Courier services brought under banking umbrella

Bangladesh Bank yesterday allowed courier service providers (CSPs) to use banking channels to settle payments for their services.

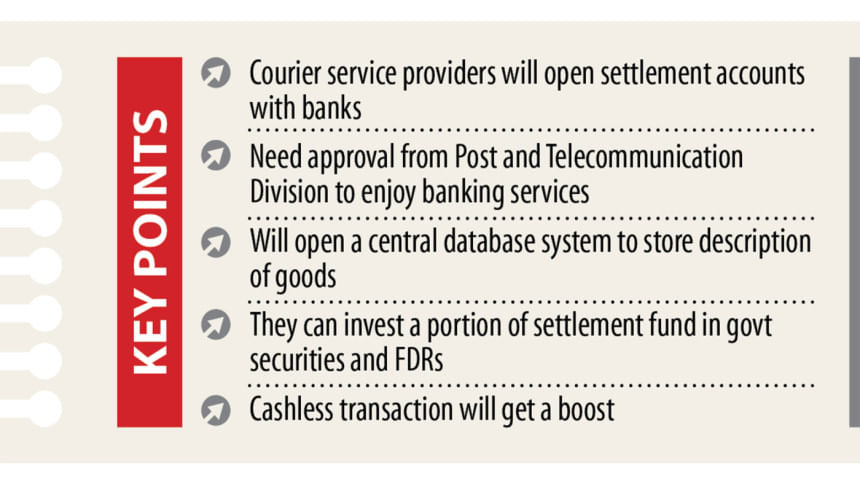

The CSPs will have to open settlement accounts with banks in order to enjoy the financial service, according to a central bank notice.

Many small businesses in different parts of the country use CSPs to deliver their goods while the recent surge in e-commerce has significantly increased their workload.

CSPs supply products to clients and collect payment on behalf of sellers.

The service providers will now be able to deposit the value of products sold to their settlement accounts, from where the money will be sent to the respective sellers.

The sellers will receive payments directly to their bank accounts or in cash.

However, a seller will not be permitted to receive more than Tk 5,000 per transaction in cash for his or her products.

CSPs will have to encourage both customers and buyers to settle transactions through banks, the central bank notice said.

"The tripartite financial transactions -- buyers, customers, and CSPs -- will be easier than before due to the latest initiative," said an official of Bangladesh Bank.

This will help them settle transactions at a faster pace, he added.

CSPs which are members of the Courier Services Association of Bangladesh will have to take prior approval from the Post and Telecommunication Division to enjoy the banking services.

In addition, they will have to create a central database system, where they will mention the details of sellers, customers and the goods sold.

The NID number of customers and sellers and the description of goods sold will have to be mentioned in the respective database system of each CSP.

The central bank official went on to say that the latest initiative will create new opportunities for CSPs.

For instance, the surplus fund CSPs have in their settlement accounts will increase significantly in the days ahead.

A portion of the outstanding fund, which usually remains deposited in their accounts, will be allowed to be invested in government securities and fixed deposit receipts (FDRs) offered by banks.

"This will open a new window to earn money for them," he said.

The central bank move will also help CSPs bolster public confidence in them.

Bringing CSPs under the banking system will also speed up cashless transactions in the country's financial sector.

Banks will have to prepare statements on CSPs' financial transactions every month.

Lenders must send the statement every three months to the central bank.

CSPs will also have to follow the anti-money laundering and terrorist financing guidelines issued by the Bangladesh Financial Intelligence Unit.

Meanwhile, CSPs which continue to settle financial transactions without sending goods will not be allowed to get the baking services stipulated by Bangladesh Bank, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments