Aid, debt, and development

This piece is the second in a series of summaries of papers presented at the "Bangladesh in the 21st Century" conference held at Harvard University (June 13-14) and organised by Bangladesh Development Initiative (US), Democracy and Development in Bangladesh Forum (US), and The Ash Institute of Democratic Governance & Innovation at the Kennedy School of Government, Harvard University. The series is being coordinated by Dr. Syed Saad Andaleeb, Professor and Program Chair, Pennsylvania State University, Erie, and President of Bangladesh Development Initiative (www.bdiusa.org). The views expressed in the articles are expressly those of the authors.

THIS article examines past and future aid allocations to Bangladesh as well as Bangladesh's debt sustainability, paying special attention to recent international debt relief initiatives and the possible fast-tracking of Bangladesh's poverty reduction strategy to achieve the Millennium Development Goals (MDGs).

Aid allocations

Some 30 years ago, Bangladesh was one of the poorest countries of the world. It was openly referred to as an international basket case. Today, there are some 40 countries that are poorer in terms of both income per capita and human development. While living conditions have improved considerably and poverty declined drastically, especially in the last few years, there are still about 40 million people living below $1-a-day in Bangladesh. Hence, Bangladesh has ample needs for more aid.

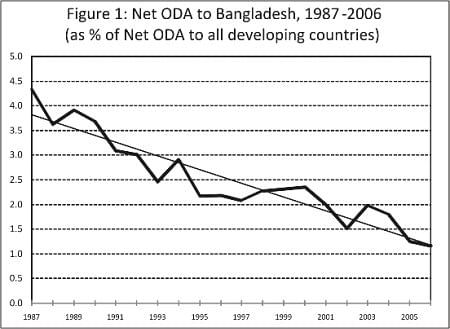

However, reviewing the aid data as provided by the Organisation for Economic Co-operation and Development (OECD) (2007), Bangladesh's share of aid provided to all developing countries has decreased considerably during the last 20 years, from 4.4 percent in 1987 to 1.2 percent in 2006, (see Figure 1). Preliminary estimates for 2007 indicate that the share of aid allocated to Bangladesh has further decreased, possibly dropping below one percent of net official development assistance (ODA) to all developing countries.

Aid flows to Bangladesh may increase temporarily in 2008 due to the provision of emergency aid; yet, the financial implications of recent debt relief initiatives are likely to cause a further decline in aid allocations to Bangladesh. While it is well known that aid flows are highly volatile and that aid flows are declining once a country has reached a certain level of income per capita, the trend over the last 20 years is not due to aid volatility, nor has Bangladesh reached yet an income per capita level that would justify the decline in aid.

What is clear is that the recent aid allocation mechanism has been biased against Bangladesh. The degree to which Bangladesh has been discriminated in terms of aid allocation becomes obvious by looking at the aid provided in per capita terms. First, while aid per capita amounted to only $9 for Bangladesh in 2005, it amounted to an average of $197 for the 37 countries with populations of less than one million. This huge discrepancy is even less comprehensible if considering that Bangladesh's gross national income (GNI) per capita ($470) was less than one- sixth of the income per capita of the 37 small states ($3,055) in 2005. Second, even if comparing Bangladesh with more populous countries, there remains a huge discrepancy in aid per capita levels. Among more populous countries with similar income per capita levels, Bangladesh receives currently the second lowest amount of aid per capita, amounting to $9 per capita relative to about one-fifth of per capita aid provided to comparable African countries.

How sustainable is Bangladesh's public debt?

In 1993, Bangladesh's total public debt amounted to Tk.725 billion. Ten years later, in 2003, it had more than doubled to Tk.1.53 trillion, and another 3 years later, it reached nearly Tk.2 trillion. These trends seem to indicate that Bangladesh's debt is not sustainable. However, expressing Bangladesh's public debt as percent of GDP provides a different picture as this ratio has actually decreased from 58 percent in 1993 to less than 47 percent in 2006. The picture improves further by looking at the trend of the ratio of nominal public debt to government revenues, which has decreased from 638 percent in 1993 to 438 percent. The only worrisome part is that the share of the domestic public debt continues to increase, which is reflected even more in terms of interest payments as percent of government revenues,

However, comparing the results with other low-income countries, Bangladesh is actually one of the highest indebted countries in terms of both net present value (NPV), debt to government revenues, and public debt service to government revenues. The only reasons why Bangladesh did not qualify for recent debt relief initiatives are due to a) Bangladesh's substitution of external debt with domestic debt (which started in the early 1990s), and b) the framework of recent debt relief initiatives focus on external public debt sustainability.

An analysis of Bangladesh's future debt sustainability under alternative macroeconomic scenarios shows that relatively small deteriorations in the macroeconomic scenario can easily threaten Bangladesh's fiscal sustainability. Keeping in mind that Bangladesh is a highly disaster- prone country, and that disasters are likely to increase due to climate change, the cancellation of Bangladesh's external public debt would not only serve as a shock absorber but also allow Bangladesh to use its scarce resources to achieve the MDGs. While Bangladesh is unlikely to face an unsustainable debt in macroeconomic terms, if approaching debt sustainability from a human and social development perspective, Bangladesh's debt is not sustainable simply because Bangladesh has more urgent needs to reduce poverty than to make external debt service payments, amounting even in the optimistic scenario, to more than $1.5 billion every year over the next 12 years.

Indeed, given that total public debt service payments amount currently to about 100 percent of government revenues, it is clear that these debt service payments can only be made as old debt is replaced by new debt, i.e. principal as well as interest payments are mostly covered by new loans. The cancellation of Bangladesh's external debt would also be justified based on equity issues as considerable amounts of debt have been canceled under recent debt relief initiatives to less poor and less indebted countries if poverty and indebtedness is defined more appropriately.

An analysis of Bangladesh's debt sustainability under an ambitious investment strategy indicates that some acceleration of Bangladesh's development strategy might be considered as long as the increase in debt levels is clearly limited and temporary. It is, therefore, suggested to adopt a new MDG-consistent debt sustainability concept, which would allow a country to increase its borrowing within certain limits as long as it makes progress with achieving the MDGs. The basic rationale behind the MDG-consistent debt sustainability is that progress made towards achieving the MDGs can be considered an asset for an economy, similar to the asset of having good policies and institutions.

Key recommendations

First, taking Bangladesh's record of achievement into account, Bangladesh should be "fast-tracked" for a rapid scale-up of aid, whereby the development agenda and development policies need to be designed based on a broad majority of domestic stakeholders. Second, taking into account recent efforts of making aid more effective, we should be more optimistic that aid can be made more effective, instead of continuing to be pessimistic about the impact of aid. Third, while aid critics have voiced concerns about negative macroeconomic implications of a scaling up of aid, experience has shown that there is no evidence for such concerns for low-income countries. Fourth, given that the Bangladeshi government pays currently more than $1.5 billion a year in external debt service to rich countries and multilateral institutions like the World Bank, and is expected to pay this amount for the next two decades, the Bangladeshi government should push the donor community to get at least all its debt to the World Bank and the IMF canceled (as many other LDCs already got such debt relief) and as Bangladesh has far more urgent needs to use these resources for poverty reduction. Fifth, the Bangladeshi government should avoid further substitution of external borrowing with domestic borrowing as domestic borrowing has far higher fiscal implications than external concessional borrowing.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments