Sales of savings tools soar on high interest rates

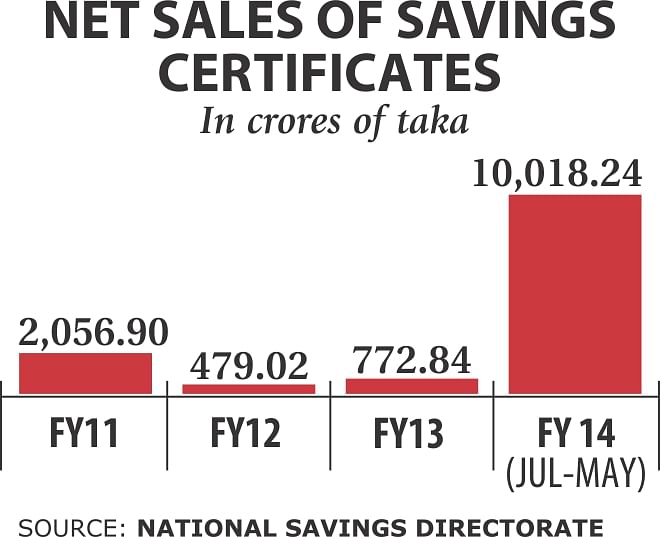

Net sales of savings instruments rose almost 14 times in the first eleven months of the just-concluded fiscal year, as investors were lured in by government interest rates as high as 5 percentage points larger than those offered by commercial banks on term deposits.

The government sold Tk 10,018 crore worth of savings instruments in the July-May period of fiscal 2014, while the amount for the same period in the previous fiscal year was Tk 735.19 crore, according to data from National Savings Directorate.

“Many people are investing in the savings instruments as these schemes provide higher returns,” said Zaid Bakht, research director of Bangladesh Institute of Development Studies.

Banks are offering lower deposit rates than those of the government-sponsored savings instruments like the five-year term certificates, three-month profit-bearing certificates, pensioner certificates and family savings certificates, he said.

The average deposit rate offered by banks came down to 8.01 percent in May, according to Bangladesh Bank, while the rate for savings instruments remained above 13 percent.

“The difference of rates is attracting people to invest more in the savings instruments,” Bakht said.

The government mainly sells the savings instruments through offices of National Savings Directorate, post offices, Bangladesh Bank and specialised and savings banks.

Post offices sell different types of local currency savings certificates, of which pensioner certificates are available for retirees of government, semi-government or autonomous bodies with at least 20 years of service.

“An increased number of customers are buying savings certificates from post offices mainly due to higher profits,” said Sanjay Kumar Saha, a postal operator at Boalmari upazila post office under Faridpur district. The Boalmari post office sold Tk 1.39 crore in savings certificates in June this year, compared to Tk 89 lakh in the same month a year ago, he told The Daily Star by phone.

An individual can invest up to Tk 30 lakh in five-year term certificates and three-month profit-bearing certificates. An investment of Tk 1 lakh on three-month profit-bearing savings certificates pays out Tk 3,000 in profit excluding all taxes every three months, he said.

An adult female can purchase up to Tk 45 lakh in savings instruments under Paribar Sanchayapatra, and earn Tk 1,070 as net profit each month for each Tk 1 lakh, the postal officer said.

Other savings instruments include wage earners development bond, US dollar premium bond, US dollar investment bond and prize bond.

The government sells various savings instruments mainly to finance deficit in the national budget, Bakht said, adding that higher sales of savings instruments will ensure less dependence on bank borrowing.

In the current fiscal year, the overall budget deficit will be Tk 67,552 crore, which is 5 percent of gross domestic product.

Of the domestic financing, Tk 31,221 crore (2.3 percent of GDP) will come from the banking system and Tk 12,056 crore (0.9 percent of GDP) from savings certificates and other non-banking sources, according to budget documents.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments