NBFIs ordered to ensure proper use of loans

The central bank yesterday ordered non-bank financial institutions (NBFIs) to ensure the proper use of loans as it looks to restore corporate governance in the financial industry, which has been tainted by scams recently.

The Bangladesh Bank asked them to carry out the internal inspection on a regular basis on the loans, according to a central bank notice.

NBFIs will have to preserve the inspection reports, which will help them bolster internal controls and compliance, the central bank said.

The BB's instructions came at a time when some NBFIs are struggling to run operations due to a lack of corporate governance.

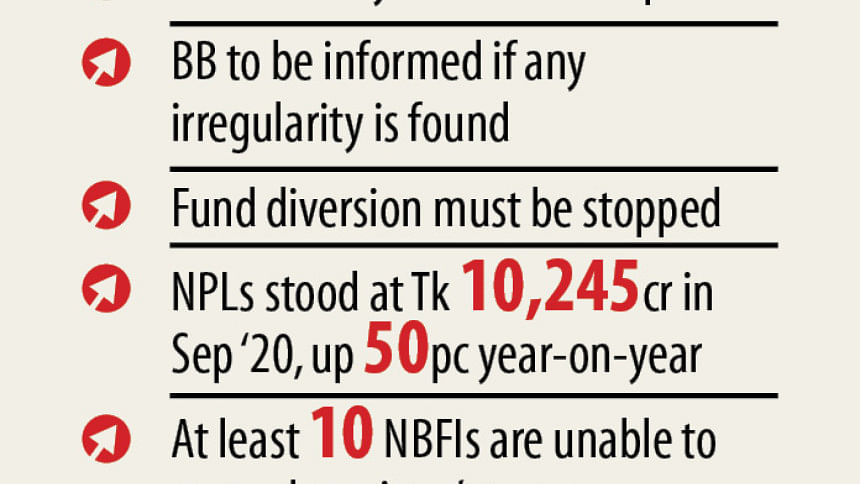

There are 36 NBFIs in Bangladesh, and at least 10 of them can't repay depositors money despite the maturity of the funds as scammers siphoned off a large amount of money from the institutions in recent years.

NBFIs will have to monitor the loans so that the fund is invested in line with the purposes stated by the borrowers in the credit applications.

The central bank instructed financial institutions to clear instalments of a project loan after ensuring that the borrowers have used the fund of previous instalments appropriately.

In addition, NBFIs will have to unearth any fund diversion immediately. Actions will have to be taken against the errant borrowers after detecting the fund diversion, the BB said.

Fund diversion takes place when borrowers don't use the loans in the sectors as mentioned in the credit proposal.

Borrowers will not be allowed to adjust or repay instalments of a loans by way of taking another loan.

NBFIs have been asked to include the provision of the proper use of loans in the internal credit regulations.

If the internal inspection teams of NBFIs find out any irregularities perpetrated by borrowers while investing the loans, NBFIs will have to inform the Department of Financial Institutions and Markets of the central bank immediately.

As of September last year, default loans in NBFIs stood at Tk 10,245 crore, up 50 per cent year-on-year. NPLs accounted for 15.5 per cent of the outstanding loans in the NBFI sector at the end of the third quarter of 2020.

The actual amount of toxic assets is much higher than the figure reported by NBFIs in September, as many of them concealed NPLs by way of using the window dressing. Besides, NBFIs also enjoyed a loan moratorium throughout last year, a facility that curbed the upward trend of NPLs for the time being.

"The instruction given by the central bank is a routine task for any NBFI," said Mominul Islam, chairman of the Bangladesh Leasing and Finance Companies Association, a platform of managing directors of NBFIs.

But, the central bank has reminded the NBFIs of the issues once again as it has recently unearthed a wide genre of irregularities at some institutions, he said.

The errant NBFIs have given out loans to fictitious companies, putting an adverse impact on them, he said.

Default loans will go down if NBFIs follow the instruction appropriately, said Islam, also the managing director of IPDC Finance.

The financial health of at least 10 NBFIs has been in dire straits due to financial scams in recent years.

For instance, Bangladesh Commerce Bank and Janata Bank are in a difficult situation to recover Tk 633 crore they deposited with six non-bank financial institutions.

Private lender BCB and state-run Janata kept the fund with Peoples Leasing & Financial Services, First Finance, FAS Finance & Investment, Bangladesh Industrial Finance Company, International Leasing and Financial Services, and Premier Leasing & Finance Ltd several years ago.

Although the funds have matured, the NBFIs are unable to return the money to the banks.

Prashanta Kumar Halder and his associates embezzled a large amount of money from four NBFIs, creating a haphazard situation for the financial industry.

The Anti-Corruption Commission is looking into the matter.

The central bank applied to the High Court in 2019 to liquidate Peoples' Leasing and Financial Services (PLFS) after the board of the NBFI had informed the BB that it was unable to pay back depositors.

PLFS is now in the process of liquidation.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments