Cold rush Bangladesh’s ice cream boom

The ice cream industry in Bangladesh has been undergoing a transformative boom, fuelled by rising disposable incomes, expanding urbanisation, and a growing middle class with a taste for indulgence. Once a seasonal luxury, ice cream is fast becoming a staple of year-round urban leisure, with brands racing to meet evolving consumer preferences.

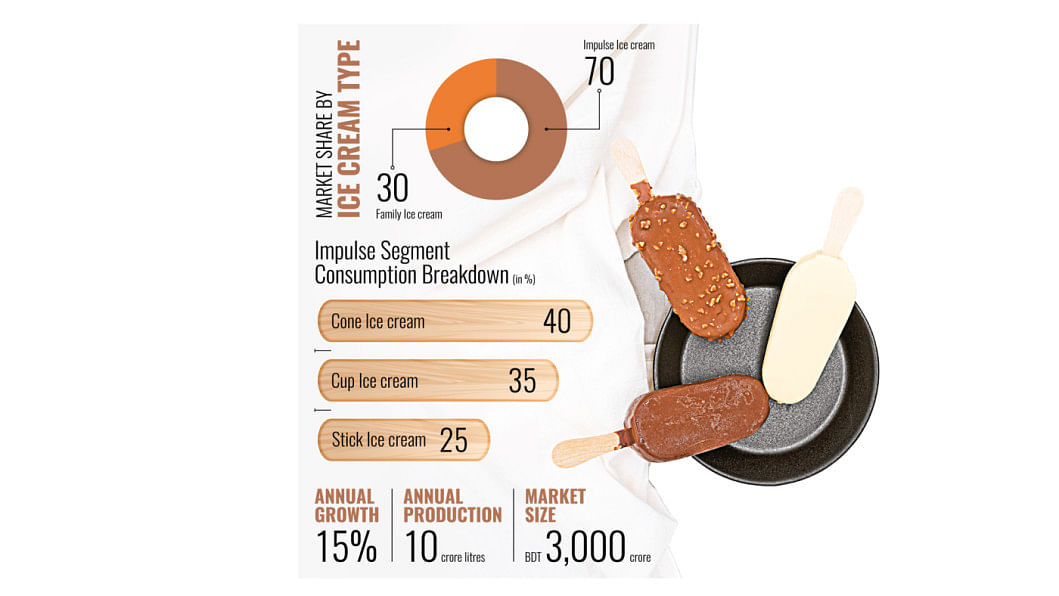

Over the past decade, the market has witnessed remarkable growth, averaging around 15 percent annually. According to industry insiders, the market size now stands at approximately Tk 3,000 crore and is projected to reach Tk 5,000 crore by 2030, if current trends persist. Annual production hovers around 10 crore litres, reflecting an appetite that shows no signs of cooling.

Several factors contribute to this steady rise. As rural electrification improves and refrigerators become more common across households, consumption patterns are shifting. Consumers are increasingly opting for trusted national brands over small, unbranded local producers. Moreover, the desire for premium flavours and hygienically preserved products is on the rise, further cementing the popularity of well-established companies.

Rise of the Big Brands

Gone are the days when local, district-based producers dominated the scene. Today, brands like Igloo, Polar, Lovello, Savoy, Kwality, Za n Zee, and Bloop lead the industry with their nationwide distribution networks and investments in quality control, branding, and cold chain logistics.

"Being a pioneer in the modern ice cream industry, Igloo places the highest priority on product quality," says ASM Mainuddin Monem, Managing Director of Igloo Ice Cream. "Over the past decade, Bangladeshi consumers have become more health-conscious, and Igloo has responded accordingly. We've also partnered with global companies such as YUM! Brands and Carl's Jr. to offer co-branded experiences."

These collaborations are not just branding exercises—they indicate the growing sophistication of Bangladesh's frozen dessert market, where international standards of taste, texture, and packaging are now the norm.

A Seasonal Sweet Spot

Despite its rapid growth, the ice cream industry remains highly seasonal. Summer months—particularly April, May, and June—account for nearly 60 percent of total annual sales. March, July, and August also record significant volumes. However, sales take a sharp dip during the winter months of December and January, making the industry sensitive to seasonal fluctuations in temperature.

Producers have long adapted their business models to this rhythm, deploying seasonal staff and tailoring marketing campaigns around the 'ice cream months'. Nonetheless, innovations in packaging and flavour variety are helping to expand consumption into off-peak periods.

Segments of Taste

The market is broadly divided into two key segments: impulse and family. The impulse category includes items such as cones, cups, and sticks—sold through ice cream carts and retail outlets. This category makes up approximately 70 percent of total sales.

Cones now account for around 40 percent of impulse sales, followed by sticks (30–35 percent), and cups. Interestingly, while cups previously led the category, cones have recently surged in popularity due to the variety of flavours and formats on offer.

The remaining 30 percent belongs to the family segment, typically comprising litre packs designed for home consumption. Within this, classic flavours like vanilla, chocolate, strawberry, and mango dominate, making up 70 percent of family sales. Dessert-style and premium value-added ice creams make up the remainder, a space where brands are experimenting with unique textures, toppings, and international flavour profiles.

Innovation on the Menu

Innovation has become a key strategy for standing out in a competitive landscape. Polar, for instance, has led the way with creative launches under its Carnival cone series.

"Polar constantly evolves by listening to its consumers, exploring emerging trends, and delivering unique flavours and formats," shares an official from Polar. "From classic tastes like Malai and Doi to indulgent options such as Salted Caramel, Mint, Mocha, and Red Velvet, we're committed to delighting customers."

Savoy has also entered the innovation race with its flagship 'Discone Ice Cream'—a fusion of taste, texture, and visual appeal. A Savoy spokesperson notes, "We always believed in Discone's potential. But seeing the audience champion it on their own – that's the real reward. They made it their own. They turned it into culture."

Chilled, but Dependent

Despite local manufacturing and distribution capabilities, the industry is heavily reliant on imported raw materials—nearly 95 percent of key ingredients and machinery are sourced internationally. Milk powder and milk fat come from Australia, New Zealand, and Europe, while chocolate and vegetable fat are mostly imported from Malaysia. Stabilizers, flavourings, natural colours, and nuts are procured from Europe, and packaging materials arrive from Thailand, China, and Turkey.

Locally sourced ingredients include liquid milk, sugar, and flour. This dependence on international supply chains makes the sector highly sensitive to global price fluctuations and foreign exchange volatility.

"High import duties on essential raw materials and equipment create unnecessary burdens," says Monem. "A separate HS Code should be introduced for ice cream-related imports, and more business-friendly duty structures are needed to support the industry."

Challenges and Opportunities

While the prospects are promising, the industry continues to face several challenges. Load shedding disrupts cold chain integrity, a shortage of skilled manpower hampers production efficiency, and underdeveloped transport networks limit access to remote markets. These structural issues, if addressed at the policy level, could unlock a new phase of growth for the industry.

With favourable government support, a stable energy supply, and continued consumer interest, Bangladesh's ice cream sector is poised to become a flagship example of how cold indulgence can drive hot profits—even in a tropical economy.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments