Rural Land Market in Bangladesh: A Situation Analysis

Participants

Shaheen Anam, Executive Director, Manusher Jonno Foundation chaired the roundtable.

Rina Roy, Director, Manusher Jonno Foundation facilitated the open discussion session.

Professor Abul Barkat, study team leader, Chief Adviser, HDRC, and Professor, Department of Economics, University of Dhaka, shared the preliminary study findings on 'Rural Land Market in Bangladesh: A Situation Analysis'.

Mr. Abdour Rouf, Deputy Secretary, Ministry of Public Administration, Professor M M Akash, Department of Economics, University of Dhaka and Mr. Shamsul Huda, Executive Director, ALRD provided expert opinions on shared findings.

Mr. Pasi Rajender, Operations Manager & Senior Capacity Building Specialist, Project Technical Assistance Team-PTAT, Mr. Shahidul Islam, Director, Uttaran, Ms. Julia Jacoby, Project Manager, Governance & Human Rights, Delegation of the European Union to Bangladesh, and Mr. Murad Bin Aziz, Governance Coordinator, Extreme Rural Poverty Programme, Care Bangladesh shared their opinions as designated speakers

Mr. Rezaul Karim, Land Settlement Adviser, Char Development and Settlement Project-IV (CDSP-IV), Ms. Mitali Nusrat Parvin, Executive Director, Onneyshan and Mr. Mannan Bhashani, Executive Director, Social Progress Services (SPS) speak in the open discussion session. A Good number of civil society representatives particularly knowledgeable on land rights issue also were present in the roundtable.

A roundtable discussion on “Rural Land Market in Bangladesh: A Situation Analysis” was held on December 3, 2014 at the Daily Star Centre jointly organised by Manusher Jonno Foundation (MJF), Uttaran and CARE Bangladesh with financial support from European Union (EU). The purpose of the roundtable was to share the preliminary findings of the survey done to explore land market situation in Bangladesh. The survey was an output of EU's 'Access to Land Programme' in Bangladesh emphasising 'land record digitalisation' with the government and civil society. This supplement contains the summary of the survey findings, key discussions and debates generated in the roundtable. -- Editor

Background

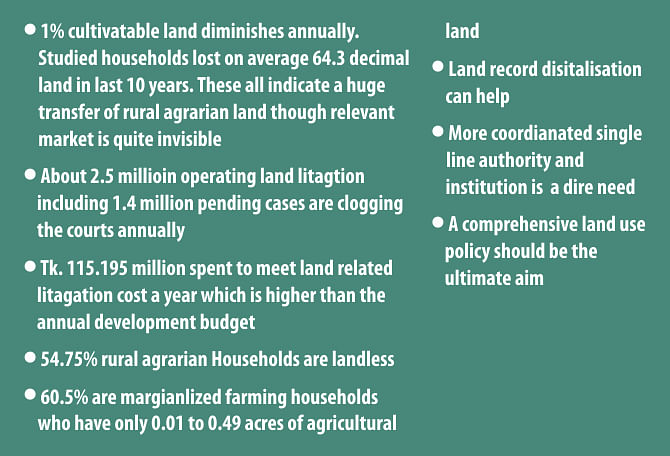

Land in Bangladesh has become the scarcest in comparison to all other resources. Competition for land has turned out to be a severe one. Landlessness and lack of access to land are among the major problems in Bangladesh. 'Real accelerated development' of Bangladesh is not possible, unless problems associated with land are resolved. Without establishing 'constitutional and justiciable' rights of the entitled population over land (ownership, access, use, tenure, etc) development (not in the sense of per capita income growth or GDP growth only) will remain a far cry.

The problematic issue of land is closely connected with survey and settlement operations which are reflected in 'records'. Because of traditional practice these records are often found flawed in themselves and the brunt of this weakness is borne by poor and powerless landholders.

Digital land record and survey to eliminate such flaws has been getting currency in Bangladesh. Along with giving priority to this initiative the government has already start off a project on digitalisation with funding support from 'Access to Land Programme' of the European Union (EU) and in consortium partnership with Uttaran, Manusher Jonno Foundation (MJF) and CARE Bangladesh.

As part of the programme, MJF conducted a first-of-its-kind survey on Land Market Situation in Bangladesh to unearth the dynamics of market mechanism in dealing with land, especially in the rural context. Human Development Resources Centre (HDRC) was assigned to conduct the survey under the leadership of Prof. Abul Barkat, a leading economist of the country. The preliminary survey findings were shared with a wide-range of audience for consultation on December 3, 2014 during a roundtable held at the Daily Star premises. The output of this consultation will emerge as a final report and a publication for wider circulation.

Summary Findings of Land Market Study

* Rental market is more competitive than sales market; resulting in less competitive aggregate land market.

* Re-arrangement of asset portfolio and livelihood obligations are some underlying factors behind market participation by the poor and marginalised.

* Growing commercialisation of rural economy is leading to commercial uses of agricultural lands which have both soaring and dampening price effects on Rural Land Market.

* Heterogeneity of landed property, absence of many buyers and sellers, prejudice of actors, asymmetric information and lack of freedom in marketplace all lead to imperfections in the market.

* Market is afflicted with asymmetric information of actors which is reflected in their reaping price loss (under-pricing in case of selling and over-pricing in case of buying), land loss (lower amount of land in case of purchase and higher amount of land in case of sale), money loss (bribe, extra charges etc.), and time loss (repeated visits to land offices).

* Institutional failure appears in the form of poor service delivery by local land offices.

Brief Summary of the Presentation

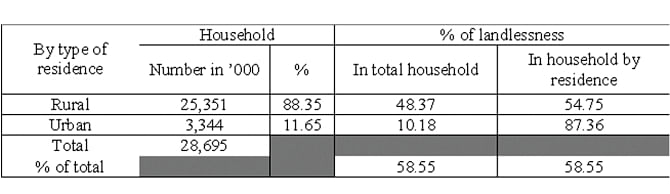

A total of 58.55 percent of households are landless in Bangladesh, among whom 48.37 percent are rural households. The remaining 10.18 percent of landless households are urban representing 87.36 percent of total urban households.

Rural Land Market (RLM)

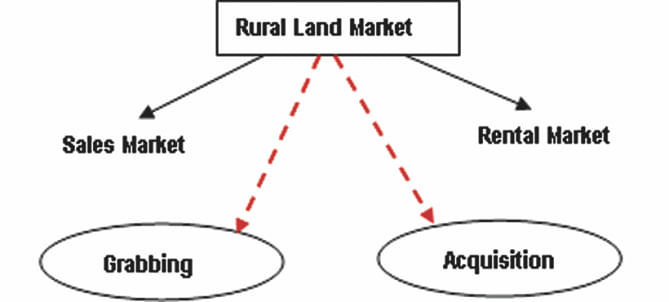

A typical rural land market includes both sales market and rental market. Sales market involves selling and buying activities and rental market involves lease-in and lease-out practices.

Apart from buyers/sellers and lease givers/lease takers, the study has confirmed a number of other actors and institutions as facilitators/intermediaries in land market. Family members, relatives and friends – neighbours, community people, villagers, elected local representatives, professional intermediaries like Dalal, financing agencies, local land offices (Sub-registrar's office, Tehsil office and AC land office), real estate agencies and contract farming companies have been identified as the main facilitators/intermediaries.

Land loss due to grabbing and acquisition has been found to often be higher than the total transfer of land involved under sales and rental market. 69.5% of studied households have reportedly lost land in the last 10 years. Nearly one-third (32.1%) has reportedly lost land due to grabbing (18.9%) and acquisition (13.2%). River erosion (32.1%), cheating by relatives (26.4%) and litigation over disputed land (5.7%) have been reported as some other major factors.

Rural Land Sales Market

The study shows that land price is almost two to three times higher in the country's northern regions than the southern regions. Apparently, productive wet land costs the highest followed by homestead, three crops land, two crops land and one crop land.

Around one-fourth (25%) of studied households has reportedly bought land in the last 10 years. Buyer households are found to have at least one family member working overseas. Doubling income (28.6%), building homestead (24.8%), need to purchase adjacent and/or other family members' land/plot (22.5%) and household food security (21.1%) are reportedly the main reasons for buying land. Savings (51.9%), earning from livestock selling (15%), business (12.8%), land mortgage (10.5%), loan from NGOs (7.5%) and loan from relatives (5.8%) are the main credit sources for buying land.

However, less than one-fifth (17.2%) of households has reported land selling in the last 10 years. Repayment of loan (16.9%), bearing cost of marriage (15.7%), higher price than other landholdings (13.5%), meeting medical expenses (12.4%), ensuring children's education (12.4%), leasing land (9%), enabling family members to go abroad (3.4%), inability to manage (3.4%), distant locations (2.2%) and sharing of heir payment (2.2%) are the key reasons for selling land.

Three broad factors have been identified as motivators in land sales market: usual, driven and allured. Usual factors are active when the buyer and seller make a review of their property portfolio under some favorable price regime which is more responsive to price. Household demand for land is driven when for food security or for maximum utilization of in-house labour, households go beyond the price movement; while distress selling or compulsion of basic demand fulfillment lead the household to 'driven' supply of land. 'Allured' demand for land and supply of land has been growing particularly with commercialisation of agriculture. The households tend to demand and supply land from short term profit motive both in terms of real and speculative investment which does not always move along with demand and supply schedule.

Marginalised Communities & Land Sales Market

In last 10 years, around one-fourth (24.9%) marginalised households bought land. Nearly one-tenth (13%, highest among Hindus) though made attempts, could not buy land. Not a single indigenous household purchased a piece of land. Almost all non-seller marginalised households (99.4%) even did not make any attempt to sell land.

Rural Land Rental Market

More than half (51%) of studied households leased-in land in the last 10 years, on average 46.5 decimal per lease holder households. Increasing income (73.4%), food security (60.3%), inadequate cultivable land (33.2%), profit gain (25.7%), meeting additional household needs (10.7%) and availability of suitable land (6.5%) have been analysed among others as the main reasons behind land lease-in. Land crop selling (39.8%), business (36.1%), savings (9.9%), NGO loan (5.2%), support from in-laws house (5.2%), land sale (3.7%) and loan from money lenders (2.1%) are the major reasons behind financial sources for lease-in.

On the other hand, the study shows, nearly one-third (30.2%) of land was leased out in the last 10 years. Meeting education/health costs (21.1%), ensuring dowry/marriage costs (10.2%), loan repayment (15.6%), increasing income (21.1%), alternative engagement than cultivation (22.7%), shortage of agri-labour (14.9%) are the main reasons behind leasing out land.

Land Rental Market & Marginalised Communities

In last 10 years nearly half (43.7%) of marginalised households reportedly leased in land. Among studied marginalised communities, char living households are reportedly on the top (61.1%) and women headed households are at the bottom (17.6%). Those who did not lease in, almost all of them blamed their financial inability for this. Of these non-lease holders more than ninety percent (92.5%) did not make any attempt to lease in.

Expectedly, in comparison to land lease-in, the number of marginalised households (30.5%) that leased out land is lesser. Notably, among studied marginalised communities Char (44.4%) and Hindu (42.3%) households have leased out the most amount of land and Adibashi (7%) the least.

Rural Land Market & Financial Governance

The study shows that there are clear provisions in the existing Rural Credit Policy to enable landless, small and marginal and share-cropping farm households to be increasingly active in rural land rental market. The amount of credit consists of per acre production cost including rental cost of land. There are also provisions like lower interest rate, occasional interest waiver, rescheduling option for successful farmers, credit allocation in open place, etc. It has been further reviewed that credit programmes of scheduled banks have clear manifestation on this.

Two main implications have been analysed for rural land market from stated policy options. Firstly, provisioning of successful credit facilitated production venture carry potentials to aid farm households to sustain ownership on land. Secondly, farming households' well access to credit contributes to make rental market livelier.

In spite of all this, the study has reviewed comparatively low credit access by small and marginal farm households particularly from banks. Only 2.44 million households, one-fourth of total eligible households, accessed bank credit during 2012-13. A further deteriorating picture is found in the study locations. Only 2.3% of studied households accessed credit from bank for land purchasing in the last 10 years and in case of land lease-in the figure is nil. Absence of protective policy measures like insurance coverage in the face of potential credit utilisation failure and/or crop failure has been analysed as a major problem.

Land Governance and Rural Land Market

A number of demand side and supply side related governance issues have been reported as the major reasons behind imperfect land market. From the demand side, it is reportedly due to unawareness/knowledge gap that restrain rural households from claiming their rights. From the supply side, no/lack of services, delayed services and misgovernance are major problems. Around two-third (65%) of households reportedly did not receive required services from land offices or were asked for bribes or get services in late. Tehsil offices, reportedly, asked for bribe and offered a receipt of lower charge than actual one.

Digital Land Record and Survey

The study did not find a satisfactory level of awareness among the common people on technical aspects of digital land record and survey. Few educated people have expressed their doubt about civil society's (NGOs) level of knowledge on technical aspects of digital land record and survey.

The study has analysed positive endorsement by concerned stakeholders on digital land record and survey particularly in regards to following:

* Contribution to better land governance

* Contribution to enhance quality of services

* Reduced sufferings and harassment

* Quick online access to land records

* Less time loss

* Comparatively errorless record

* Different fees and rent will be well known and paid easily

* Rapid and comfortable mutation process

* Easy identification of Khas land and water bodies locations

* Long standing land issues will be resolved

* Reduced corruption and save time

* Easy upgradation of Porcha

* Easy transfer of land to buyer's account

* Better communication between Tehsil office and AC Land office

From the Roundtable

Next to study findings presentation, a lively discussion was held in the roundtable. The following points present a brief summary on this.

Land Governance

All the discussants agreed upon the issue of weakness of the existing land governance system, particularly in view of its inability to protect the rights of women and the poor in the current land market dynamics. Policy flaws and institutional arrangements were identified as the dominant type of governance flaws.

Two types of policy flaws were mainly discussed: 1) existing policy/processes are not pro-poor and 2) the country lacks any functional land use policy. Mr. Huda acknowledged the Ministry of Land for its earlier initiative to draft the 'Agricultural Land Protection and Use Act' and seriously questioned its intention since the draft act has been nearly shelved, reasons of which are not yet known publicly. Referring to the long-standing battle on land rights and the continued sufferings, Mr. Shahidul Islam expressed his frustration by saying “Existing land laws are against the interest of poor and landless people. Without changing these laws we doubt we can bring any meaningful changes.” Professor Akash however put an emphasis on a comprehensive policy package and offered a six point policy proposition to enable land to the tillers: 1) available khas land needs distributing among poor rural households 2) absentee land owners (either rich or poor) living in urban areas need encouraging to lease out land on a fixed price 3) a land use act needs implementing 4) cooperative needs forming with exclusive membership of rural poor 5) trade union or cooperative of agricultural labours needs forming and 6) digital land ownership record needs including clear indication for usage of specific land.

Multiple authorities and institutions at different layers and a lack of coherence and coordination were some main points of criticism regarding institutional arrangements of governance. As discussed, stated flaws particularly associated with institutional incapacity and/or poor service delivery is where the poor and marginalised are victimised most. To encounter this gap Mr. Rajander emphasised on a coherent land management and land administration system building in the country. Citing from Japan experiences Mr. Huda however suggested that it is not necessary that land issues need to be coordinated from a single Ministry. There can be several Ministries but, what is needed is to create a different department/directorate to deal with the entire issue of land governance at the execution level.

Furthermore, governance issues of land-grabbing and land-acquisition get under serious attack in the roundtable. Ms. Nusrat Parvin voiced separate policy options to curb land grabbing. Mr. Akash stated, “land market related study is always incomplete in Bangladesh unless land-grabbing and land-acquisition are considered since they are the two main causes of land transfer.”

Digital Land Record and Survey

The roundtable unanimously agreed that digital land record and survey would contribute to better land governance. They analysed the process as an immediate first step towards a comprehensive land policy. The discussants also analysed different aspects of digitalization critically.

Ms. Julia Jacobi stated, “How do you define digitalization is important. It may range from simple scanning of documents to using critical technologies for land administration. We should decide what is affordable in our current situation.” Mr. Rajander stated, “The kind of information we are going to feed into the digitalisation of land records system is very important because by giving and putting wrong information in it, we may create an even greater mess."

To Mr. Huda, “Through appropriate structure and technologies, recorded information needs to be made accessible to the poor and disadvantaged”. He further suggested for quasi-judicial bodies to resolve land record related conflicts through quick on-the-spot hearings since according to him more than fifty percent of land related disputes are due to conflicting information about the same record.

Professor Akash holds the opinion that digital land records and surveys need to ensure a clear database on land grabbing and land acquisition. According to him, this can help to curb land grabbing tremendously. He further put emphasis on recording of specific land usage relevant information and ownership.

Referring to the West Bengal experience Mr. Rouf emphasised political willingness in order to make the land record digitalization aspect a real success.

Land Bank

To ensure an effective and efficient land market system, the concept of 'land bank' system gets explored in the roundtable. This system, as explored, refers to a situation where land information and land transfer related total authority and control need to be assigned to an autonomous body titled 'land bank'. This institution will act like a Department/Directorate. Anyone intended to buy or sell land must approach this institution. After careful study, this institution would either buy or sell land on behalf of the government. Referring to this institutional arrangement Mr. Huda further argued that this institution can be made accountable to multiple ministries or authorities but it is important that single agency/office is providing all land market related services at public ends.

Professor Akash was more reluctant to see land bank as a specialised financial institution to regulate credit services so as to ensure an effective land market in which poor and marginalised communities are equally active like others. He however dismantled Professor Barkat's proposition for an interest free credit scheme, raising viability concern, in case the bank is established. Instead, he proposed a minimum service charge for accessing credit.

Optimum Use of Land

Instead of equal access building to land market a more competitive aggregate land market is analysed to be more desirable in which optimum and more productive use of land appears to be the underlying assumption. This is clearly a shift of focus from an all-inclusive rural land market to a more aggregate rural land market. Professor Akash's speech best supplements this, “We can start from the optimum usage of land. Even under capitalism, which promotes efficiency, share cropping has been discarded and labour intensive middle size farm has been promoted. Like Japan, we can adopt a law by which the state can control land usage.”

Interest Free Short-Term Agricultural Credit by Janata Bank – A Success Case

Janata Bank Limited started executing an interest free short-term agricultural credit programme since 2009-10. There was provision for not paying back of even the principal amount if there is crop failure during loan period. In its primary stage, this programme was introduced in the Aila and Sidr-affected Southern 12 districts and Monga-afflicted Northern 5 districts. Starting fund was Tk. 10 million only and distributed among 1,289 farmers. Beneficiary coverage increased to 3,831 farmers during 2013-14. It has been reviewed that credit recipients have successfully utilised their credit and recovery rate has been almost 100% in preceding years. Welfare of beneficiaries manifested particularly in their relief from debt cycle.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments