Prime Bank on a mission to revolutionise academic banking with PrimeAcademia

Managing finances within academic institutions is often a fragmented and complicated process. Students, parents, teachers, and institutions frequently rely on multiple, disconnected banking services—resulting in operational challenges and missed opportunities for tailored financial support.

PrimeAcademia, Prime Bank's latest innovation, addresses this gap by offering a unified and comprehensive financial solution for all educational stakeholders under one integrated platform. This initiative is particularly vital in a country where around 30 million people remain unbanked, and nearly 72 percent of the population lacks basic financial literacy.

What is PrimeAcademia

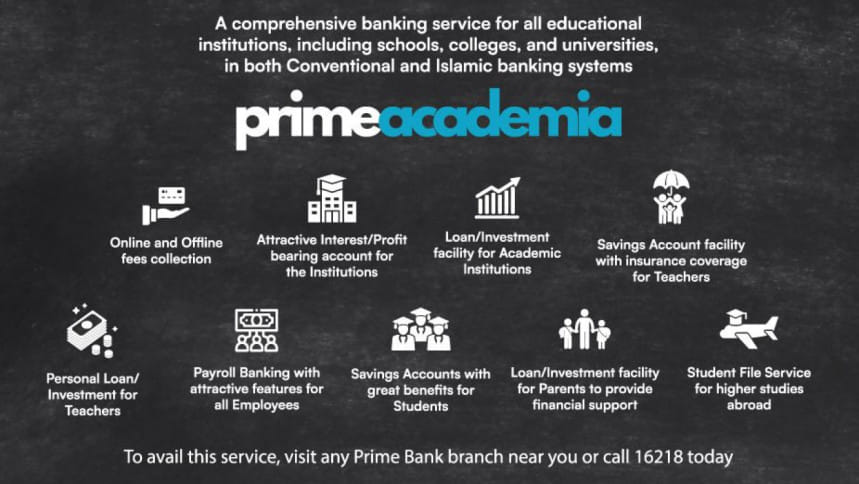

PrimeAcademia is a comprehensive banking platform tailored to the unique financial needs of academic institutions, their staffs, students, and parents. Developed by Prime Bank PLC., the solution simplifies financial management through services like digital fee collection, payroll processing, tailored savings accounts, and education-focused loans.

It includes institutional accounts with competitive interest or profit options, insurance-backed savings plans for teachers, and loan facilities for parents, ensuring that financial support is accessible at every level of the academic ecosystem.

What kind of services does PrimeAcademia offer?

PrimeAcademia provides a full suite of services to streamline financial operations in educational institutions both in Conventional and Islamic Banking mode. These include:

• Profit or interest-bearing current accounts offering competitive rates up to 4 percent p.a.

• Digital fee collection through prime bank owned software 'prime collect' beyond the mobile financial services, debit/credit cards, mobile apps and internet banking.

• Tools for bulk and individual salary disbursements, VAT/tax payments, and government dues.

• Investment and financing options for institutions.

Teachers receive dedicated savings accounts with attractive returns up to 5 percent p.a. and insurance coverage up to BDT 3 lac. They also benefit from personal and professional loan facilities along with pre-approved credit card.

Students are offered youth-targeted savings accounts—earning 5 percent p.a returns for those under 18 and 4 percent p.a for those above. PrimeAcademia also provides student file services to aid in studying abroad.

Parents can access education loans and investment options to ease tuition and academic expenses.

With these features, PrimeAcademia emerges as a robust, one-stop banking solution for the academic sector.

Why PrimeAcademia is a timely initiative

In today's digital world, efficiency and accessibility in banking are not luxuries—they are necessities. With educational institutions managing a complex array of financial responsibilities, the need for an integrated solution has never been greater.

"We view young people as catalysts for inclusive growth. PrimeAcademia helps them access tailored banking services and practical financial education, unlocking their potential for lifelong success," says M M Mahbub Hasan, Head of Financial Inclusion and School Banking at Prime Bank PLC.

The situation is particularly pressing in Bangladesh, where the youth population stands at 46 million, and over 4.7 million of them are university students. Alarmingly, a significant portion of this group still lacks basic financial literacy. Given that youth comprise 36.53 percent of the total workforce, their financial empowerment is not only a personal need but a national priority.

By streamlining banking for students, staff, and parents, PrimeAcademia simplifies financial operations while promoting financial inclusion and economic participation.

A crucial step toward financial literacy

Many students complete their education without acquiring essential financial knowledge—an oversight with long-term consequences. PrimeAcademia aims to change that by instilling responsible financial habits and offering practical tools early in life.

Through youth savings accounts and financial engagement programmes, the initiative encourages saving, budgeting, and informed decision-making—paving the way for a financially literate generation.

Transforming academic banking for the future

In a sector long constrained by outdated financial systems, PrimeAcademia is a breath of fresh air. It empowers educational institutions with digital solutions and equips students, teachers, and parents with tools for a better financial future.

"Educational institutions are at the heart of social and economic progress. Through PrimeAcademia, we are delivering institution-focused banking solutions and seamless digital integration to support the education sector's financial infrastructure," says M Nazeem A Choudhury, Deputy Managing Director at Prime Bank PLC.

As Bangladesh looks toward a future shaped by its youth, initiatives like PrimeAcademia are not just innovative—they are essential.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments