Adopting the ‘Bank in a Box’ concept

The ongoing coronavirus pandemic has caused world leaders, health authorities and law enforcement agencies to take drastic safety measures and led to a slowdown in the world economy. Subsequently, most industries have adapted remote working as the way forward.

Today, advanced technology has changed the way we live, work and communicate with our peers and better knowledge of science and advancement in technology has enabled us to digitalise the different aspects of our livelihoods. Different industries are adopting technologies to accommodate growth and offer new services. In these critical times, working from home has compelled many to become technologically savvy and learn workplace software and new apps to navigate a workday, full of video meetings, digital chats and collaborative projects, previously done in person.

The banking sector is one of the oldest industries in the world and technology advancement has helped improve its functionality by reducing the age-old problems of long waiting hours and the enormous amount of paperwork. Technological advancement in the financial industry has enabled better services for the customers by increasing the use of current alternative online banking options and reducing the functionalities of traditional banking, which involved transferring money by either physically visiting a bank or over the phone.

Bangladesh is one of the top 10 countries in the world with the highest number of populations still not under the financial umbrella. The formal financial institutions in the country, under the guidance of the central bank, have been working relentlessly to reach the unbanked population. There are a number of factors restricting access to finance for the majority of the people in the country.

There are few reasons for Bangladesh ranking among the top 10 countries in the world with the highest number of populations still not under the financial umbrella. According to a 2019 report by Bangladesh Bank, the unbanked population in Bangladesh includes various underprivileged and marginal groups. One of the major barriers to access to finance in Bangladesh is geographical or physical access, especially in the rural areas. The report by Bangladesh Bank claims that there are less than seven bank branches (or ATMs) per 100,000 people and about 67 branches (or ATMs) per 1,000 square kilometres.

Moreover, due to Covid-19, the Bangladesh Bank, on March 24 2020, cut banks' transaction time by four hours and the banks will be open to the customers from 10 am to noon. This step was taken to accommodate banking emergencies of the people during the crisis period. According to the notice published by the central bank, only a required number of branches will be allowed to operate for depositing and withdrawing cash. For ensuring the safety of employees, Bangladesh Bank produced guidelines for certain banks to provide compensation packages for bankers risking their and their family members' lives to perform their duties, to provide service during the crisis.

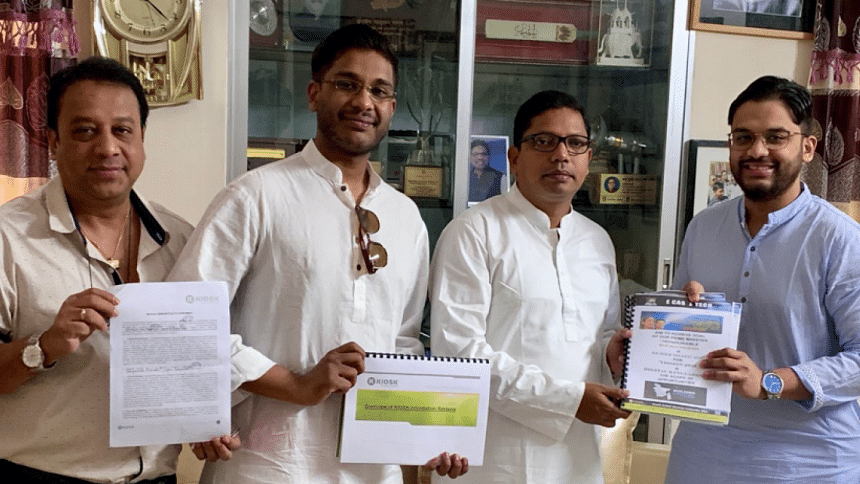

This seems to be the perfect time to adopt the 'Bank in a Box' concept, a project coined by two young individuals, Mahbubul Wasek and Mashrur Wasek, Partners of E CAS E TECH, which will not only provide a safe way of banking by digitalising the financial institutions in Bangladesh, but also help improve financial inclusion in the country. The self-service kiosk machines, with the functionality of video conferencing agents and tellers, reduces the need for physical locations to provide financial services. It provides new employment opportunities and encouragement for the way forward to the 'new normal', causing agents and tellers to work within the safety of their homes and eliminating the risk of spreading diseases from multiple hand transactions of cash. The project was showcased as a prospective IT product at the Digital Device Innovation EXPO 2019 in Bangladesh.

It is an initiative by E CAS E TECH, in collaboration with leaders in Custom Self-Service Kiosk Manufacturers, Kiosk Information Systems, Colorado, USA, under the guidance of Bangladesh's State Minister of ICT Zunaid Ahmed Palak and his team. The ICT Division of the Government of Bangladesh is set to create a new skilled workforce for the remotely managed video conference live agent feature.

These self-service kiosk machines will also be a cost-effective alternative with lower infrastructural and operational costs for the banks to reach the population located in remote geographical locations through formal institutions, where traditional bank branches are not feasible to open and too expensive to operate. It can also be a contender for the current alternative solutions that Bangladesh Bank initiated to reach the unbanked population. These solutions, namely sub branching and agent banking, are tailor made manual attempts to serve the unbanked population. Self-service kiosk machines will be able to automate and digitalise these processes, and at the same time provide a more secure and efficient way of banking to the people.

The 'Bank in a Box' concept provides an alternate solution for individuals who are not able to access banking facilities physically, and also for those who do not own a personal computer or any handheld devices to conduct digital banking. One of the unique features of this alternative banking solution for Bangladesh is the live agent feature, which will be able to assist majority of the potential customers, who do not have the required technological education, to operate e-banking services, in their preferred language of Bangla or English. This leap into the next generation of high-quality remote video communications will be able to provide the sense of talking to a real agent face-to-face, similar to being at a physical bank branch.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments