Unilever Consumer Care sees drop in Q3 profits

Unilever Consumer Care, formerly known as GlaxoSmithKline, witnessed a drastic year-on-year fall in profits in the July-September quarter of this year due to low sales amid the ongoing coronavirus pandemic.

Besides, global supply chain disruptions have made it difficult to secure raw materials, leading to a shortage of finished goods, said KSM Minhaj, chief executive officer and managing director of Unilever Consumer Care.

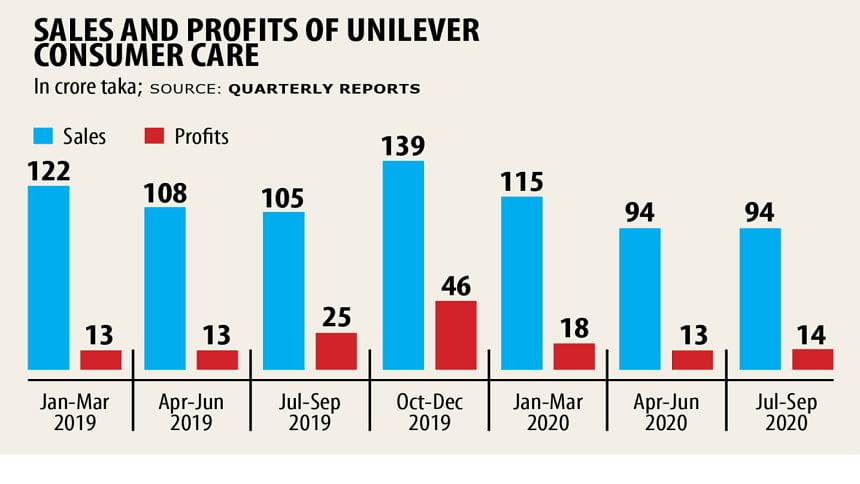

Sales receipts dropped by 10.39 per cent to Tk 94.17 crore between July-September quarter while profits fell 44.74 per cent to Tk 14.07 crore during the same period, the listed multinational's financial report shows.

The decline in profits is a result of decreased sales, rising cost of raw materials, increased customs duty on dry mix ingredients (DMI) and scrapping of the enterprise resource planning system, the company said in a disclosure published on the Dhaka Stock Exchange (DSE) website yesterday.

Unilever Consumer Care markets and sells around 400 brands in more than 190 countries. These include nutrition and oral healthcare products, led by brands such as Horlicks and Sensodyne.

"Our iconic health food drink brand, Horlicks, saw lower sales in the third quarter due to a shortage of imported DMIs," Minhaj said.

The company's profits were affected by the decision to increase import duties on DMIs from 15 per cent to 25 per cent alongside a price hike in other key ingredients like full cream milk powder.

"But despite the inflated import duty, we have reduced the price of Horlicks to make our nutritional products more affordable for our customers, considering the fact that their purchasing power has been reduced after the Covid-19 outbreak," he added.

When news broke that Unilever Consumer Care, which still trades under the name of GlaxoSmithKline, registered reduced profits and sales for the quarter, the company's share price dropped 1.10 per cent to Tk 2,100 yesterday.

Even though sales have dropped, the cost of goods sold rose by 38 per cent year-on-year to Tk 51.98 crore in the third quarter, according to Unilever's quarterly financial report.

However, Unilever Consumer Care, a subsidiary of Unilever Bangladesh, did see its profits grow by 2.49 per cent in comparison to the second quarter (April-June), when the coronavirus outbreak was at its peak.

In June, Unilever spent about Tk 2,020 crore to buy more than 82 per cent of GlaxoSmithKline's (GSK) health food and drinks business in Bangladesh from Setfirst, a corporate director of the company.

Earlier in 2018, GSK Bangladesh, a subsidiary of the British multinational company GSK Plc, shuttered its 60-year-old pharmaceuticals business in Bangladesh.

The company was listed with the Dhaka Stock Exchange in 1976 and has disbursed over 500 per cent cash dividend at least for the last five years.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments