Regulatory lunacy to set ourselves up for the next market crash

There is such a thing as regulatory lunacy and one should look no further than directive of Bangladesh regulators requiring sponsor directors of all listed companies to hold minimum of 2 percent total share to maintain their directorship.

Although this may seem like a clever idea at first blush, this is yet another short sighted whimsical policy while real reforms to monitor the market is sorely lacking.

In 2011 when the market was correcting to a reasonable level after rising to the stratosphere during 2009 and 2010, rather than letting the market run its course, inept policymakers and uninformed bureaucrats searched for all kind of “crazy” schemes and one of such scheme was to require directors of all listed companies to hold 2 percent or more shares in their companies.

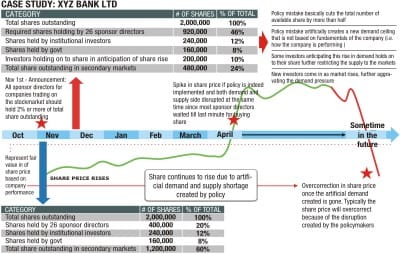

What does that mean really to the market fundamentals as a whole? It disturbs the market equilibrium by fundamentally distorting not only demands for a particular share but also the supply side thus compounding the problem to set ourselves for a market crash in the future as the case study example illustrates below:

So what's the intended consequence of the policy dictate? It will create artificial demand for a particular share of a company by forcing all directors to buy share in their company at the current price.

As the sponsor director of institutions goes to the DSE or CSE to buy back the share, he finds less and less share available for sale as outlined in the case study above.

This distorts the market, artificially inflating the value of the company since price is not measured by how the company is performing but rather on the fact there is more demand and less supply.

As with any markets, the market fundamental will eventually adjust. The sudden demand that was created by regulators will go away and when that happens, the market will change direction south fast crashing below fair value.

The losers again will be small investors who got into the market late but the winners will be certain manipulator and government cronies who probably pushed for these short-sighted policies in the first place.

In the case example above (which is representative of majority of the institution in the country), most of the 26 board members are entrepreneurs. They worked hard towards building up this great institution that had greatly contributed to the country's economy and progress throughout the last 30 years while the country went through bitter political bickering and violence, coups, natural disasters and other calamities.

XYZ Bank now caters to millions customers on a daily basis and has 100 branches throughout the country; the bank's paid up capital increased 500 percent and so did its income.

In the beginning, the Board of Directors collectively have maintained 50 percent or more share in the company but slowly they lowered the percentage of their holding of the share to provide more access to market shareholder to share the success of the company.

The company paid 20 percent or more dividends each year for the last decade. The same regulators that are dictating the directors to buy back the shares are the one who also dictated that more quality shares be made available to secondary market investors to make the stock market a vibrant one; the directors complied.

Then the market correction of 2011 came and all of a sudden all past regulatory dictation went out the window. Now the directors, who bought down their holding to comply with past regulation had to come up with the capital to bring back their holdings to 2 percent in six months.

If this isn't lunacy, I don't know what is.

Recent comments by the president of the DSE that the directors of companies reaped benefit while leaving the small investors holding the bag is disconcerting. He should clarify that the majority of the directors do not hold 2 percent of total share because they were required to sell off their shares due to regulatory directives from before.

It is a known fact (and outlined in the government's own mandated commission findings which the government unbelievably -- only in Bangladesh -- dismissed later) that only handful of sponsor directors with connection to the present government took advantage of the situation.

But the inept government and regulators did nothing to punish those individual but now wants to punish everyone else around them. To make a comparison; it's like we know who the village thief is but because the thief is too rich and powerful, we will just lock up all his neighbours instead so hopefully the problem will go away.

What's more unfortunate is that the handful of directors that misappropriated the money in the first place will now have the same opportunity as the market goes up due to fundamental disequilibrium.

I think the sponsor directors of public institutions should fight this lunacy vigorously through the court system (although the court system is not independent and at the governments dictate). I am still surprised no-one has yet come forward to file a case against a whimsical policy that will basically take away what these directors have worked all their life for.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments