Bangladesh’s export needs to diversify to mid-tech sectors

Bangladesh should widen its export base within and beyond the ready-made garment industry by moving into mid-tier technology sectors, said Aditya Gahlaut, head of Asia for Global Trade Services at HSBC.

In an interview with The Daily Star during his recent visit to Dhaka, he said exports are vital to the economy, not only for the foreign currencies but also for employment.

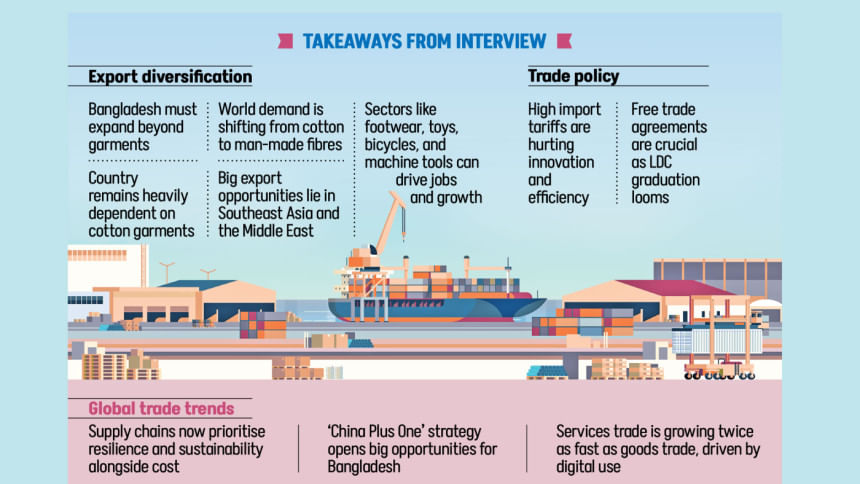

He said the country now remains heavily dependent on cotton garments, while global demand is shifting towards man-made fibres.

"There is obviously a need to diversify within the ready-made garment space, and there are markets which are unexplored, whether it is Southeast Asia or the Middle East," Gahlaut said.

He argued that Bangladesh, like many other Asian economies, must look beyond garments and develop low to mid-tech industries. "Because, firstly, you have a comparative advantage in this sector and secondly, it generates employment."

Sectors such as footwear, toys, machine tools, agricultural products and bicycles, he noted, can provide both jobs and export growth if given proper attention.

As the region's largest trade bank, HSBC helps clients diversify their businesses. But Gahlaut pointed out high import tariffs, which he said had long stifled innovation in South Asia.

"If you have a high import tariff and you protect domestic industry, what also happens is you prevent domestic industries from becoming efficient from innovating because they know they have some sort of protection."

He said tariffs are an important source of government revenue, yet lowering them will ultimately make local firms more competitive.

He pointed to China as an example. "If you look at how China grew its manufacturing, it first focused on backwards participation, where producers import intermediate inputs and then use them to produce the final goods and then export."

Over time, Chinese companies mastered the technology to make those inputs themselves and shifted towards forward participation, focusing on intermediate goods while final assembly moved abroad.

Turning to Bangladesh's upcoming graduation from the least developed country club next year, he said free trade agreements are essential if the nation hopes to sustain growth, especially in garments.

On the global outlook, Gahlaut said tariffs have become central to short-term economic discussions. "We are now at a position where we see the dust settling a bit with multiple countries' reciprocal rates already announced."

Although uncertainty remains high since not all sectoral tariffs have been disclosed, he said. "When there is uncertainty, the one thing businesses do not do or corporates do not do is invest."

But he argued that shifts in world trade had begun long before US reciprocal tariffs came into play.

"Twenty years back, a corporation's decision to purchase from somewhere was based on one parameter, which was cost. It has changed during the last five years; supply chain decisions are made based on three parameters now. Efficiency is still one of them. Resilience is the second thing. The third thing is sustainability from a different lens."

He said supply chains are also being reshaped by the "China Plus One" strategy, where firms reduce reliance on China by expanding into other countries. "That is a big opportunity for corporations in a lot of markets, including Bangladesh."

Another change, he said, is demand-side resilience, as companies try to position themselves closer to consumers. This, in turn, will fuel growth in partnerships, joint ventures and contract manufacturing.

He also mentioned the rapid expansion of trade in services, which has been growing twice as fast as goods trade.

"As people are converting a good, a physical product, into a service offering. It is just how people now have started to consume things."

For instance, Gahlaut said people are not buying CDs anymore, but they subscribe to Apple Music, Spotify, etc. Ten years from now, people will consume a car instead of buying it. That is how the younger generation operates.

While tariffs might dominate the headlines, long-term trends such as digitisation, consumer behaviour and sustainability would continue to drive change, he added.

Once uncertainty clears, companies will have to diversify into new markets and build new relationships. European and US firms want to remain linked to Asian supply chains, while Asian companies themselves are looking outward, Gahlaut said.

"In this situation, our ability to support them is much higher."

HSBC, he said, operates in 18 Asian countries and accounts for 90 percent of their trade flows. It is the region's largest trade bank, more than twice the size of its nearest competitor.

"We are pretty strong in trade, and for us this is actually playing in our hands."

Banks, he said, have an important role to play in helping clients navigate uncertainty. Demand for receivable finance is already rising as companies seek to protect themselves against buyer risk.

HSBC has also invested heavily in digital solutions, with most transactions now processed online. Tools such as HSBC TradePay and Supply Chain Finance cut paperwork and speed up funding.

Digital lending based on e-commerce data is another area the bank has expanded, making cross-border trade faster, safer and more inclusive, he said.

HSBC's profit in Bangladesh rose almost 9 percent year-on-year to Tk 1,086 crore in 2024.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments