Half of banks lag in SME loans

Nearly half of the 30 private commercial banks (PCBs) exhibit poor performance in SME credit disbursement, despite the central bank's continuous efforts to boost it.

Thirteen PCBs disbursed less than 5 percent of their total loan portfolios to small and medium enterprises, according to Bangladesh Bank data. The average SME loan portfolio for a PCB is 13.45 percent.

On the other hand, six PCBs lent around 40 percent or more of their total loans to SMEs, statistics show.

“This is embarrassing,” says Anis A Khan, managing director and chief executive officer of Mutual Trust Bank, on the banks' poor credit disbursement to SMEs. Khan believes it should be at least 30 percent as Bangladesh's economy is SME-driven.

Although there are no exact figures, sector people guess there will be around four to five lakh SMEs in the country.

According to the Bangladesh Economic Review 2009, around 6 percent of the country's $90 billion economy comes from SMEs, which is also the largest sector in terms of employment generation.

But different studies conducted over the years found that most SMEs do not get bank finance and even if they do, they will have to show collateral and pay high interest rates.

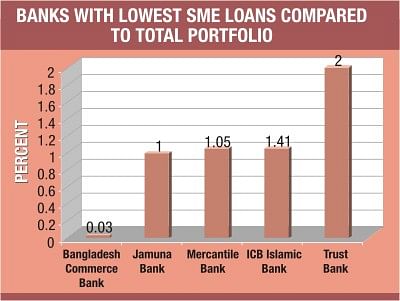

Bangladesh Commerce Bank, the poorest performer with only 0.03 percent of its total loan portfolio, disbursed only Tk 2 lakh in SME loans in January-March.

The SME loan by Jamuna, Mercantile and ICB Islamic Bank is only around 1 percent of their total portfolios. Jamuna Bank disbursed Tk 24 crore, Mercantile Bank Tk 13 crore and ICB Islamic Bank Tk 12 lakh to SMEs in the January-March quarter.

Trust Bank's SME loan stood at only 2 percent of its total loan portfolio, which is 3 percent for Dutch-Bangla Bank and 4 percent each for Social Investment Bank and One Bank.

The SME loan distributed by Eastern, Standard, Mutual Trust, Bank Asia and Shahjalal Islami Bank is around 5 percent of their total loans. Pubali Bank's SME loan takes up slightly over 8 percent of its total loan portfolio.

On the other hand, BRAC Bank topped the list with over 62 percent, followed by EXIM Bank at 48 percent and AB Bank and Uttara Bank at nearly 40 percent each.

Dr Monzur Hossain, research fellow at Bangladesh Institute of Development Studies (BIDS), identified risk, collateral, high interest rate and a lack of knowledge among the sector people for poor credit disbursement.

Hossain, who is now preparing the sixth five-year plan on SME financing, asked banks to be innovative in developing products for SMEs.

“Banks are developing expertise and increasingly becoming interested in funding SMEs," said Helal Ahmed Chowdhury, managing director of Pubali Bank.

He said his bank's SME credit portfolio is not so poor in terms of amount (Tk 515 crore).

“If we include traditional small loans ranging between Tk 10 lakh to Tk 20 lakh in the SMEs, the portfolio will increase significantly,” he claimed.

Anis A Khan of Mutual Trust Bank also said his bank has been taking measures to increase loans to SMEs.

[email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments