FY 13 budget proposals: Mission formidable

Photo Bottom: M Munir Uz Zaman, AFP

The finance minister presented his budget proposals for FY 2012-13 to the Parliament on June 7. The proposals have been already subjected to considerable dissection by many eminent citizens as well as trade bodies and research rganisations. This article is one more contribution to the on-going discussions. It focuses on very few aspects of the budget in consideration of the limitations of space.

The context

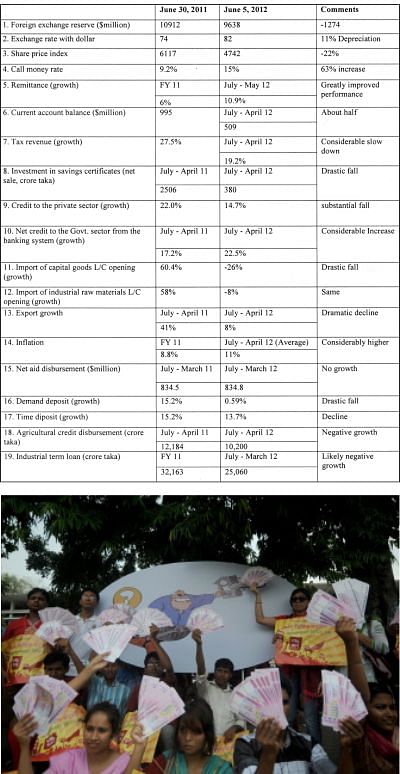

The budget for the upcoming fiscal year has been prepared at a time when the macro- economy continues to suffer from many stresses. A cursory look at the 19 indicators presented in the accompanying table unequivocally reveals that both domestic and external sector indicators do not present a particularly bright picture. The only silver lining in the dark cloud is that remittance growth in the current fiscal year is higher. One could also guardedly commend tax revenue collection by the National Board of Revenue (NBR). The growth of collection, however, is considerably lower than the preceding year and does not exceed nominal GDP growth (defined as real GDP growth plus inflation) by any substantial margin. That means that there will not be any great increase in tax revenue/GDP ratio; the estimate given in the budget statement is 10.1% -- a change of 0.4% from FY 11.

Against the above backdrop, the budget statement expects GDP growth in the current fiscal year to be in the vicinity of 7% -- presumably higher than last year's questionable 6.7% and well above the preliminary estimate of 6.3% by Bangladesh Bureau of Statistics. The grounds cited are bumper boro crop, remarkable achievement in power generation and improved implementation of Annual Development Programme (ADP). Here, it may be pointed out that crop agriculture accounts for about 10% of GDP; boro crop may thus account for 5% - 6% of GDP. The remarkable achievement in actual power generation (as opposed to capacity addition) is not supported by the extent of load-shedding and improved ADP implementation is not supported by available information.

In the backdrop of vociferous complaints by the private sector about high interest rate inhibiting investment, the budget statement argues that empirical studies do not show correlation between private sector investment and interest rate. Two comments are in order here. First, there may be a question of threshold below which interest rate change may not matter significantly. That threshold has been most likely crossed in Bangladesh. Borrowing rate of 17% to 18% cannot be dismissed as a disincentive for investment. Secondly, in a situation where other discouraging factors such as shortage of gas, electricity and transportation facilities is combined with regulatory bottlenecks, the interest rate is likely to play a significant role.

FY 13 budget:

(a) Macro framework

The budget is based on the assumption of 7.2% growth of GDP. The factors which are hypothesised to contribute to the acceleration by about 1% over FY 12 growth are: (i) the agreement signed with the International Monetary Fund (IMF) for disbursement of about 1 billion credit under Extended Credit Facility (ECF) will generate greater confidence among other development partners as well as foreign investors. This will augment both public and private investment through expedited release of aid by development partners and increased foreign direct investment; (ii) improved ADP implementation will enhance public investment and also accelerate disbursement of foreign aid; (iii) the increase in interest rate on savings instruments will enable the government to resort to higher levels of non-bank borrowing. The implicit assumption is that reliance on bank borrowing will decline, creating space for private sector borrowing from the banking system and thus higher private investment.

None of the above arguments is very convincing. First, only time will tell whether the government will be able to fulfill all the commitments it made to IMF in the Memorandum of Understanding dated March 27, 2012. In the event of failure to do so and postponement of the release of the second tranche, confidence will erode. Second, even if there is no such eventuality, the conclusions under (i) above may not materialise. The bulk of foreign aid comes in the form of project aid. Each development partner country has its own decision criteria for release of funds. IMF certification would play insignificant role in foreign investors' decision. Their concerns relate primarily to issues like political and macroeconomic stability, infrastructural facilities, administrative efficiency, availability of relatively cheap, skilled and disciplined work force, access to local finance at affordable cost for meeting operational costs etc. Bangladesh obviously does not score high in respect of any of these considerations. Second, successive governments have made efforts to accelerate implementation of ADP with no outstanding achievements. What is needed here is to completely revamp the incentive system of public servants, enhance their competence, commitment and accountability and avoid politicisation in recruitment and career progression. Obviously, these cannot be accomplished in the short run. Third, the impact of interest rate increase on sale of savings instruments is, at best, uncertain. The saving capacity of ordinary citizens has been eroded by high levels of consumer price inflation; this is also reflected in the slower growth of bank deposits.

Another macroeconomic assumption in the budget is that inflation will come down to 7.5%. There is no detailed explanation of how this will be achieved. The anticipation is based on declining trend in international food prices and increased supply of foreign exchange, which will presumably exert a benign influence on the exchange rate and thereby inflation. Available indications are that the current trend in declining food prices may not persist for long. As regards availability of increased foreign exchange through foreign direct investment and aid, comments in the earlier paragraph are relevant. Even more importantly, there is very little likelihood of any significant boost of export growth. The United States and the European Union are the markets of overwhelming importance for our exports. According to latest available IMF projections (April 2012), the growth in the United States economy will be 2.1% and 2.4% in 2012 and 2013 respectively -- well below 3% in 2010 (recent unemployment data suggest further slow down). The growth rates of Euro area in the respective years are projected to be -- 0.3% and 0.9% as compared to 1.9% in 2010. Overall, one cannot expect much respite for exchange rate from increased supply of foreign exchange. Furthermore, the impact of reduction of subsidies on petroleum products and electricity has to be taken into account. Potential inflationary consequence of these measures, at least in the short run, has not been mentioned in the budget statement.

(b) Size and financing of the budget

The total expenditure envisaged in the budget is estimated to be Tk. 1,91,738 crores -- 18.1% of GDP. Public expenditure as percentage of GDP is very low in Bangladesh in comparison with many other developing countries. There is urgent need for increasing public expenditure to improve infrastructure and the quality of human resources as well as to alleviate poverty. From this perspective, the proposed expenditure level cannot be considered unjustified. But there are serious concerns about the financing and administrative capacity to implement.

The government expects to raise revenues amounting to Tk. 1,39,670 crores -- growth of 21.6% over the revised estimate of FY 12. In view of ongoing efforts to expand the tax net territorially and also various rate changes proposed in the budget, the target of NBR tax revenue (estimated to be 21.5% higher than revised estimated for FY 12) may be achieved. As regards, non-NBR tax revenue, the revised estimate for FY 12 remains at the same level as originally budgeted, FY 13 budget envisages an increase of 16.6%. This is not an impossible task, but appears to be doubtful in view of past record. However, the target in respect of non-tax revenue which accounts for about 16% of total revenue is unlikely to be met. The revised estimate for FY 12 is also lower than the original budget by Tk. 4,000 crores. In this context, it may be noted that a significant source of non-tax revenue could be the dividend contribution by state-owned enterprises, most of which are not only not paying dividend but also owe huge debt service liability to the government. I do not see any road map to correct this ignominious situation. Overall, one can expect some shortfall in total revenue collection and corresponding increase in budget deficit if expenditure targets are to be met.

The budget estimates a deficit of Tk. 52,068 crores, which is nearly equal to total ADP size and amounts to 5% of GDP. This is not an unacceptably high level, but there are concerns about the source of financing. External sources are expected to provide Tk. 18,584 crores -- the disbursement during July 11-March 12 was only Tk. 6,838 crores. Borrowing through the national savings certificates is estimated to be Tk. 7,400 crores -- the net sale during July 11-April 12 amounted to only Tk. 380 crores. If these two sources fail to deliver, which is the most likely scenario, the government will overshoot bank borrowing estimated to be Tk. 23,000 crores by a hefty margin. This will entail adverse consequences in the forms of aggravated inflation, constrained access of credit for the private sector and higher interest rate, as happened during the current fiscal year.

(c) Tax policies

Tax policies have to be guided by considerations of revenue productivity, administrative simplicity, tax payers' convenience, incentives to save and invest, equity and efficiency of production. The limitations of time and space preclude any detailed evaluation of tax proposals in the budget. I will comment on a few only.

* In case of customs duty, duty reduction on the basis of end use is likely to aggravate mis-declaration and corruption. These relate for example, to nutritional supplement for mothers and children, certain equipments for pharmaceutical industry, steel for ship building and capital machinery for export industry;

* Income tax deduction at source at 15% on bank interest for those who do not provide tax identification number and 2% for mobile users' talk time is an indefensible decision. With Bangladesh Bank's initiative to open Tk.10 bank account, many relatively poor people have opened bank accounts, and similarly many poor people presently use mobile phone;

* The ground cited for very generous treatment of cinema industry, which has been given the benefit of tax holiday as well as withdrawal of 35% supplementary duty, is tenuous;

* The most outrageous decision relates to declaration of undisclosed income with payment of 10% fine as addition to the normal rate (presumably with no questions asked regarding the sources of undisclosed income), no time limit and no condition of investment. Such provisions are immoral, have yielded very little economic benefit in the past, encourage acquisition of black money and cause resentment among honest tax payers;

* As regards tax on exports, I am in general opposed to imposition of tax on gross turnover as a substitute for tax on profit. The practice is being followed as a matter of administrative convenience. Raising the rate from 0.6% to 1.2 % has provoked strong reaction from the business community. In view of recent negative trend in export growth, the choice of timing is not perhaps appropriate.

(d) Social safety net

The budget proposes an allocation of Tk. 22,750 crores for social safety net programmes. This represents about 12% of total expenditure -- considerably lower than 17.3% allocated in FY 09 budget. Obviously, this is not very consistent with the objective of promoting inclusive growth even though there may be other ways to accomplish this objective. Social safety nets, if properly administered, play an important role in reducing poverty and therefore deserve higher allocation.

(e) Annual development programme

The proposed size of ADP of Tk. 55,000 crores (5.3% of GDP) is not too large in relation to the country's need. But there are serious questions about its financing. ADP will have to be almost entirely loan financed and in this context earlier comments about external assistance and savings certificates are relevant. Moreover, administrative deficiency in using the allocated financial resources is well-known. In the revised budget of current fiscal year, ADP size had to be reduced by about Tk. 5,000 crores. Eventually, actual expenditure may be in the range of Tk. 36,00037,000 crores. Thus, ADP budget for FY 13 would thus represent some 50% more than the actual utilisation of the preceding year. There are also, of course, other perennial problems of implementation with hasty use of funds in the last three months, the poor quality of work done, inappropriate choice of projects, and inclusion of too many projects leading to thinning out of resources, prolonged implementation period and cost overruns.

I have no problem with the sectoral allocations under ADP. Local government and rural development, energy and power, transport and communication, education and ICT, agriculture and health account for over 80% of total ADP. This distribution more or less conforms to earlier practices.

Concluding observations

The budget for FY 13 has been prepared at a time when the economy continues to suffer from many stresses. The optimistic assumptions with regard to GDP growth and inflation appear to be unrealistic. Though the proposed expenditure level cannot be faulted in consideration of the country's need for enhanced public expenditure in many areas, there are serious questions about financing as well as implementation capacity of public administration. Nevertheless, increase in allocation for social safety nets deserves consideration. Some of the tax proposals do not conform to recognised canons of taxation.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments