To appease US, NBR to offer zero-duty for 100 more goods

The National Board of Revenue (NBR) is set to propose zero import duties on an additional 100 goods in the upcoming national budget, aiming to boost bilateral trade with the United States and cushion higher tariffs on Bangladeshi products entering the American market.

The move received policy-level approval from Chief Adviser Professor Muhammad Yunus during a meeting with National Board of Revenue (NBR) officials on Monday, where Finance Adviser Salehuddin Ahmed was also present.

According to NBR sources, while tariff exemptions cannot legally be granted based on the country of origin, the curated list that was proposed features 161 items that are predominantly imported from the US.

Officials say the selection was made carefully to minimise any significant impact on government revenue.

The items on the list include raw materials and capital machinery used in the textile and garments sector, such as garnetted stock of cotton, cotton waste, raw or retted flax, textured polyester yarn, synthetic yarn, artificial filament tow, synthetic staple fibres, and textile machinery.

The list also covers military and law enforcement equipment, including turbojets, turbo propellers, weapons such as guns, howitzers, mortars, rocket launchers, grenade launchers, standard-issue military arms, muzzle-loading firearms and target-shooting shotguns and rifles, as well as other firearms imported by or on behalf of the government of Bangladesh.

Additionally, various machinery for the energy, medical, agriculture, and poultry sectors have been included.

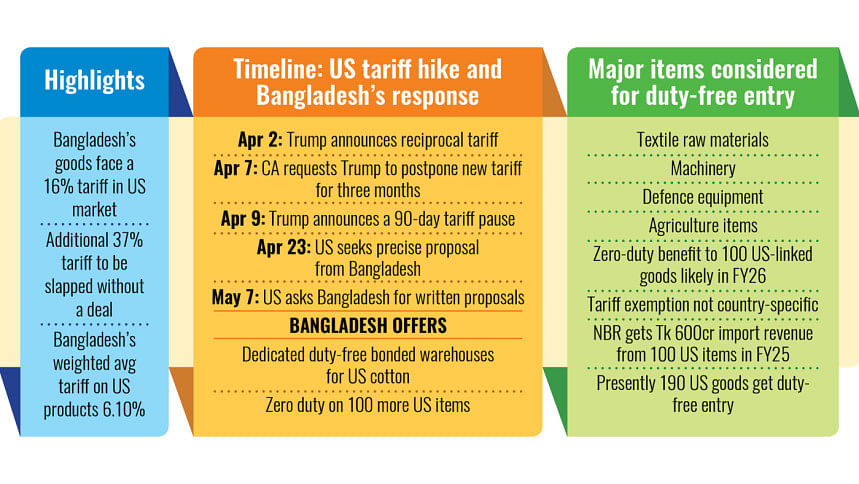

The initiative comes in response to the Donald Trump administration's decision to impose a 37 percent tariff on imports from Bangladesh, announced on April 2, under his sweeping "reciprocal tariffs" policy.

The announcement triggered a global market crash and sparked widespread diplomatic and economic uncertainty. However, a 90-day pause was declared within a week.

Bangladeshi exports to the US already face a 15 percent tariff, meaning the imposition of an additional 37 percent supplementary duty would raise the effective tariff to 52 percent -- posing a serious threat to the country's access to the US market.

In light of these developments, Chief Adviser Yunus formally requested a three-month deferral of the new US tariffs on Bangladeshi exports to allow time for bilateral engagement and review.

To help address the emerging trade imbalance and mitigate the impact of the new US tariff regime, Bangladesh decided to expand its list of zero-duty items for US-origin imports.

A letter from Commerce Adviser Sheikh Bashir Uddin to US Trade Representative Jamieson Greer confirmed that 100 more products would be added to the existing list of 190 items that already enjoy duty-free access.

As per the NBR data, until April of FY25, Bangladesh imported 4.5 lakh tonnes of goods from the United States, valued at Tk 27,245 crore, under the product categories proposed for duty exemptions.

The government collected Tk 595 crore in duties from these imports, which currently face tariff rates ranging between 10 percent and 59 percent.

Experts in the sector welcomed the move to exempt more items, but stressed that the success of the initiative would depend on the selection of products with real demand and import potential.

"The key point is to identify products for which there is actual demand. Duty waivers won't bring meaningful benefits unless imports increase significantly," said Syed M Tanvir, managing director of Pacific Jeans.

Abdullah Hil Rakib, managing director of TEAM Group, told The Daily Star, "The US has imposed similar retaliatory tariffs on competitor countries as well. Our focus now should be to ensure that we gain a relative advantage over our competitors.

"Currently, our garment industry is operating at 52 percent to 54 percent of its capacity. If we want to push that to 65 percent to 70 percent, the European and American markets are crucial. That's where the big orders come from," he said.

Both entrepreneurs expressed optimism that the NBR's initiative would have a positive impact on the ready-made garments sector and help it secure a stronger footing in global markets.

NBR data shows that Bangladesh imported $2.91 billion worth of goods from the US last year.

The customs value of these imports stood at Tk 35,189 crore, generating Tk 2,166 crore in duties and taxes -- an average effective duty rate of 6.15 percent.

In contrast, Bangladesh exported goods worth $8.4 billion to the US during the same period, highlighting a significant trade imbalance.

To address this, Bangladesh had previously allowed zero-duty benefits on 190 US-origin products. The Ministry of Commerce has now sent a letter to the US administration pledging to add 100 more items to that list.

The budget for FY26 is scheduled to be unveiled by Finance Adviser Salehuddin Ahmed on June 2 via a televised address. The budget will be implemented through an ordinance, with VAT and tariff measures taking immediate effect.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments