Cement sales rise slightly

The cement makers are finally getting some respite from the Covid-19 fallout thanks to a slight increase in sales but they believe it will not be possible to book any profit this year.

By the end of 2020, sales could reach 80 per cent of what it was last year.

"Sales in the sector grew by 7 per cent in September compared to the month before, which gives hope of recovery in the future," said Asadul Haque Sufyani, chief operating officer of Bengal Cement.

Bulk orders for cement are coming as the construction work on the government's major development projects resumed in July.

Besides, expatriate workers are going back to their jobs, leading to a ripple effect on the rural economy that will impact the cement sector, Sufyani said.

According to the chief operating officer, it takes at least two months to start disbursing funds for the development projects after a new budget is passed.

For this reason, it is taking a bit of time for sales volumes to return to pre-pandemic levels.

The various development projects will start in full-swing in the coming days as the monsoon season is about to end and the following dry weather is peak season for the cement sector.

In a bid to cover all the development activities which were put on hold during the two-month lockdown between March 26 and May 30, the government is going to float new tenders.

And apart from this, the Covid-19 situation will likely. return to normal, which gives the sector hope, he added.

Mohammed Amirul Haque, managing director of Premier Cement, said the cement manufacturers will not be able to make profits this year even though sales increased recently.

Sales will decline by 20 per cent year-on-year, which will increase the overhead production costs and reduce profit margins.

Now that around 70 to 80 per cent of construction work has returned, it has benefitted the cement sector, he added.

However, Haque fears that the coronavirus situation may intensify during the upcoming winter, which will adversely affect the sector.

"We need policy support from the government to change Bangladesh into an industrialised nation from a trading one," he said, adding that the cement business provides no scope for quick profits.

Premier Cement could supply cement for 62 of the government's ongoing development projects, such as the Padma Bridge, Rooppur Nuclear Power Plant, Matarbari power plant and Karnaphuli Tunnel, according to the managing director.

The National Board of Revenue (NBR) is not industry friendly as it has imposed illogical custom duty on imported raw materials, Haque said.

The NBR also neglects to return adjustable advance income taxes, which could help the sector handle the current capital crisis.

Besides, the NBR does not accept digital certificates on consignments and imposed a 5 per cent customs duty instead of the 3 per cent charged under the South Asian Free Trade Area (SAFTA).

The whole world is heading towards digitalisation while the NBR is walking backwards to old and traditional ways, which is another barrier for businesses, he said.

Manufacturers deposit adjustable income tax to the NBR when importing raw materials through bank loans, for which the millers are liable.

Cement makers could see some benefits in the coming days though if some of the existing challenges are removed as demand will continue to rise alongside the return of economic activities, he added.

Khandoker Kingshuk Hossain, chief marketing officer of Bashundhara Cement, said industrial growth in the sector cannot be achieved this year despite the recent increase in sales.

"Bashundhara Cement will not achieve growth like that of last year but sales could be the same as it was before," he said.

Hossain hopes that the upward trend in sales will steepen in November and December following a dull season for the sector due to the pandemic and incessant rain.

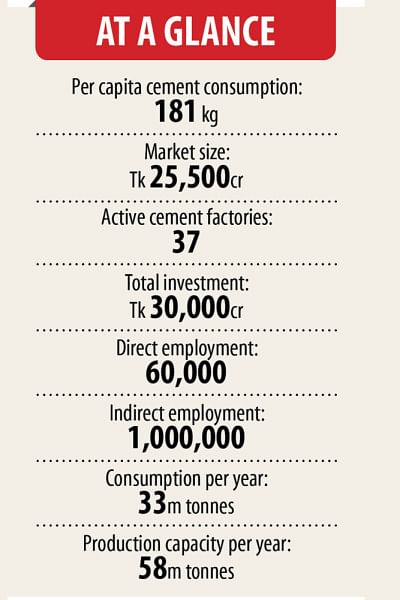

There are 37 active cement factories in Bangladesh which invested over Tk 30,000 crore to attain a combined annual production capacity of 58 million tonnes against a demand of 33 million tonnes.

According to Bangladesh Cement Manufacturers Association (BCMA), local companies dominate the market, where annual sales have reached $3 billion, or Tk 25,500 crore.

Of the total consumption, individuals account for 25 per cent, real estate companies and developers 30 per cent and the government 45 per cent.

Bangladesh's per capita cement consumption is around 181 kilogrammes but is expected to increase to 220 kg by 2020.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments