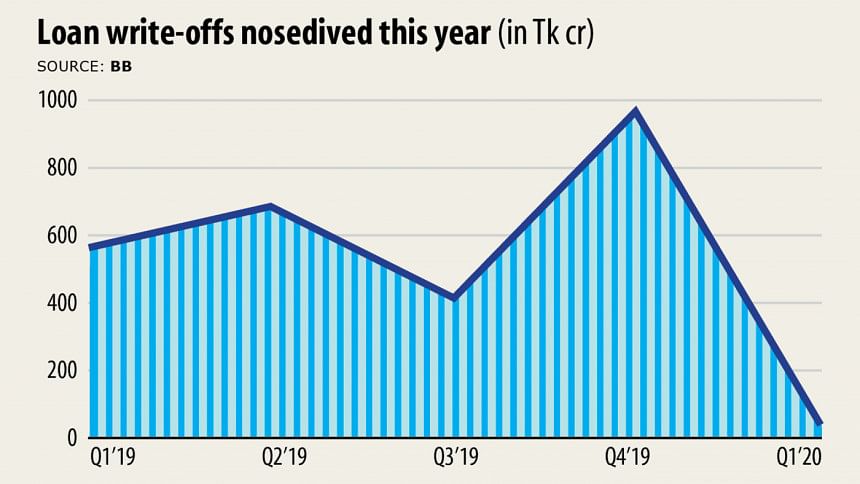

Between January and March, loans amounting to Tk 33.5 crore were written off, down 96.5 per cent from a quarter earlier and 94 per cent from a year earlier, according to data from the central bank.

This is the lowest write-off amount since the first quarter of 2017 when banks removed Tk 24.74 crore from their balance sheets.

The downward trend of the write-off loans is not a good indicator for the financial sector as it gives lenders the leeway to not set aside funds against the defaulted loans.

The central bank gave a regulatory forbearance to banks on 19 March, allowing them to not consider businesspeople as defaulters if they fail to repay instalments until 30 June.

The deadline has been extended to September to help businesses tide over the economic hardships brought on by the global coronavirus pandemic.

"This is responsible for the incredulous indicator for the banking sector," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, a think-tank.

The regulatory forbearance, a policy that permits banks and financial institutions to continue operating even when their capital is fully depleted, has reined in the upward trend of the defaulted loans and did not give the lenders the scope to clean up their balance sheets by using the write-off module.

At the end of March, default loans stood at Tk 92,510 crore, which was 9 per cent of the total outstanding loans in the banking sector.

As per Bangladesh Bank regulations, banks have to keep provisioning of 0.25 per cent to 5 per cent for unclassified loans, 20 per cent for default loans of sub-standard category, 50 per cent for the doubtful category and 100 per cent for bad or loss category.

The central bank has long followed a practice that permits lenders not to preserve the required provisioning against both unclassified and default loans.

For instance, 11 banks suffered a provision shortfall of Tk 8,632 crore as of March and all of them had taken permissions from the central bank to keep provisioning in phases.

But such forbearance is not applicable for the write-off loans.

So, banks should give an all-out effort to strengthen their provisioning base to tackle the ongoing financial recession, one of the worst in history, said an analyst.

Global lenders have paid heed to the issue and put aside funds in the form of provisioning to fight against any unexpected shock.

Four American lenders -- JPMorgan Chase, Wells Fargo, Bank of America and Citigroup -- together took loan loss charges of $33 billion from April to June.

But such practices in Bangladesh's banking sector are absent. Rather, most banks try to dodge the provisioning.

Profits of most of the banks have dropped off 30 per cent and 40 per cent due to the economic slowdown, said Emranul Huq, managing director of Dhaka Bank.

"So, it is tough for lenders to keep any additional provisioning by writing off loans," he said.

Besides, the 9 per cent lending cap, introduced in April, has dealt another blow to banks as it has caused the profit to shrivel.

The central bank's move that orders banks not to classify businesspeople as defaulters until September has encouraged lenders to ignore the loan write-off.

But Mansur said that banks would have to keep the provisioning aggressively to protect their financial health from any shock.

Last year, the central bank gave another regulatory forbearance to banks that permitted them to reschedule default loans with a 10-year repayment tenure and 2 per cent down payment.

Defaulted loans amounting to Tk 52,770 crore were regularised in 2019 -- the highest in a single year -- riding on the relaxed loan rescheduling rules.

This also made the practice of loan write-off less attractive, a development that further weakened the financial strength of the banking sector.

Default loans amounting to Tk 2,597 crore were removed from the balance sheets last year, down 19.03 per cent year-on-year.

A total of Tk 55,553 crore has been written off since the facility was introduced in January 2003.

Of the amount, 77 per cent has remained outstanding to date.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments