Reforms shore up Bangladesh's credit stability: Moody's

Bangladesh's credit stability has been shored up by the momentum in reforms agenda, global rating agency Moody's said.

But the existing and new risks loom large over the recent garment factory fire, complexity regarding the Padma Bridge financing and the upcoming national elections.

Moody's said the recent momentum in the pace of reforms -- as witnessed by the passage of a new value added tax law, and reforms related to fuel prices and the financial sector -- is credit supportive.

Higher capital flows could be bolstered by possible issuance of sovereign or quasi-sovereign bonds, the normalisation of aid flows, and improvement in the foreign investment.

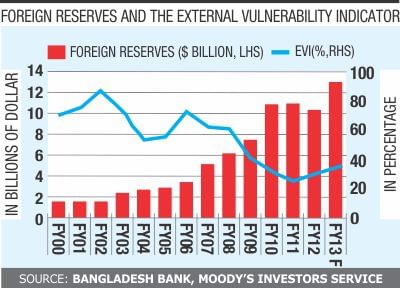

As a result, the reserves may go up to around $13 billion by the end of the current fiscal year, from $10.3 billion at end of last year, the agency said in a report on December 14.

The International Monetary Fund's $987 million credit will help Bangladesh implement the planned structural reforms, the report said.

Moreover, the successful conclusion of an IMF review last week will likely pave the way for the disbursement of a second tranche worth $141 million, taking the total disbursements to $282 million, it said.

This will be beneficial for the external liquidity situation, which is just beginning to recover from pressures faced last year, the rating agency said.

Hassan Zaman, chief economist of Bangladesh Bank, termed the report a balanced assessment.

It reflects the improvements on the macro-stability front during this year as well as the current and future challenges the economy faces, Zaman added.

Moody's said Bangladesh is the only South Asian country that has consistently posted current account surpluses in the past decade though the external balance was under pressure in fiscal 2011 due to slow exports, expensive imports and falling remittances.

Steady growth trends, a more positive outlook for the external sector, stabilising exchange and interest rates, and the recent momentum in reforms are positive, Moody's said.

“However, recent successes could be dampened by a number of factors."

The challenges include implementation risks regarding the newly enacted measures, weaker global growth and implications for exports, the threat of continued labour unrest, and the possibility of a messy transition to parliamentary elections in 2014.

These factors could derail the smooth progress in reforms, it said.

“Institutional weaknesses have been a constraint on our credit assessment of Bangladesh,†the rating agency said.

Moody's also said the suspension of project aid by the World Bank and the misappropriation of loans by a state bank further underscored poor governance and transparency issues.

In an effort to address these issues, the authorities are now incorporating suggestions from an external panel and are taking steps to improve supervision in the banking sector.

On the recent fire at a garment factory in Ashulia, the Moody's said it also highlights underlying tensions in the labour market, which could have negative implications on foreign aid, investment flows and exports.

Easing pressures on the external front should drive a 'virtuous' cycle with a favorable balance of payments position, more stable exchange and interest rates, and growth trending largely in line with its forecast of 6.1 percent year-on-year, Moody's said.

Domestic growth remains largely consumption-driven, which in turn is spurred by worker remittances and export earnings.

Shifting to a more sustainable growth trajectory will entail a ramp up in capacity that will fuel a pick-up in investment, it said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments