Loan write-offs pick up

Write-off loans rose slightly in the second quarter of 2021, although they remain at the lower level thanks to the eases of rules because of the coronavirus pandemic.

Between April and June, loans amounting to Tk 126 crore were written off, according to data from the Bangladesh Bank. It was Tk 102 crore in the first quarter.

This means it totalled Tk 228 crore in the first six months of 2021. Default loans amounting to Tk 970 crore were removed from the balance sheets in the entire 2020.

Usually, loans are written off when they are entirely provisioned and have no realistic prospect of being recovered. So, these loans are shifted to off-balance sheet records, a move that reduces taxable income on the income statement.

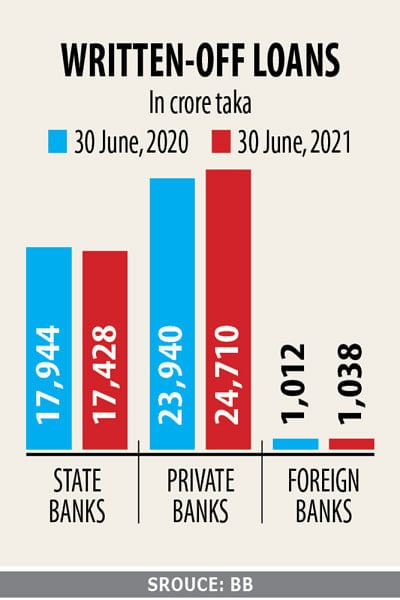

Since the facility was introduced in January 2003, a total of Tk 57,249 crore has been written off.

Of the sum, Tk 43,543 crore has remained unrealised, while Tk 13,706 crore has been recouped.

The trend of loans being written off usually slackens in the first nine months of a year before climbing in the final quarter.

Banks usually write off a substantial amount of default loans in the final quarter to avoid taxation, said a banker.

Lenders provide corporate taxes from their operating profit after making a provision against default and unclassified loans.

Banks have to keep 0.25 per cent to 5 per cent of the operating profit as unclassified loans, 20 per cent for default loans of substandard category, 50 per cent for the doubtful category, and 100 per cent for bad or loss category. It is 100 per cent for write-offs.

Bad loans, including the write-off loans, totalled about Tk 138,787 crore till June.

Mutual Trust Bank Managing Director Syed Mahbubur Rahman said write-off loans were basically a part of the regular cleaning up process of banks.

"If the asset gives me no revenue, there is no point of keeping it there."

Many raise questions that banks cannot recover the written-off loans as they are not monitored properly, which, says Rahman, is a wrong perception.

The boards keep a tab on the write-off loans and regularly update the Bangladesh Bank about it, he said.

Rahman credited various government benefits, including payment waivers, for the decline in the write-off loans. Lawsuits were not filed against the borrowers as courts were closed during the lockdowns, he said.

"Previously, we could file cases if instalments were unpaid for three years. Now, cases cannot be lodged until the borrowers fail to repay the loans for at least five years."

Agrani Bank Chairman Zaid Bakht also attributed the relaxation in the loan classification policy and the drop in lawsuits amid the pandemic for the falling loan write-offs.

Although the loans are erased from the balance sheets, it does not mean banks forget them.

"Every year, we recover a lot of money as we keep pursuing the borrowers," said the former research director of the Bangladesh Institute of Development Studies.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments