Pubali Bank on a tear

At the time of its denationalisation in 1984, Pubali Bank's defaulted loans were more than 50 per cent owing to a lack of corporate governance.

The bank set out to turn around from its fragile financial health and it has not had to look back since then.

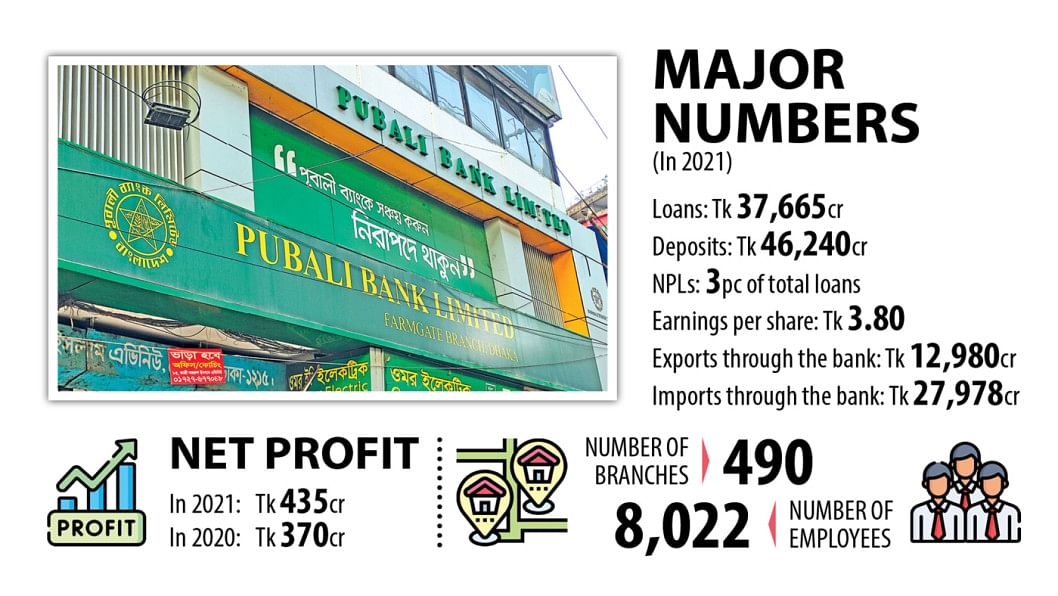

Today, Pubali Bank is one of the sound financial organisations in Bangladesh and non-performing loans (NPLs) have fallen to as low as 3 per cent, way lower than the industry average of more than 8 per cent.

"But it was not a smooth journey as multidimensional efforts had to be taken to improve the health," said Safiul Alam Khan Chowdhury, managing director of Pubali Bank Ltd.

He joined the bank as a senior officer in 1983 after completing his post-graduation from the University of Dhaka.

After serving it for nearly four decades, he is set to retire tomorrow, joining a small group of banking professionals who spent their entire career in a single organisation and went on to helm the pole position.

In fact, Chowdhury was the one who had first-hand knowledge of how the bank was rebuilt from the scratch. In fact, he played an active role in improving the financial health of the lender.

"Our main aim was to fortify the corporate governance, helping the bank become vibrant," said Chowdhury in an interview with The Daily Star yesterday.

Capacity development and the change in the mindset of the workforce have also played a crucial role in the transition of the bank. And all contributed to the reduction of NPLs drastically.

Subsequently, it came out of the list of problem banks in 2005 and the Bangladesh Bank withdrew its observer two years later.

At present, Pubali Bank is the highest profit maker among conventional private commercials bank in Bangladesh.

Its net profit stood at Tk 435 crore last year, up 17.4 per cent a year ago. Operating profit surged to Tk 991 crore in the first nine months of 2022, versus Tk 771 crore generated during the identical period a year ago.

"We have achieved all these without compromising corporate governance," said Chowdhury.

He cited customer satisfaction as the main driver for the bank's stellar performance year after year.

Pubali Bank has placed equal importance on mobilising deposits, selecting borrowers cautiously, and facilitating exports, imports and remittance flow in order to diversify earnings.

Embracing modern technologies and digital solutions has put the bank on a higher growth trajectory.

ICT-based initiatives of the Bangladesh Bank, customers' expectations and demand, and rapid advancement in information and communication technology have significantly influenced the banking industry in recent years.

Thus, the lender, which was established in 1959, has taken a leading role when it comes to introducing a number of banking services provided digitally.

In order to take banking services to customers, it introduced an app-based banking product named "PI Banking" in August 2020. An e-KYC (electronic know your customer) and an instant e-KYC-based account opening system have already been rolled out.

"We have invested a lot to ensure security and use big data analytics, data mining and artificial intelligence to reshape our online banking," Chowdhury said.

According to the veteran banker, technological advancement will be the key driver for growth in the banking sector in the coming years. So, Pubali Bank has decided to rely less on cash and workforce with a view to minimising costs.

He also touches upon the ongoing stress in the country's foreign exchange market, driven by US dollar shortages amid higher imports and escalated commodity costs.

"The central bank has taken some good initiatives such as the restrictions on importing luxury items, increasing the margin on letters of credit, giving incentives to remitters and exporters, and fixing the exchange rate for exports and remittance."

"The country needs to reduce imports through import substitution by utilising every available resource."

Chowdhury suggested exporters search for niche markets to increase export and create their own brands.

"We also need to focus on the Indian market to raise our exports and narrow the trade gap. Congenial environment for doing business has to be created to attract foreign direct investment."

During his long career, he worked as a branch manager, regional manager, division head, chairman of the credit committee of the head office and in many other positions. He was promoted to the post of managing director from additional managing director in April last year.

He singled out his four-year stint as a manager of the Motijheel Corporate branch as the most challenging time for his career.

At that time, the bank was categorised as a problem bank because of its high volume of NPLs.

Management realised that if two branches – the Motijheel corporate branch and the foreign exchange branch -- could eliminate huge losses, the result would be enormous and shake up the bank, paving the way for it to move out of the ignominious category of the problem banks.

Chowdhury was given the charge of running the Motijheel branch.

"I took up the challenge because I have always believed that there exists opportunity wherever there is a challenge. I gave my 100 per cent and within a short time, the branch became profitable."

"The success generated a huge momentum for the entire bank and sowed the seed for its current growth trajectory," Chowdhury said.

In recognition of his honesty throughout his career, the board of Pubali Bank honoured him with the Integrity Award for the last fiscal year. The central bank also recognised Pubali Bank as a sustainable lender during his time at the top.

Chowdhury's parting advice for the banking industry: "Human resources have to be developed to equip themselves for the massive technological changes going through the financial industry. Banks will also have to find ways to mitigate risks."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments