High inflation, costly loans force firms to cut spending

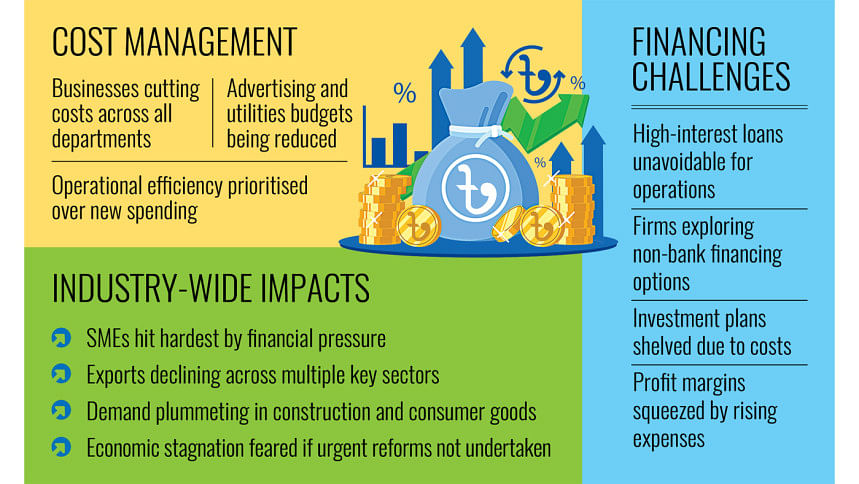

From mild steel rods to electronics and food products, advertisements in newspapers and on televisions have decreased as businesses say they have tightened their belts to weather stubbornly high inflation, the steep devaluation of the local currency, and punishingly high bank interest rates.

Besides, some manufacturers say they are now opting to reduce office utility consumption, optimise office supplies, minimise bank dependence, and find alternative funding sources.

Others are taking a closer look at operational expenses, trimming excess spending, and trying to get the maximum output with limited resources.

"The situation is really difficult," said Md Nurul Afsar, deputy managing director of Electro Mart Group, a manufacturer and marketer of electronics and home appliances.

In recent months, Electro Mart has scaled back its promotional activities, including newspaper and television ads, as part of a cost-cutting strategy.

Despite mounting financial pressures, the company has refrained from raising product prices, fearing that such a move could impact sales amid the inflationary pinch.

"Instead, we are focusing on cost-effective measures," said Afsar.

The top executive said that the company is being squeezed by bank interest rates as high as 17 percent, severely impacting profit margins.

Three years ago, banks used to charge single-digit interest on loans, exchange rates were around Tk 80, and inflation was roughly 6–7 percent.

"Due to the high interest rates over the previous years, our business margins have shrunk significantly. We are trying to cut unnecessary expenses wherever possible to absorb the extra burden," he told The Daily Star.

This effort includes limiting utility usage, optimising office supplies, and cutting down on non-essential expenditures.

"We are reducing costs across all minor areas of daily office expenses — wherever there is room to save," he said.

Similarly, BSRM Steels Limited is adopting a number of cost-cutting measures to cope with rising bank interest rates and brutal inflation, said Tapan Sengupta, the company's deputy managing director.

"We are trying to manage the impact of high bank interest and inflation by cutting costs in every area and making optimal use of technology," Sengupta told The Daily Star.

According to him, the steelmaker is focusing on cost efficiency by trimming daily expenses while ensuring employee salaries remain unaffected.

"We are only spending on cost-effective areas that provide value for money. For instance, our marketing budget has been scaled back," he said.

However, avoiding high bank interest is not feasible, as borrowing is essential for business investment, he mentioned.

"There is no escaping bank interest rates. Borrowing to run the business is a necessary part of investment, so the high rates must be managed," he added.

Meanwhile, leading conglomerate PRAN-RFL Group is trying to reduce its reliance on bank loans to minimise the impact.

"We have had to cut down on bank borrowing, reduce costs, and think outside the box just to survive," said Ahsan Khan Chowdhury, the group's CEO. "Doing business in this climate has become extremely challenging."

According to him, the company has focused on lowering production costs, reducing dependency on bank financing, and exploring alternative sources of funds.

"Our employees have been working tirelessly, and we are continuously applying innovative approaches to control costs and improve efficiency," he said.

Chowdhury said that the fight against red-hot inflation by raising bank interest rates over the past two years has severely hurt small and medium enterprises.

Meanwhile, Anwar-ul-Alam Chowdhury Parvez, president of the Bangladesh Chamber of Industries (BCI), said soaring utility bills are further compounding the challenges for businesses.

Regarding the small and medium business segment, Parvez said that gas and electricity price hikes have pushed up production costs, while high bank interest rates are making it nearly impossible for them to survive.

Given such conditions, domestic producers are being forced to raise prices, directly burdening consumers already struggling with high living costs, he added.

As a result, sales and profit margins have plummeted compared to last year, a trend clearly reflected in the quarterly reports of listed companies.

"If listed firms are struggling this much, one can only imagine the plight of unlisted ones," Parvez added.

Citing a recent BCI assessment of the business environment under the current political context, Parvez cautioned of deep stagnation without urgent policy actions.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments