Tk 500cr stimulus for pandemic-hit people who returned to villages

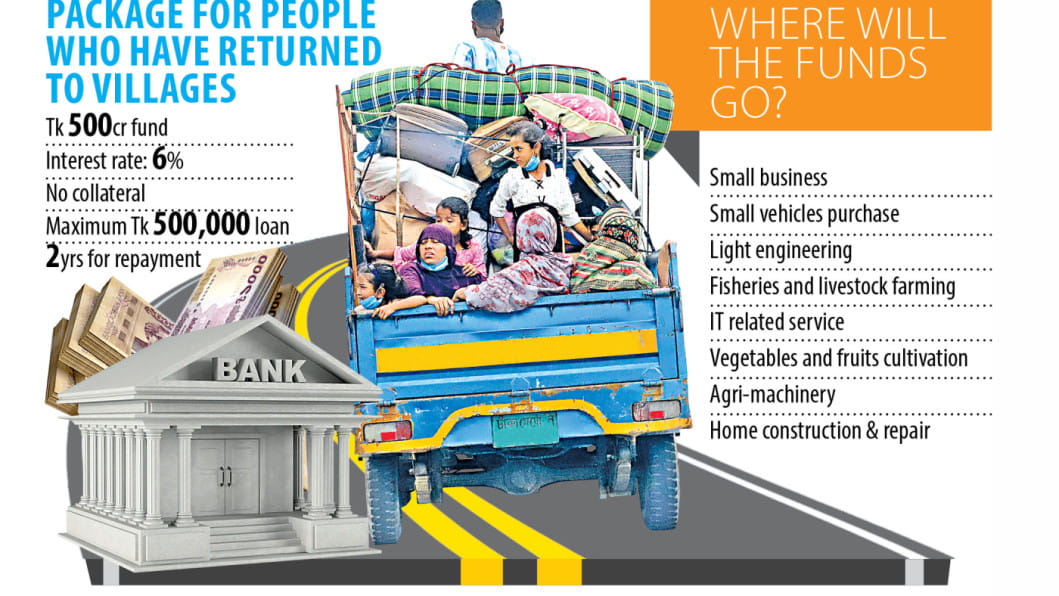

Bangladesh Bank has decided to roll out a stimulus package of Tk 500 crore to support people who migrated back to their villages due to the ongoing economic hardship.

A good number of urban people who lost their jobs at the height of the coronavirus pandemic are now leading a difficult life without any employment in villages, according to a central bank paper.

This will put an adverse impact on the rural economy, which is why the BB has decided to bring the people under the stimulus package titled Refinance Scheme for "Ghore Fera" (homecoming).

The returnees will be able to get funds at six per cent interest rate from the scheme.

Lenders will get funds at 0.5 per cent interest rate, meaning that they will enjoy an interest margin of 5.5 per cent for disbursement of the loans.

Borrowers who will avail Tk 1 lakh to Tk 2 lakh will be allowed to repay the loan by 18 months, which includes a grace period of three months.

The repayment tenure will be two years, including a six-month grace period, if the amount of loan ranges between Tk 2 lakh and Tk 5 lakh.

Clients will not need to provide any collateral.

The tenure of the refinance scheme will end on October 30, 2024. The loan recovery, however, will continue afterwards, according to the BB document.

A study found that 27.3 per cent of the urban population temporarily migrated from cities, particularly Dhaka, on depleting savings for lockdown extensions and rising expenditures, mainly rent and utilities.

A portion later returned but 10 per cent stayed back, according to the third round of the survey done in March 2021. The study by the Power and Participation Research Centre and the Brac Institute for Governance and Development began in April 2020.

"The rural economy will receive a boost if jobs can be generated for the returnees," said the central bank in its paper.

The BB has selected eight sectors to provide the fund: for local businesses with small capital; purchase of small vehicles in the transport sector; light engineering; fisheries and livestock; setting up service centres for information technology; cultivation of vegetables and fruits; purchase of agriculture equipment; and building and repairing houses.

State-run banks will not need to ink any participation agreement with the central bank to take part in the refinance schemes, but this will not be applicable to private and foreign commercial lenders, which will have to sign the agreement to disburse the loans.

A BB official said the central bank would issue a notice to this end within a day or two.

Since the inception of the pandemic, the central bank has rolled out 10 stimulus packages involving Tk 160,000 crore.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments