Higher debt to put strain on Bangladesh as revenue remains low

The debt-to-GDP ratio of Bangladesh is going to cross 40 percent in the current fiscal year as the government continues to borrow to bankroll its expenditures amid lower collections of revenues.

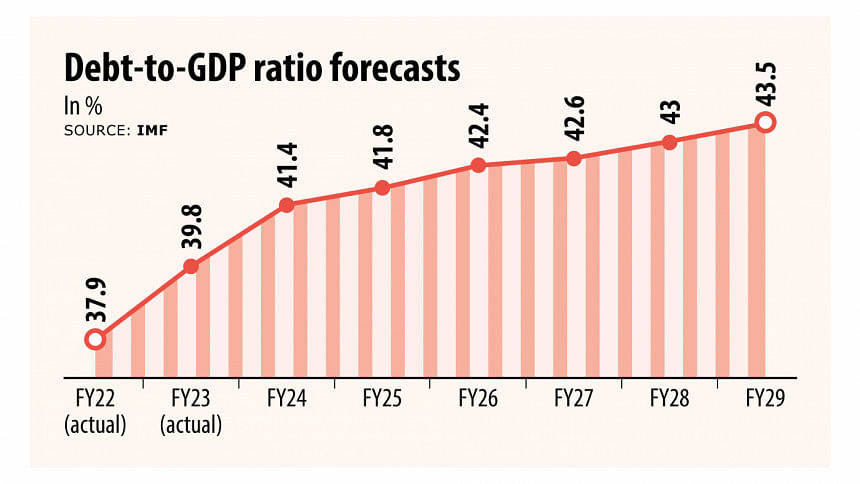

It was 39.8 percent in the fiscal year 2022-23 and is forecast to be 41.41 percent at the end of 2023-24, according to a fiscal monitoring report of the International Monetary Fund (IMF) released last week.

In the last decade, the debt-to-GDP ratio rose by 13 percentage points. The IMF forecasts that the ratio will reach 43.5 percent in 2028-29.

Keeping the ratio below 55 percent is of low risk, according to the IMF.

However, local economists say this could be risky if the revenue growth does not pick up and the existing US dollar crunch prevails.

Due to the growing debt, interest payment costs are rising for Bangladesh.

While the debt burden is rising for the South Asian country every year, revenue earnings are forecast to be low.

The revenue-to-GDP ratio has ranged between 8 percent and 9 percent over the last one decade. The IMF forecasts that it would be 8.8 percent in FY24 and increase to 10.2 percent in FY29.

Although the debt-to-GDP ratio is higher in neighbouring India compared to that of Bangladesh, its revenue-to-GDP ratio is higher.

In India, the debt-to-GDP ratio is projected to stand at 82.5 percent in FY24, which was 82.7 percent in the previous fiscal year. The revenue-to-GDP ratio was 20.2 percent in FY23.

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, said whether the existing debt-to-GDP ratio of Bangladesh can be deemed risky depends on how the GDP was rising with the loans, how revenue was growing, and on the availability of foreign exchange.

The revenue earnings of the country more or less have remained stagnant and the crisis of US dollars has been prevailing for the past one and a half years.

"So, the loan repayments may create some pressure although the GDP is growing," he said.

Since revenue earnings are not rising at a higher pace, the country needs to borrow to meet the budget deficit.

Hussain recommended raising revenue earnings and reducing wasteful expenditure to lessen the risks of high debt.

As of September 30, the government's outstanding debt amounted to Tk 16,55,156 crore: Tk 9,74,092 crore at the domestic front and Tk 6,81,064 crore at the external front.

The government has set aside Tk 94,376 crore to service interest payments for FY24. It spent 53.2 percent of the amount in the July-December period.

In July-December, the government spent Tk 50,223 crore for interest payments against loans, up from Tk 39,925 crore in the first half of FY23, according to a finance division report.

As the debt service to revenue ratio is increasing, it reflects an increase in the cost of domestic debt, the IMF said, adding this reiterates the importance of raising the revenue-to-GDP ratio.

Bangladesh's tax revenue is among the lowest in the world, owing to the country's relatively poor tax performance and a lower tax compliance.

The IMF quoted the Bangladesh government as saying that the risk of external debt distress and the overall risk of debt distress remains low.

Rising interest rates, both external and domestic, will remain a critical challenge in the coming years and the government has revised interest payment projections, it said.

The IMF said the government restated its commitment to public financial and debt management to improve the debt dynamics and ensure fiscal and debt sustainability.

It acknowledged the urgent need to accelerate domestic revenue mobilisation to meet financing needs.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments