Syndication to ease lending risks: study

Syndicated loans have emerged as a good tool for banks to reduce the risk of loan defaults by borrowers, as financing by multiple lenders helps spread out credit risk, said a survey by Bangladesh Institute of Bank Management (BIBM).

The survey finds that only 0.64 percent of syndicated loans are classified compared to 10.06 percent of bank loans; the percentage of rescheduling of syndicated loans is also low.

“The good performance of syndicated loans might be a result of rigorous scrutiny at pre-sanction and monitoring by multiple banks at post-sanction,” said BIBM Supernumerary Professor Helal Ahmed Chowdhury, presenting a draft paper on loan syndication in Bangladesh, at a research workshop at BIBM office.

The survey was conducted among the banks and financial institutions, where 62 percent of banks and 37.5 percent of non-bank financial institutions responded, said Chowdhury, co-author of the paper, at the programme.

Two assistant professors of BIBM Atul Chandra Pandit and Md Ruhul Amin, BIBM Lecturer Md Abdul Halim and Prime Bank Deputy Managing Director Md Touhidul Alam Khan also contributed to the study, the first ever on loan syndication in Bangladesh.

By the end of June 2016, the total number of projects under syndicated lending stood at 398 with a consolidated funding of Tk 76,528 crore, according to the survey.

Banks and financial institutions began loan syndication in 1990s in Bangladesh, at a time when the central bank imposed a single borrower exposure limit.

“After 2005, the syndicated loan market experienced a continuous increase in deal size, diversification of sectors and complexity of deals. The growing demand of power sector projects, as well as the government's priority towards this sector, opened the doors for syndicated loans,” the study said.

So far, local banks have accounted for more than half the syndicated projects, followed by the non-bank financial institutions and foreign banks.

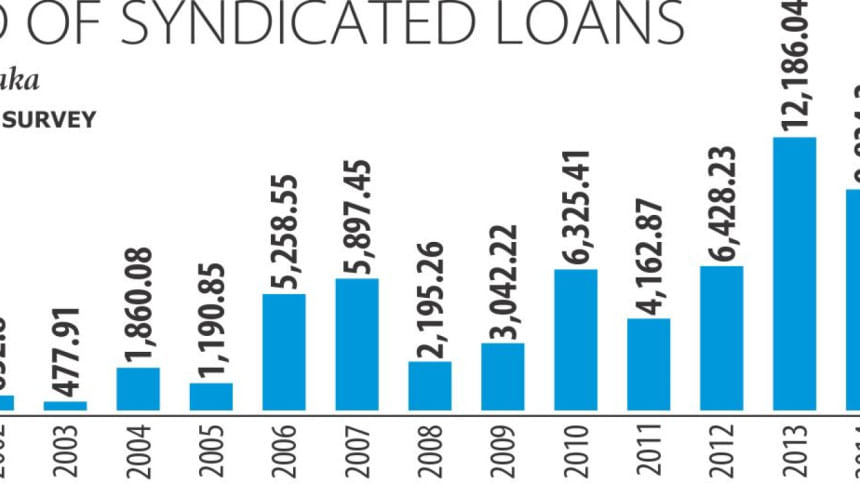

The survey finds that the compound annual growth rate of syndicated loans was 23 percent between 1995 and 2016. It said the highest amount of funds was raised in 2013, which accounts for 16 percent of total fund raised between 1995 and 2016. The amount of syndicated financing dropped in 2014, but rose a bit in 2015.

Discussants at the event linked the decline in syndicated financing in the last two years with a rise in the flow of foreign loans and the increased capacity of individual banks to fund relatively bigger projects.

“It is good that we were able to reduce non-performing loans and help borrowers through syndicated financing,” said Mesbah Uddin Ahmed, general manager and head of corporate at IDLC Finance.

The power and energy sector received the highest of 29 percent of total funds under syndicated financing, followed by telecom, engineering and the steel industry. But the highest number of projects was financed in the garments, textile and spinning sectors, while the lowest number was in real estate.

At the event, BB Deputy Governor SK Sur Chowdhury said the central bank encourages banks and financial institutions to finance large projects through syndication, in order to reduce banks' credit risk for better financial analysis and monitoring.

The benefit of syndication is that it splits and spreads out the various risks of the banks, he added.

“While bankers are striving hard to reduce their non-performing loans, the syndication mode can be a way out of this situation,” said Chowdhury.

However, there are some problems, such as the cumbersome and lengthy process of syndication, said the paper. It discourages good borrowers from raising large funds from the domestic market through syndication. There is also a lack of skilled human resources, added the BIBM paper.

Mohammad Shams-Ul Islam, managing director and chief executive of Agrani Bank, said the central bank should frame a prudential guideline on syndication.

Entrepreneurs in the past considered projects worth Tk 60-70 crore, but they now dream big projects worth Tk 1,000 crore, said Golam Hafiz Ahmed, managing director and chief executive of NCC Bank.

Banks should go for syndication in relatively small projects to avoid the risk of concentration in the long term, he added.

Arif Khan, chief executive and managing director of IDLC Finance, said Bangladesh is on a growth trajectory and the real issue would be financing long term projects.

He suggested development of a bond market and pension funds. In the short term, syndication can be a good instrument for entrepreneurs.

BIBM Supernumerary Professor Muhammad Yasin Ali warned that onslaught may come to the banking sector for failure of a group. “We can avoid the risk through syndication.”

There should be rules that any group that wants loans should raise a part of its funds through the capital market, he added.

He suggested better coordination between the central bank and Bangladesh Securities and Exchange Commission.

BIBM Director General Toufic Ahmad Choudhury chaired the session.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments