Banking sector poised to derail growth momentum for Bangladesh economy

The current vulnerable state of the banking sector steeped in default loans poses the biggest danger to sustenance of Bangladesh’s tremendous growth momentum, said the International Monetary Fund.

Bangladesh logged in 8.15 per cent GDP growth last fiscal year -- after three consecutive years of more than 7 per cent expansion -- and is on track to surpassing the number this year.

“The recent strong economic growth can continue only with a sound financial system that effectively allocates savings to more productive uses,” said the Washington-based multilateral lender in a report after its specialist team visited Bangladesh last month.

As per latest central bank data, which is of September last year, default loans in the banking sector stood at Tk Tk 116,288 crore, which is an all-time high.

Eight state-run banks accounted for more than 50 percent of the default loans: Tk 59,622 crore.

High and increasing default loans and weak governance in the banking sector, especially in state-owned banks, remain major policy challenges, said the report, which was handed in to the finance ministry and the Bangladesh Bank.

To address them, the main priorities are a strict enforcement of existing legal and regulatory requirements, an increase banking sector capital and a reform of the state-owned banks, with a clear separation of commercial and development functions.

The IMF mission though welcomed ongoing efforts to strengthen the legal system to address banking sector weakness, which should be completed in a timely manner.

The mission is sceptical about the success of the central bank’s most recent loan rescheduling package.

It allowed defaulters to reschedule loans by providing 2 per cent down payment.

The move will lower the default ratio initially.

However, without additional measures, there are significant risks that the rescheduled loans will become defaults again, it said.

The IMF mission is also opposed to the idea of forming a public asset management company to take over banks’ toxic loans from them. A draft act on this has already been formed.

“Considering the current regulatory and legal environment, establishment of an asset management company poses significant fiscal risks.”

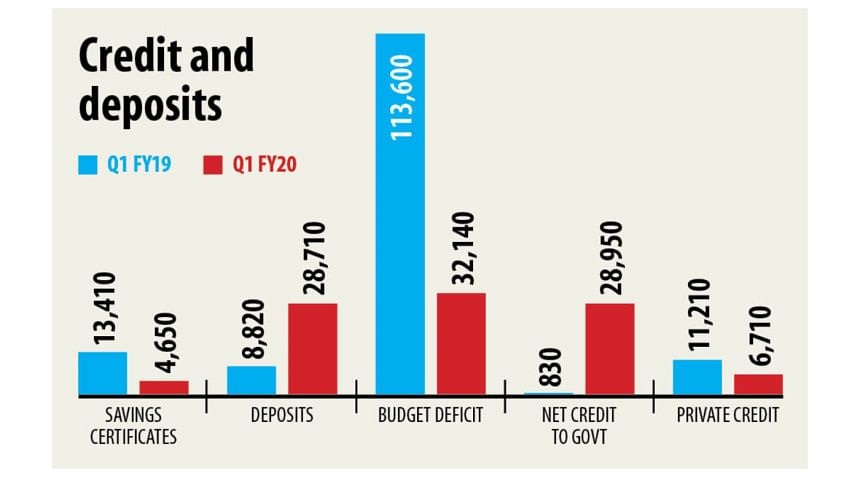

The report also expressed reservations about the increase in government borrowing from the banking sector, brought on by the sharp decline in savings certificate sales and slowdown in revenue growth.

While the increase in the deficit during the first quarter of fiscal 2019-20 was broadly matched by an increase in bank deposits, the simultaneous reduction in savings certificate issuance added to the demand on bank funding.

Subsequently, private sector credit growth slowed down.

In November last year, private sector credit growth dropped to 9.87 per cent, which is the lowest since 2008 at least. The BB’s data goes as far back as 2008.

While the IMF welcomed the decline in savings certificate sales, it called for stepped-up efforts for a smoother transition to lower instrument issuance.

If the government’s revenue deficit continues to widen without a sustained increase in deposit growth, crowding out of private investment would increase, with a possible adverse impact on growth.

Improving revenue collection through a coordinated approach to expand the tax base and modernise tax administration remains a priority, the report said.

Collections grew just 4.83 per cent in the first four months of the fiscal year, down from 6.74 per cent registered a year earlier.

This resulted in a significant widening of the fiscal deficit, according to the IMF specialist team.

Subsequently, they called for automation and introduction of electronic fiscal devices at the earliest as well as simpler VAT structure with fewer non-standard rates and exemptions.

The steps would help both increase revenue and streamline tax administration.

Given weak revenue collection and likely increases in various subsidies, including for liquefied natural gas imports, keeping the budget deficit within 5 per cent of GDP while protecting priority social spending and implementing the budgeted investment spending could become challenging.

The BB should continue to monitor inflation developments closely and stand ready to adjust its stance, it said.

“Inflation expectations remain elevated,” it said.

Bangladesh’s average inflation crept up four basis points to 5.59 per cent in 2019, which saw fluctuations throughout the year and a skyrocketing of the price of onion, an essential cooking ingredient.

Full-year inflation averaged 5.7 percent in 2017 and 5.55 percent in 2016, according to data from the Bangladesh Bureau of Statistics.

The central bank should also continue to increase exchange rate flexibility to help buffer the economy against external shocks, the report said.

Export diversification remains another priority for the government, the IMF mission said.

“Recent export contraction in the garment sector shows risks from excessive reliance on this sector for export growth.”

Export earnings fell 5.84 per cent year-on-year to $19.3 billion in the first six months of the fiscal year on the back of lower shipment of apparel items.

The shipment of apparel, which usually makes up more than 80 per cent of national exports, fell 6.21 per cent to $16.02 billion, according to data from the Export Promotion Bureau.

Within the garment sector, moving to a wider variety of higher value-added goods and expanding to different markets would help buffer external shocks.

Improving the business environment would help attract foreign direct investment, support the creation of new export industries and help nascent industries grow, stimulating higher economic growth over the medium term.

The IMF also suggested a heatmap for Bangladesh to keep track of monthly economic development for efficient and proactive macroeconomic management.

Heatmaps, which are two-dimensional visual representations of data using colours, where the colours all represent different values, enable an efficient and comprehensive overview of a topic at-a-glance.

The multilateral lender also plans to help Bangladesh offset the social impact of automation.

Preliminary results suggest that occupations most vulnerable to automation, judged by the average risk of automation being above 70 per cent, account for about 60 per cent of the current labour force.

The occupations include clerical workers, agricultural workers, plant and machine operators and other elementary occupations, the IMF report added.

An IMF team will arrive in March to help the country with the issues.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments