Economy making uneven recovery

Bangladesh's economy is making an uneven recovery with larger firms at a faster pace and small and medium enterprises (SMEs) falling behind, said the Centre for Policy Dialogue (CPD) yesterday.

"Smaller firms, people belonging to the low-income category and the poor (people) in general have been affected disproportionately and have not received adequate government support," said CPD Senior Research Fellow Towfiqul Islam Khan.

He was presenting the CPD's review of the economy in the fiscal year 2020-21 at a virtual media briefing.

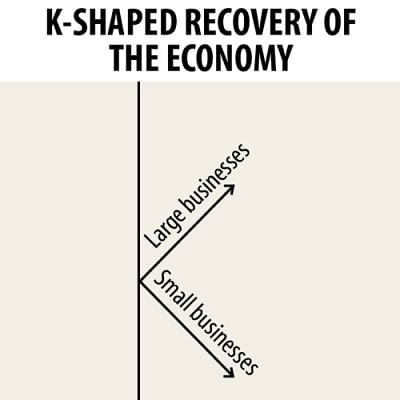

The independent think tank said globally, the possibility of a K-shaped recovery, when a segment of the economy pulls out of a recession while others stagnate, was being widely discussed.

The CPD said stimulus packages and liquidity support would help large industries and public organisations recover at a faster pace while the SMEs would lag behind.

"Bangladesh is likely to follow a similar shape," he told the event moderated by CPD Executive Director Fahmida Khatun.

The CPD said the SMEs were important sources of employment and the slow recovery of these small and medium businesses could lead to a further rise in inequality.

"This could jeopardise the sustainability of the recovery. Policymakers need to chart out the recovery path in a manner that does not leave out the weaker but critically important sectors of the economy," he said.

CPD Executive Director Fahmida Khatun said the big entrepreneurs would be able to recover soon while the small ones would face challenges to do so.

The CPD said Bangladesh performed well in terms of economic recovery compared to many other countries in the world that have been ravaged by the Covid-19 pandemic.

The think-tank said the economy remained resilient because of its domestic strength resulting from high agricultural production, remittances and exports, particularly that of readymade garments (RMG).

The CPD said it would take more time for the global economy to recover. Hence, it said, the immediate focus should be on the domestic economy.

"We need to strengthen our domestic demand. The government's initiatives are required to boost domestic demand," said Mustafizur Rahman, distinguished fellow of the CPD.

The government should announce a second stimulus package apart from increasing expenditure to increase demand and encourage private investment, he said.

If government expenditure drops, private investments is likely to be discouraged, he added.

The CPD said the SMEs should be prioritised and employment focused in the second phase of the stimulus package.

Continuation of the same packages with an extended timeline will not produce the intended results and outcomes, it added.

Soon after the pandemic, the government announced the stimulus packages that had attempted to facilitate the economic recovery process by offering cheaper credits alongside monetary easing, it said.

However, asymmetry is observed in terms of access to and implementation of the stimulus packages. Meanwhile, large industries were more successful in accessing and attaining the packages' benefits compared to their smaller counterparts, the report read.

"There is no doubt that the economy will require a second round of stimulus packages for the attainment of a sustainable recovery," it said.

The civil society body also talked about the health of the banking sector.

Khatun said the banking sector was suffering from high amounts of classified loans.

The CPD said excess liquidity in the banking sector has nearly doubled from Tk 103,000 crore in January 2020 to Tk 205,000 crore in December 2020.

Khan said banks may attempt to offset their losses from holding excess liquidity by giving out risky loans. It may lead to a higher volume of non-performing loans, high inflation and the creation of asset bubbles.

"Unfortunately, there is no access to information on the true health and performance of the banking sector during the ongoing pandemic," said the CPD.

Wilful loan defaulters should not be allowed to access to any of the Covid-19 related stimulus packages, he said, adding that weak and poorly governed banks should not be allowed to participate in the Covid-19 related liquidity support packages.

He said all sectors may not be able to recover in the same way. For instance, in the export of the RMG, knitwear posted a 3.8 per cent growth while woven wear had experienced a sharp decline of 10.9 per cent.

Recovery performance is not the same across the different agro-based businesses and enterprises too. The highest level of recovery was observed in case of business of vegetable production and poultry sub-sectors, both of which reached the pre-Covid level, according to the CPD.

"In case of dairy farming, however, it has yet to reach the pre-Covid level," it said.

CPD Research Director Khondaker Golam Moazzem recommended launching an integrated financial system.

"Because, lack of integration in financial system is the main reason for financial corruption," he said.

Citing rising prices of rice against the backdrop of very low food stocks at public warehouses, he said the government should act fast to replenish stocks.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments