Credit card spending keeps growing as virus recedes

Spending through credit cards maintained an upward trend in September as people kept flocking to online sites in the tourism and hospitality sector as the coronavirus crisis continues to wane.

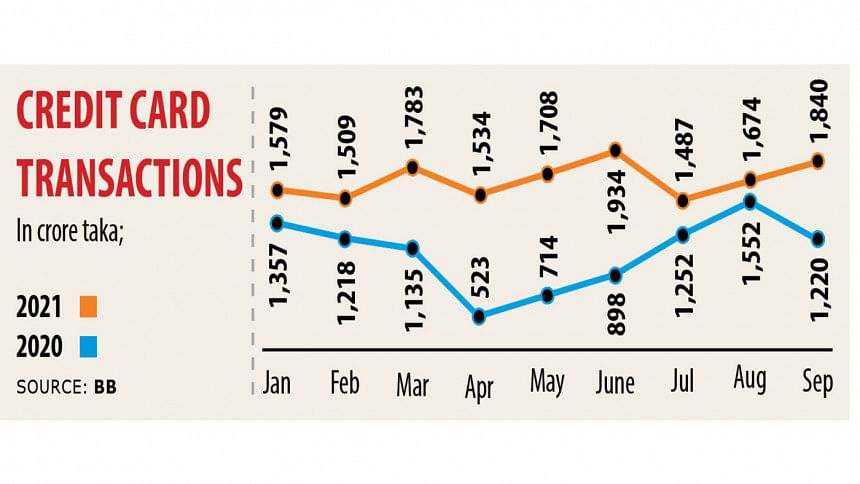

Credit card transactions collectively stood at Tk 1,840 crore in September, up 10 per cent from a month earlier and 51 per cent year-on-year, data from Bangladesh Bank showed.

The tourism and hospitality sector reopened in August after the Covid-19 infection rate began receding.

This has had a positive impact on the upward trend of spending through credit cards, according to bankers engaged in expanding the card business.

What is more, people buoyed by the improving coronavirus and economic situation are increasingly purchasing lifestyle products through their cards.

As such, credit card transactions witnessed magnificent growth in June this year due to advance purchases for Eid-ul-Azha as spending stood at Tk 1,934 crore that month, up 13.25 per cent from a month earlier and 115.46 per cent year-on-year.

The transactions went down in July due to the post-Eid effect before rising again in August.

Syed Mohammad Kamal, country manager of MasterCard, said people are now purchasing lifestyle products and engaging in both domestic and international travel as coronavirus curbs have been eased.

A good number of international flight routes recently reopened as well, encouraging travellers to go abroad. Against this backdrop, the use of credit card is on the rise, he added.

However, he expressed concerns about the new coronavirus variant that has already spread to some countries, creating a tense situation in the business community.

"Economic hardship may return if another wave of Covid-19 hits the country," the country manager said while calling for all relevant parties to promote contactless payment as it could play a vital role in containing the spread of the deadly virus.

A lack of confidence in e-commerce caused by massive irregularities recently unearthed in the sector came as a major blow to the digital payment segment.

Some e-commerce platforms were found to have not delivered products and services to clients despite receiving advance payments.

Clients now largely pay the value of the products based on the cash on delivery system, avoiding settlements through card transactions.

The amount of e-commerce transactions totalled Tk 778 crore in September, up 0.25 per cent from one month ago and 91 per cent year-on-year.

Mahiul Islam, head of retail banking at Brac Bank, said the use of credit cards had increased to a large extent.

The bank has set a target to issue around 7,000 credit cards to clients this month.

Up until September, the number of credit cards in the market totalled about 18.03 lakh, up 1 per cent from a month ago and 11 per cent year-on-year.

"But, we are now a bit worried about the latest variant of the coronavirus. If it spreads alarmingly, the purchasing power of people will face another disruption," Islam said.

"This will have an adverse impact on the economy's current upward trend," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments