Banks' third quarter earnings fall due to loan provisioning

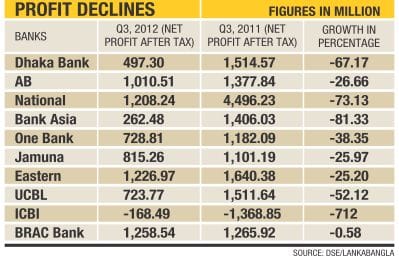

Of the 17 banks that have reported their third quarter results so far, 10 have registered negative net profit growth for the quarter year-on-year.

The banks that saw a decline in their net profits are: BRAC Bank, ICBI Bank, United Commercial Bank, Eastern Bank, Jamuna Bank, One Bank, Bank Asia, National Bank, AB Bank and Dhaka Bank.

“Most of banks' growth declined due to provisioning of non-performing loans and low income from the capital market,” said Syed Mahbubur Rahman, managing director (MD) of BRAC Bank.

Rahman said the increase in the costs of doing business and interbank volatility on transactions, which rose to 15 percent during the quarter, did not help matters either.

“Banks' income from import financing and foreign exchange gains also dropped,” added the BRAC Bank MD.

Islami Bank's MD Mohammad Abdul Mannan said classified loans are on the rise due to the industrial borrowers falling short of their production targets as a result of utility crisis.

“Investment in capital market got stuck due to volatility in the market. As a result, banks adjusted the loss in the accounts,” he said.

Sayeed Ahmed, general manger and chief financial officer of Pubali Bank, said: “Banks' growth in profit declined due to slowdown in economic activities.”

“Most of the banks are inundated with provisioning of non-performing loans, while profits from import financing business and stockmarket declined massively as well,” he said.

While LankaBangla Securities said the drop in commission from the opening of letters of credit, too, played a part.

“Most of the banks' growth in profit declined due to provision for non-performing loans,” said the country's leading broker, while adding that the banks' earnings from stockmarket were unremarkable.

Meanwhile, stocks declined for the fourth consecutive day on the back of bank and non-bank financial institutions' underwhelming third quarter results.

DGEN, the benchmark general index of Dhaka Stock Exchange (DSE), closed the day at 4,409.36 points, after falling 75.62 points or 1.68 percent.

“Dismal earnings performance registered by most of the banks, non-bank financial institutions and manufacturing companies caused the investors to take cautious position,” LankaBangla Securities said in its regular market analysis.

Of the 30 listed banks on the DSE, 13 are yet to disclose their quarterly corporate results.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments