The economic spasms of debt rescheduling

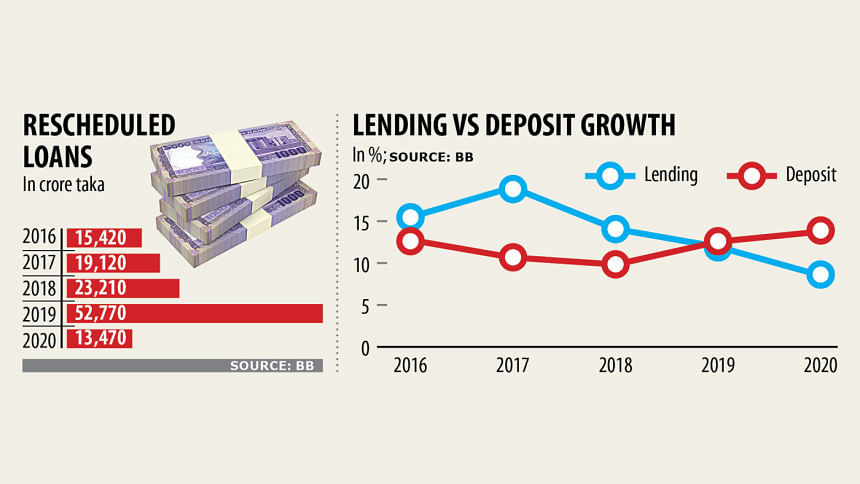

The warning from Bangladesh Bank (BB)—that unrealised rescheduled loans might create a challenging situation for the profitability and solvency of banks in the future—is quite ominous. In its Financial Stability Report (FSR) for 2020, the central bank has cautioned that rescheduled loans, if not recovered, might adversely impact the banks and eventually, one fears, destabilise the whole banking sector.

Rescheduling of loans in Bangladesh has been, and continues to be, a hot topic of discussion. And that is because in recent times, it was not fiscal or monetary policy or any other compelling economic situation that forced the central bank to go for debt rescheduling. Rather, in most cases, it was another manifestation of crony capitalism, whereby habitual defaulters, close to the politically powerful in the country, were salvaged from dire situations, one of which was being declared a loan defaulter. It has been also seen that many loan defaulters who were also aspirants to public offices, scamper for loan rescheduling just before elections to avoid being disqualified from participating in the election. And they were also duly obliged.

Rescheduling of perennial and habitual loan defaulters had come under criticism not just by the financial watchdogs. Even the apex court of the country, for example, had questioned BB's legality of allowing defaulters to reschedule their loan with a repayment period of up to 10 years. The situation this year is different and it was essential to reschedule loans of medium and small businesses as well as provide succour to those farmers who are weighed down by loans with little scope to recover due to the pandemic.

Rescheduling loans indiscriminately is counterproductive. If failure to repay bank debts does not carry penalties, then the practice is replicated by other loanees too, and the consequence is exactly what the BB has apprehended might eventuate—cast the banks in an irredeemable situation.

The condition is dire, but we dare say that the culture of loan default has been somewhat encouraged by certain policies of BB, and a significant portion of loans have become non-performing loans as a result. Nevertheless, we hope that by exercising rigorous monitoring and implementing stringent measures for loan recovery, the banks would make a difference between the habitual defaulters and those compelled under the strain of the pandemic to have defaulted on their payment.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments