BB to stand by strike-affected businesses

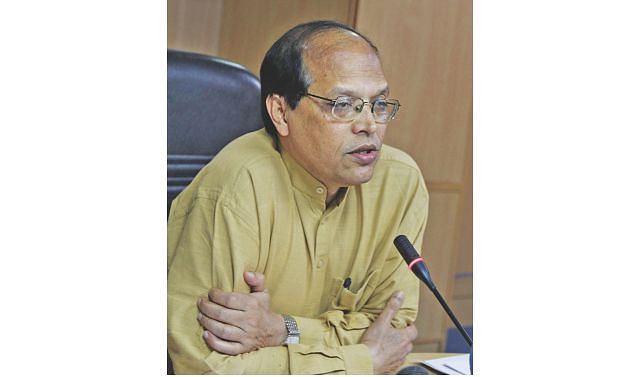

The Bangladesh Bank, being within its existing policy framework, will help the businesses affected by the present political unrest, Governor Atiur Rahman said.

“If a businessman becomes defaulter due to shutdowns, his payment deadline may be extended but the loans will not be waived,” Rahman told The Daily Star in an interview.

However, he said no wholesale assistance will be provided; rather the affected businesses will get support case by case.

Multilateral development partners and researchers have already warned that the political unrest, coupled with shutdowns and violence, will stifle business activities and the country's GDP (gross domestic product) growth this fiscal year.

The central bank has started helping the areas of economy which deserve assistance, the governor said.

Some banks have already been asked to remain open on weekends to help businesses recoup their losses incurred by shutdowns.

The governor said: "The business community will have to adapt to the new situation and, if necessary, will operate at night."

If anybody faces problem in transportation of goods and informs the BB of the trouble, arrangements will be made to give them police protection, Rahman said.

The political crisis should be resolved soon as it has been hurting the economy, he added.

Rahman's tenure as the governor will end on April 30 and he has already been awarded a second term.

During his first term, a number of banking scams, including the Hall-Mark one, and stockmarket debacle rocked the banking sector.

Rahman said there is no room for relaxation in

supervision.

An online "supervision dashboard" enabling real time monitoring of key areas of ongoing banking transactions at the branch level has been developed as a new supervision tool, he said.

The tool will help detect and prevent fraudulent and unauthorised transactions both at the branch and head offices of the banks.

The governor also said the BB's onsite and offsite supervision has been sharpened, by engaging an adviser on fraud detection and prevention.

Particular attention has been given to the quality of corporate governance, internal audit and internal controls in banks.

On monitoring the state banks, Rahman said the BB will continue its strong supervision, frequent inspection and examination irrespective of government or private banks.

As there have been allegations that many innocent bank officials were unduly being linked to the scams, the governor said the affected officials can lodge complaints with the central bank's customer interest protection centre.

“We are trying to build up the centre as something like the office of an ombudsman.”

Rahman said they plan to put in place an innovative intelligence mechanism to contain corruption.

People inside the banks will give information about any irregularity and their identity will be kept secret.

After necessary investigation, action will be taken against the culprits, Rahman said.

The central bank was often blamed for the abnormal rise and fall in stock prices at the beginning of the present government's tenure.

The governor said the main responsibility lies in the hands of the Bangladesh Securities and Exchange Commission.

At that time, the stock regulator was not much stronger but now it has strengthened its monitoring mechanism.

The central bank and the stockmarket regulator are working closely, Rahman said.

“A lack of confidence, not liquidity, is the main problem of the stockmarket.”

He said the economy of Bangladesh is still very healthy even amid the global economic crisis. If the political unrest does not prolong, the economy will turn around.

The central bank expects the GDP growth to be more than 6 percent despite all the hurdles.

Rahman said no change will be brought to the monetary policy stance of the central bank.

An inflation-curbing but growth supportive approach will be followed.

“We will strengthen research-based impact assessment of our monetary policies,” he said.

About the appreciation of the taka against the dollar, the governor said the ongoing market interventions by the central bank will help avoid sharp fluctuations.

This has succeeded in keeping both exports and inward remittances on a growth path, he said.

The governor said the US, Europe and Japan are resorting to monetary easing to help their economies and financial markets overcome the slowdown and lingering stresses from the global financial crisis.

This has not yet resulted in stoking of global inflation, which remains subdued, except for sporadic price pressure bubbles in some asset markets.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments