Private airlines caught in a bind

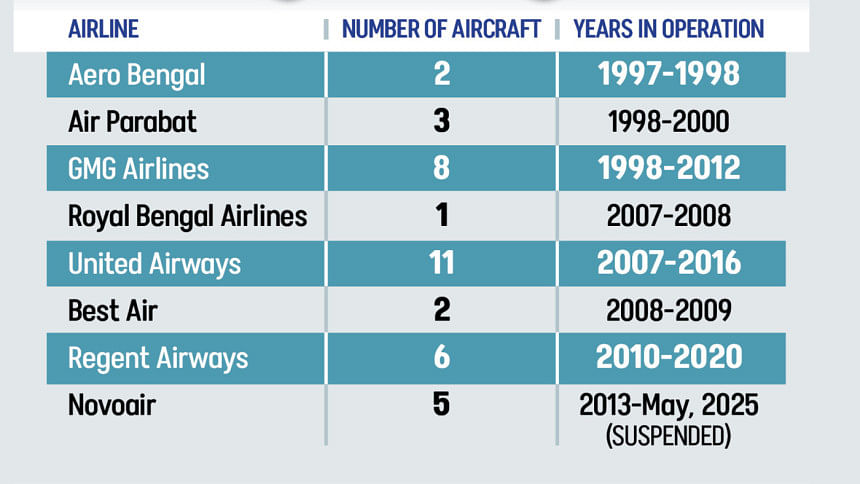

Bangladesh's private airline industry is struggling to stay afloat, hobbled by soaring fuel prices, punitive surcharges, and what operators describe as unfavourable policies. Of the 10 private carriers that have entered the market over the past three decades, only two -- US-Bangla Airlines and Air Astra -- remain in operation.

Novoair, which plans to resume flights on May 21 after weeks of suspension, stares into financial distress, underscoring the perilous state of the sector. Industry insiders say the sector is being systematically undermined by outdated rules, excessive fees, and a lack of government support, even as international carriers tighten their grip on the market. Foreign airlines now control roughly 75 percent of passenger traffic, leaving local operators to battle for a shrinking share.

"Foreign carriers are thriving in Bangladesh's aviation market while the local ones are in a sorry state. This is mainly because the country's aviation policy is not conducive to the industry's growth," said Kazi Wahidul Alam, an aviation analyst.

Currently, 39 foreign carriers operate flights to and from Dhaka, compared to only three Bangladeshi airlines, including Biman. A total of 1.24 crore passengers travelled from Hazrat Shahjalal International Airport last year, compared to 1.16 crore in 2023, shows CAAB data.

Asked why local airlines fail to flourish, Novoair Managing Director Mofizur Rahman said, "Entrepreneurs are often blamed for incompetence and poor planning. This may be partially true. But one must consider that they invest in a sector where every part of the government apparatus is unfriendly, if not outright hostile, towards private airlines."

CAAB regulations are outdated and don't meet global standards, said Rahman, also secretary general of Aviation Operators Association of Bangladesh (AOAB).

"Direct and indirect taxes levied on private airlines account for 50 percent of their operational costs. The industry stakeholders keep on pleading with CAAB, the ministry concerned, the tax authority and government agencies for remedies but their appeals fall on deaf ears."

Imran Asif, chief executive officer of Air Astra, said, "Based on my 15 years of experience as the chief executive of three airlines, I believe three steps could help revive the country's airline industry -- adjusting fuel prices, reforming policies on fees and surcharges, and developing skilled manpower."

HIGH FEES, SURCHARGES

Surcharges on outstanding fees for local airlines can accumulate up to 72 percent a year, said aviation experts.

In India, the annual surcharge is between 12 and 18 percent; in Pakistan, it's only 2 percent; in Singapore 8 percent; and in Oman 10 percent.

AOAB has been demanding that the government fix the surcharge at a reasonable rate, scrapping the monthly rate of 6 percent.

"Once you fall into the surcharge trap, it becomes nearly impossible to turn things around," said Kamrul Islam, spokesperson for US-Bangla Airlines.

In recent years, GMG Airlines, United Airways and Regent Airways grounded their fleet as surcharge dues kept mounting.

Regent Airways, the latest private airline to cease operations in 2020, owes Tk 283 crore in surcharge; United Airways Tk 355 crore; and GMG Airlines Tk 368 crore, shows CAAB data.

Aircraft landing and parking fees here are also significantly higher than that in many other countries.

Giving an example, Kamrul said the landing fee for a Boeing plane is Tk 15,000 at Kuala Lumpur airport. But if the same plane lands at Dhaka airport, the charge is Tk 2.50 lakh.

HIGH JET FUEL PRICE

Since jet fuel accounts for 40-50 percent of an airline's operational costs, high fuel prices render commercial operations of local airlines uncompetitive, said aviation industry insiders.

In Bangladesh, jet fuel price stood at $0.76 per litre in the second week of May, while it was $0.49 in Singapore; $0.50 in Malaysia; $0.51 in Qatar and Thailand; $0.53 in Oman; and $0.58 in China.

"Major carriers like Emirates and Singapore Airlines that operate long-range aircraft don't refuel at Bangladeshi airports because of high fuel prices. Local airlines, on the other hand, have no option but to buy fuel at prices 20-30 percent higher than that in the global market," Imran noted.

Jet fuel prices here are not determined by free market dynamics or best practices, such as assessments by independent price reporting agencies, which help prevent arbitrary pricing, he added.

Moreover, local airlines pay a 42.62 percent duty to buy jet fuel for domestic flights whereas the duty is below 4 percent in India, said Mofizur.

LACK OF SKILLED MANPOWER, WRONG STRATEGY

Local private airlines largely rely on former employees of Biman and Bangladesh Air Force to build their workforce as the country still lacks infrastructure to train and produce skilled aviation professionals.

These ex-employees constitute the majority of the local airlines' workforce, including pilots, technicians and engineers, said Imran.

"The current situation is far from favourable for the aviation industry. A strong, competitive aviation sector cannot be built without state-backed training facilities," he added.

ATM Nazrul Islam, an aviation expert who worked for several private airlines, said the now-defunct airlines pursued flawed marketing strategies, and most of them chose unsuitable aircraft and also wrong routes.

To support his argument, he cited the GMG Airlines' purchase of a 540-seater Boeing-747 for operating flights on Dhaka-Dubai route which proved commercially unviable.

No Bangladeshi airline will survive beyond a certain period unless it pays attention to proper planning and market analysis, he noted.

WHAT THE REGULATOR SAYS

CAAB Chairman Air Vice Marshal Md Monjur Kabir Bhuiyan said the fees for local airlines have not been increased in recent years.

Asked about high surcharge, he said it becomes applicable only when an airline doesn't pay fees.

"The civil aviation ministry fixes surcharge. We just follow it. As far as I know, they are considering reducing surcharges. Besides, we have taken steps to cut various types of fees, including landing and cargo charges. The ministry will make the final decision."

About the claim that the regulator's policy is unfavourable to private airlines, Kabir said that there are no rules or regulations that go against private carriers.

Referring to high jet fuel prices, he said CAAB has already conveyed the matter to the government agencies concerned.

"We have made every effort to help the aviation sector thrive… If any airline cannot survive due to administrative problems or financial difficulties, there is nothing we can do," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments