BB makes money costlier to tame inflation

The Bangladesh Bank yesterday announced an array of measures to bolster its fight against stubbornly high inflation, a major headache for the new government.

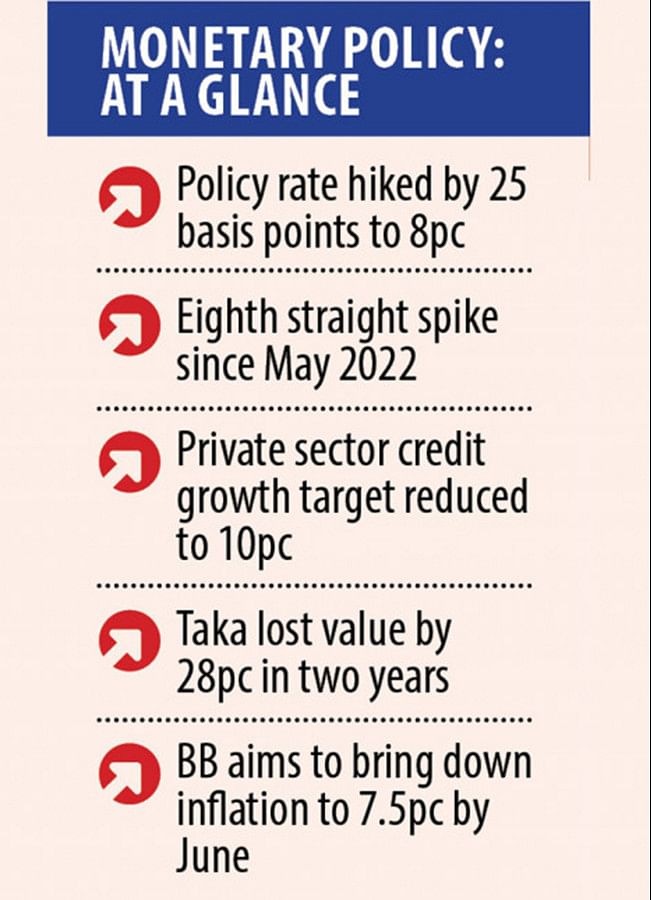

The policy rate, the rate at which the central bank lends to financial institutions, was increased by 25 basis points to 8 percent, its eighth straight spike since the tightening cycle began in May 2022, as inflation shows no signs of cooling. The move is aimed at making the cost of funds higher.

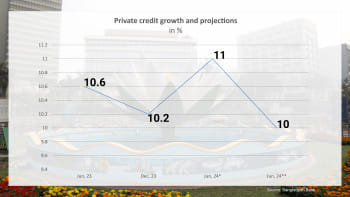

The central bank also cut the private sector credit growth target to 10 percent from 11 percent to dampen demand and decided to adopt a crawling peg to curb the exchange rate volatility.

All these measures are aimed at bringing down inflation to 7.5 percent by the end of the current fiscal year in June. The target was previously set at 6 percent.

Analysts described the measures in the monetary policy statement (MPS) for January-June as inadequate to tame inflation that has stayed over 9 percent since March.

The central bank also has revised downwards the economic growth projection for FY24 to 6.5 percent.

"We are not concerned about GDP growth. Our main aim is to bring down the inflation rate to the desired level," said Governor Abdur Rouf Talukder as he unveiled the new MPS at a media conference.

"Bangladesh Bank's strategic directives are centred on upholding a vigilant, hawkish approach to monetary policy until inflation rates are effectively reined in," the central bank said.

Bangladesh has long been struggling to contain inflation since external shocks driven initially by the coronavirus pandemic of 2020 and later by the Russia-Ukraine war hurt the South Asian economy like other countries in the world.

Globally, central banks pushed their interest rates speedily and sufficiently – many to record highs -- to make loans expensive, thus bringing inflation largely under control. But the BB acted in a cautious manner and insufficiently.

The central bank visibly got down to work in June last year when it raised the policy rate to a record high, scrapped the lending rate cap of 9 percent, and put in place a new interest rate-setting mechanism.

Yesterday, the BB said the recent upward trajectory of inflation has indeed been arrested and a gradual decline has begun.

"However, it is noteworthy that given the global and domestic headwinds prevailing in the economy, this deceleration is occurring at a slower pace rate than initially anticipated."

Bangladesh navigates through a complex global economic landscape, its economy faces several near-term macroeconomic challenges. Foremost among these are the intensifying inflationary pressures fuelled by disruptions in global supply chains and heightened commodity prices.

"Additionally, fluctuations in the value of the taka, especially against the US dollar, are causing ripples through the economy, impacting everything from domestic inflation to trade balances and foreign exchange reserves."

The new monetary policy rightly anchors on the reduction of inflation with a hawkish approach, former governor Atiur Rahman told The Daily Star.

"This gives a signal that the central bank means business and will continue to do whatever is needed to rein in inflation. However, given the persistently high level of inflation for nearly a year or so, the rise in the policy rate could be more, at least by another 25 basis points."

"Maybe, the BB will come back to it shortly to prove that it is indeed hawkish."

The new monetary policy statement comes at a time when most countries are not sure whether their battle against inflation has been won. Fresh uncertainties for the global economy have been created owing to the Middle Eastern conflict and the Red Sea crisis, which have already disrupted the movement of goods through the key shipping route.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said the new policy was not aggressive enough.

"The policy rate should have been increased by 1 percentage point to 1.5 percentage points, while the inflation target should have been set at 3 percent to 4 percent," he said.

"The direction of the monetary policy is right but the measures are not enough to rein in higher inflation."

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, said expectations were high from the MPS as the election was over.

"There is no longer an excuse for delaying actions to reduce inflation, stabilise foreign exchange reserves, relax import controls, and alleviate financial sector vulnerability."

"The challenges are meticulously articulated in the MPS, but they fall short on all fronts in terms of measures concrete enough to yield some visible results within the current fiscal year."

Prof Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, a think-tank, said the new contractionary monetary policy is appropriate. "But it alone can't control inflation."

"There is a need to ensure coordination between the fiscal policy and the monetary policy and increase the institutional efficiency to stabilise the macroeconomy. The government needs to ensure proper market management."

Kamran T Rahman, president of the Metropolitan Chamber of Commerce and Industry, said the containment of inflation is the most important under the current circumstances.

"We can't afford to have a runaway inflation. All will suffer if inflation continues to remain high," he said, adding that the spike in interest rates will affect businesses.

The central bank said it is contemplating the implementation of a crawling peg system to control unusual fluctuations in the currency's value, amid an increasing call for a gradual shift toward a market-based exchange rate system.

The taka has lost its value by about 28 percent against the dollar in the past two years, making purchases from the international markets costlier for the import-dependent nation.

The crawling peg is a system of exchange rate adjustments in which a currency with a fixed exchange rate is allowed to fluctuate within a band of rates.

The crawling peg will serve as a transitional arrangement, paving the way towards a fully flexible regime in the future, according to the Bangladesh Bank.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments