Cut kerosene, diesel prices

The Centre for Policy Dialogue yesterday said the value-added tax rate should be 12 percent in the low- and middle-income countries in South and East Asia.

Bangladesh's proposed uniform VAT rate of 15 percent is on the high side when compared to neighbouring low- and middle-income countries in South and East Asia, said CPD research fellow Towfiqul Islam Khan.

He made the comments while presenting the think-tank's recommendations for fiscal 2017-18 budget in the capital's Brac Centre Inn.

The global median rate for VAT is 15 percent, but in South and East Asia and among low- and middle-income countries in general, the median appears to be 12 percent.

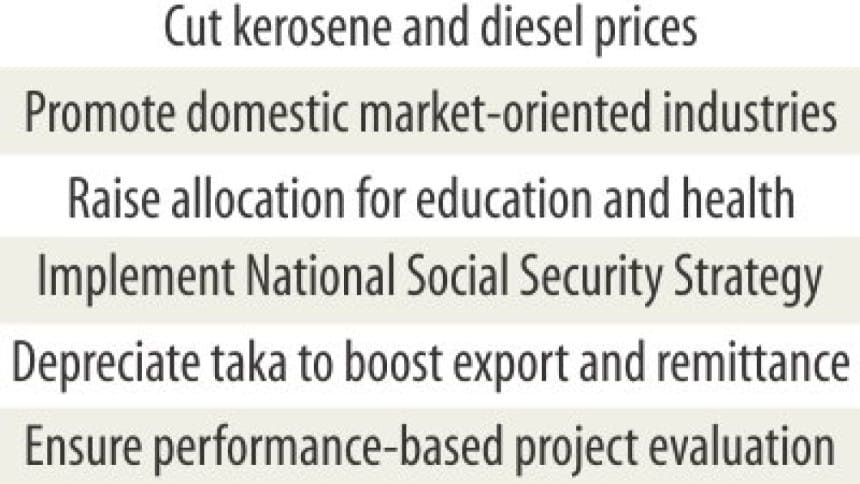

If a uniform VAT rate is to be implemented from July 1, it is recommended that the rate be reduced to 12 percent gradually over a medium term, the CPD said.

It is hoped that after the uniform 15 percent VAT rate gets effective, the ensuing revenue expansion will enable the government to lower the VAT rate without adverse earning consequences.

The civil society body also suggested adjusting VAT rates to the prices of utilities such as electricity in a way that the combined effect does not create a serious burden on consumers.

CPD warned that the cost of production in almost all sectors might go up in the coming months as a result of the new VAT law.

There might also be depreciation of the money exchange rate, a rice price spike and a further increase in tariffs for electricity and gas.

Consumers will have lower disposable income due to the declining remittance inflow and the increase in indirect tax coverage.

To reduce the impact, the think-tank suggested cuts in the prices of kerosene and diesel, which would help raise consumers' disposal income.

“Private investment is showing promising signs. At this moment, it is necessary to provide relief to the private sector so that they can remain competitive,” said CPD distinguished fellow Debapriya Bhattacharya.

CPD also urged the government to slash the personal income tax rate for the lowest threshold to 7.5 percent from 10 percent.

A reduction in personal income tax will help boost people's disposable income, especially of those belonging to the middle-class, Debapriya said.

“This cut will bring more revenue to the state as it will increase domestic demand.”

CPD also recommended providing strategic protection to domestic market oriented industries.

According to Debapriya, incentives to domestic market-oriented small and medium enterprises will have a positive impact on the economy as a whole.

The sector has potential to take Bangladesh forward. A revolutionary change may take place from rural to urban areas if these enterprises get minimal support of what the export-oriented sectors have been getting for the last two and a half decades, he said.

CPD recommended an expansionary fiscal policy to spur private investment and attain development goals for the nation, citing that economic indicators such as falling inflation and interest rates are favourable for such moves.

But realistic targets should be fixed, said CPD.

It also suggested carrying out proper assessment of fiscal incentives through observing performances since fiscal incentives are not always given based on scientific analysis.

“This is a matter of political economy. Those who have lobbying power and political connections control budgets,” said Debapriya.

On budgetary framework, he said quality of fiscal structure deteriorates gradually.

Referring to the gap between targets set and the actual realisation of budgetary goals, he said big budgets are prepared without any realistic analysis and without taking the institutional capacity into consideration.

“This creates a sort of fiscal illusion ... it seems big but it is not big in reality,” Debapriya added.

Bangladesh's budget implementation capacity is quite low compared to other developing countries such as India and Vietnam.

“It is high time to turn this so-called big budget myth into reality,” CPD research fellow Towfiqul said.

One of the reasons behind the inadequate implementation of budget is lack of ownership, particularly among the public representatives, as budgets are not prepared based on adequate consultations, Debapriya said.

At the end of the day is the budget, a document containing some figures put by some bureaucrats or a document that comes through a political process, he said.

The CPD also suggested depreciating Bangladeshi taka to boost remittance inflow and export receipts.

Debapriya said there is an apprehension that new VAT rate will increase the burden of indirect tax on people. Efforts should be on to collect increased direct tax to ensure equity.

The implementation of new VAT will fuel prices of various goods and services in the market and increase financial burden on people.

CPD suggested increasing allocation for education and health and expediting reforms.

Chaired by CPD Executive Director Fahmida Khatun, CPD distinguished fellow Prof Mustafizur Rahman and CPD Research Director Khondaker Golam Moazzem also spoke at the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments