LankaBangla Finance triumphs despite liquidity pressure

When the country's financial sector was facing the mounting challenge of liquidity pressure last year, LankaBangla Finance logged handsome growth in its profit.

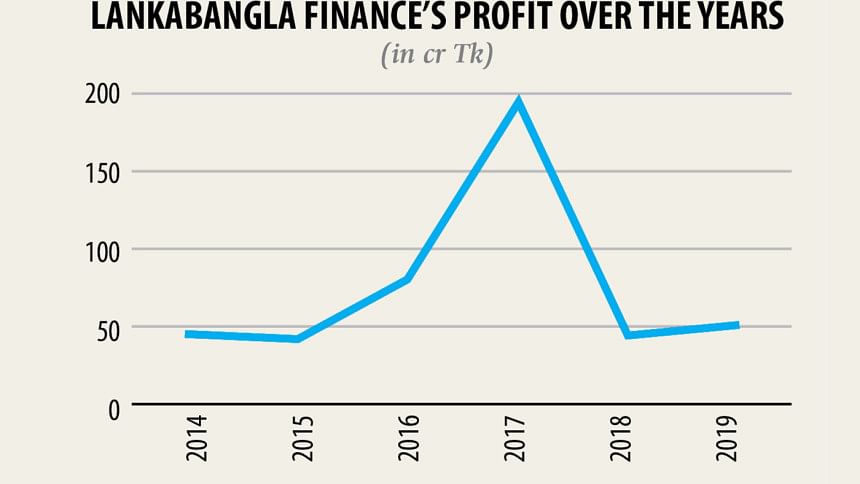

In 2019, the listed non-bank financial institution's profits rose 14.35 per cent year-on-year to Tk 50.82 crore while its earnings per share stood at Tk 0.98.

"A decrease in losses at one of our subsidiaries, LankaBangla Investments, helped us make a higher profit," said Khwaja Shahriar, managing director of LankaBangla Finance.

It has three subsidiaries: LankaBangla Securities, LankaBangla Investments and LankaBangla Asset Management Company.

Of them, LankaBangla Investments, a merchant bank, incurred a loss of Tk 18.48 crore in 2019, which was Tk 51.03 crore in the previous year.

Most of the margin loan accounts with the merchant bank yielded negative equity in 2018. This was handled properly by selling shares and adopting some other strategies last year, which is why losses came down.

"This has contributed to the rise in our consolidated profit."

LankaBangla Securities, however, saw a drop in its profit due to the bearish stock market and a decline in turnover, Shahriar said.

The brokerage house's profit fell 55.98 per cent year-on-year to Tk 12.53 crore in 2019 when the Dhaka Stock Exchange's average turnover went down 15 per cent to Tk 480 crore.

As 2019 was a challenging year for the non-bank sector due to the liquidation of People's Leasing and Financial Services (PLFS), LankaBangla Finance's profit crept up slightly, according to Shahriar.

Its profit was Tk 73.60 crore in 2019, a rise from Tk 71.41 crore in the previous year.

On June 27 last year, the finance ministry instructed the central bank to shutter the PLFS for its failure to improve its financial health, in a first for Bangladesh's financial sector.

The government also announced that another four or five companies were under the scanner for their lacklustre performance and might face the same fate. This created a huge liquidity pressure in the sector as many depositors started to withdraw funds.

"Despite the liquidity pressure, we were able to log in profit faring fine in the first quarter of the current year," Shahriar said.

The company's profit rose 24.55 per cent year-on-year to Tk 6.87 crore in the first quarter of the year.

"But the pandemic again has hurled a new and big challenge for the sector."

Many of the borrowers affected by the economic fallout of the novel coronavirus cannot repay loans, which has put huge pressure on all lenders, he said, adding that they have been in continuous communication with their clients but cannot force them to pay back.

"If the borrowers don't survive, how will they repay?"

Shahriar, however, thinks the present crisis might linger until the third quarter of the year and the situation will start to look up from the fourth quarter.

"As the country's stock market is now bearish and we have huge exposure in the market, it is also not clear how much money we are going to make from stock investment," he added.

Stock investment by the NBFI was Tk 459.25 crore at the end of 2019 against Tk 551.35 crore on December 31, 2018.

DSEX, the benchmark index of the Dhaka Stock Exchange, slumped more than 20 per cent to 3,603 in the first three months of the year.

LankaBangla stocks traded at Tk 12.90 each yesterday on the Dhaka bourse.

The NBFI declared 12 per cent dividend -- 7 per cent cash and 5 per cent stock -- for the year that ended on December 31, 2019.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments