Inflation creeps up in Sep

Inflation increased 16 basis points to 5.3 percent last month, mainly because of price rise in food items, especially of staple rice.

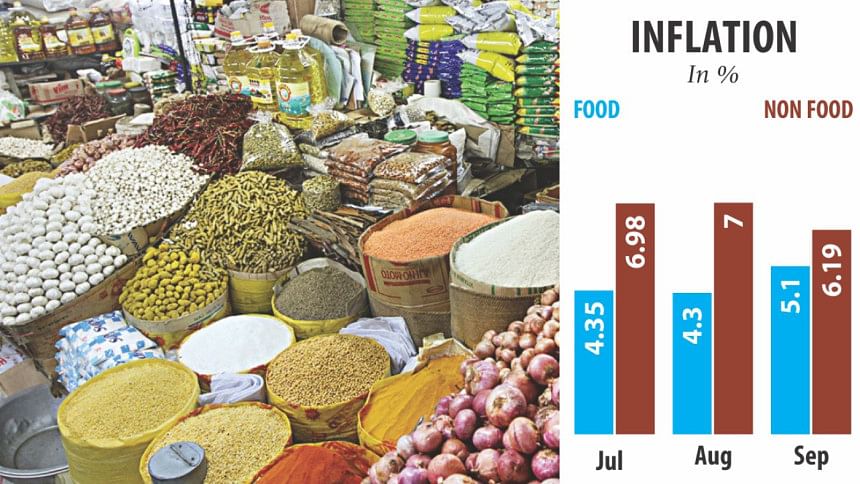

Food inflation rose 80 basis points to 5.1 percent in September, according to Bangladesh Bureau of Statistics.

The price of per kilogram coarse rice jumped 16 percent during the last one year, according to Trading Corporation of Bangladesh.

However, non-food inflation declined 81 basis points to 6.19 percent, the BBS data showed.

A planning ministry official said people spent much on food items last month, especially for Eid-ul-Azha, when around 55-57 lakh cattle were sacrificed.

The government has targeted to keep the inflation rate within 5.8 percent this fiscal year, and the last month's data showed that it was still below the government target.

In its latest monetary policy, the central bank also aimed at keeping the inflation rate within the budgetary target, and the recent trend showed that it is in a safe zone.

Although there was pressure on the Bangladesh Bank to relax the monetary policy for increasing investment, it took a balanced policy by bumping up the private sector credit growth and keeping the policy rates unchanged.

The World Bank in its Bangladesh Development Update said while there was pressure for relaxing the monetary policy stance in order to stimulate private investment, the modest relaxation reflected in the central bank's monetary policy for July-December 2016 is open to debate.

The risks of expansionary monetary policy were dramatically illustrated during fiscal 2010-11, when broad money growth averaged 22 percent per year and private credit growth accelerated to 25 percent per year, it said.

“Excess liquidity did not increase private investment but instead fuelled inflation, depreciated the exchange rate and contributed to the generation of land and stock price bubbles.”

Although the liquidity growth targets in the current monetary policy are not as expansionary as in fiscal 2010-11, they are on the high side, the lender said.

The evidence suggests that the higher growth of liquidity is unlikely to help private investment or gross domestic product growth but may simply feed into inflation.

The monetary policy does not adequately address existing inflationary pressures and the continued appreciation of the real exchange rate.

“With global inflation slowing dramatically to the 2-3 percent range, Bangladesh needs to reduce domestic inflation through firmer fiscal and monetary policies.”

It is not advisable to target inflation at 5.8 percent when all the external competitors and export markets have much lower inflation, the report said.

Besides, the scope for expansionary fiscal and monetary policies in Bangladesh remains limited because of binding structural constraints on the supply side.

In an environment of binding structural constraints, rising risks and limited policy buffers, growth-sustaining structural policies are urgently needed.

“If well targeted, they could also support short-term aggregate demand. Easing inflation pressures have allowed the BB to cut policy rates and maintain their accommodative policy stance.”

Since the drop in international commodity prices is responsible for only part of the decline in inflation, further policy easing is not warranted in view of rising core inflation and uptick of credit growth, the WB said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments